The country of spring brings warmth and flowers bloom, and it comes first to welcome spring and bloom gold. The fire burns the leaves of the forest, the red clouds fall, and the plum blossoms bloom in full bloom, and the whole tree turns white.

At 22:00 Beijing time on the 23rd, Uniswap Foundation governance director eek637 posted on the governance forum of the well-known decentralized trading protocol uniswap about activating Uniswap protocol governance. RFC (request for comments) [1], Uniswap Foundation official Twitter @UniswapFND pushed the proposal (as shown below). At the same time, Uniswap's governance token UNI instantly exploded by more than 50%, and the hourly line increased from 7 The knife crossed 11 knives and reached a maximum of nearly 12.6 knives in the next hour. It is still at a high of 12 knives.

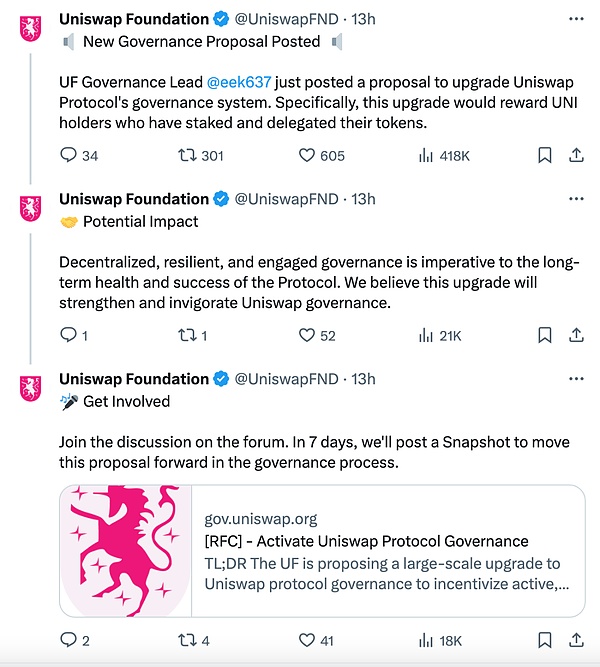

Uniswap Foundation official tweet is as follows:

"New governance proposal released: UF (Uniswap Foundation) governance director @eek637 has just released a A proposal to upgrade the Uniswap protocol governance system. Specifically, this upgrade will reward UNI holders who hold and delegate tokens."

"Potential Impact: Decentralized, resilient and participatory governance is critical to the long-term health and success of the protocol. We believe this upgrade will strengthen and revitalize Uniswap’s governance."

Let us pick up the magnifying glass again and take a closer look at the key points of the proposal.

The following is a summary written by eek637 himself:

"* UF (Uniswap Foundation) A massive upgrade to the Uniswap protocol governance is proposed to incentivize active, engaged, and thoughtful delegation. Specifically, we propose upgrading the protocol so that its fee mechanism rewards UNI token holders who have delegated and custody their tokens.

* This proposal describes the motivation for this change and details the technical changes and logistics required to implement this change.

"* Multiple appendices provide additional background information.

"* Assuming no major impediments arise. , the snapshot voting for this proposal will be released on March 1, 2024, and the on-chain voting will be released on March 8, 2024."

In a brief summary After reviewing the governance results of Uniswap in the past year, he pointed out the current problems:

"Free-riding and indifference are still potential risks to the sustainable development of the Uniswap protocol. .The UNI used to vote on a certain proposal is less than 10% of the circulating supply. In addition, a large part of the existing representatives are "out of date". As of February 1, 2024, the top 30 representatives in voting power Among them, 14 representatives have not voted in the past 10 proposals, and only 7 of them have proposed proposals."

And the solution he tried to propose what is it then? It is to provide incentives to UNI holders who actively participate in governance:

"We are pleased to inject vitality into governance by linking authorization with protocol fees— —Incentivize not just delegation, but thoughtful and active delegation. Specifically, we believe that UNI token holders will be incentivized to select those representatives who vote and participate in the protocol, thereby promoting its growth and success. If this proposal is approved Successful, we believe we will see a massive influx of new delegators. At the same time, as existing deputies will need to be re-delegated in order to receive tokens, we will see "stale" existing delegates transferred to those who have proven their commitment to support the protocol representatives. Furthermore, this mechanism can operate on its own in the future - continuing to incentivize participatory delegation without the need for any additional accommodations."

Specific The technical solutions focus on the following three points:

"If this governance proposal is implemented, they will:

『* Upgrade Uniswap protocol governance to enable permissionless and programmatic protocol fee collection

『* Prorate any protocol fees to UNI token holders who have voted and delegated voting

"* Allows governance to continue to control core parameters: which fund pools are subject to fees, and how much they charge"< /p>

The code level mainly involves two new contracts, V3FactoryOwner.sol and UniStaker.sol, which will not be described again. Anyone who wants to know more can go directly to the original proposal.

Next rhythm arrangement:

"1. Today, February 23: According to governance procedures, this post will remain open for dialogue for at least 7 days.

"2. Today, February 23: The Code4rena review competition begins and will last for 10 days days. For competition details, please click here (24).

"3. Next Friday (March 1): UF (Uniswap Foundation) will release Snapshot, options include "Yes, upgrade the owner of UniswapV3Factory", "No, do not upgrade the owner of UniswapV3Factory" and "Abstain".

"In the Code4rena competition and any After the mitigation measures are completed, instances of V3FactoryOwner and UniStaker will be deployed and verified on Etherscan. This post will be updated with links to deployed and verified contracts.

4 . March 7: Assuming the snapshot is successful, UF will issue an on-chain vote. After successful execution, the setOwner function of UniswapV3Factory will be called and the v3FactoryOwner address will be passed.

5. The Immunefi bug bounty will take effect before the on-chain voting successfully ends. The bounty details including the link will be announced before the on-chain voting."

This horoscope The proposal that was just half-written was actually so powerful that it blew up a UNI that ranked among the top 20 companies in terms of market capitalization. In the VIP group of Planet members, the author jokingly said that even before the chicken blood was injected, people were already excitedly asking for it as soon as the needle was shown.

In fact, my understanding of the proposal is mixed. Excited people feel that UNI will finally pay dividends and gain empowerment. Those who are worried believe that this will make UNI more likely to have securities properties and become the target of SEC sniping.

However, the short-term logic of the market is not the logic of fundamentals at all, but the logic of capital. There is a strong banker who wants to blow things up, but the news is just to cooperate. Pulling the pan is justice. In front of Bola, reason and logic are pale - the logic of bullishness is bullshit, and the logic of bearishness is bullshit.

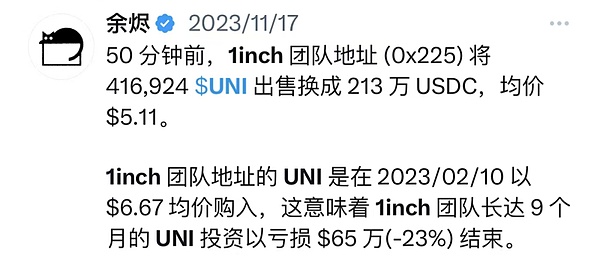

At this time, the people who want to cry the most are probably the meat cutters like the 1inch team who fell before dawn:

Traveling through bulls and bears, currently The three main positions of Jiaolian (BTC, ETH, UNI) have all returned to profit status. Only by crossing bull and bear positions can we truly test our vision of focusing on long-term value.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Xu Lin

Xu Lin JinseFinance

JinseFinance Anais

Anais JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Kikyo

Kikyo