Author: MIIX Capital

Foreword

Uniswap is a DEX based on the AMM mechanism. It will launch V3 in May 2021 and is expected to launch the V4 version after the Dencun upgrade in 2024. As Uniswap's position on the DEX track continues to expand and is not easily shaken, with the Dencun upgrade and the launch of the V4 version, it is expected to have better price performance. However, the number of Holders and Balances of Smart money, as well as the on-chain behavior of market makers, indicate that Uni is less likely to rise significantly in the short term, and it may be necessary to observe the specific on-chain situation after Dencun.

1. Project Overview

Uniswap is a DEX based on the AMM mechanism. It will be launched in 2021 The launch of V3 in May has brought great success. By introducing market mechanisms, it has improved capital utilization, reduced handling fees, and increased LP income. The V4 hooks under development bring programmability to Uni. This property will enhance the composability of the pool and provide more refined capital efficiency control, leaving a lot of room for imagination.

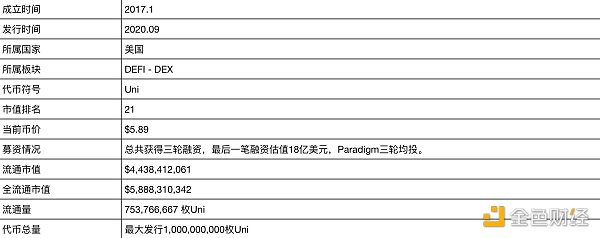

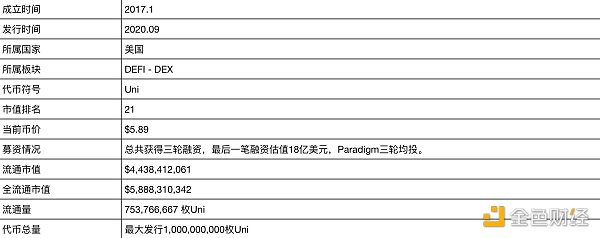

1.1 Basic information

Data deadline: November 30, 2023, https://www.coingecko .com/en/coins/Uniswap

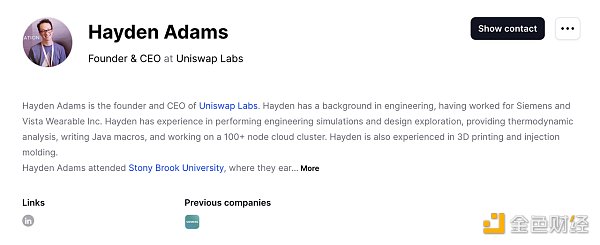

1.2 Founding Team

Hayden Adams: Graduated from Stony Brook, New York University, worked as a researcher at Columbia University Medical Center in June 2012, and joined Siemens in 2016 to conduct engineering simulation and design exploration for numerous customers in the automotive and aerospace industries. Uniswap Lab was established in October 2017. He was also one of the developers of Ethereum. I personally invested in Lens protocol and Wallet connect.

< p style="text-align: left;">Marvin Ammori: Chief Compliance Officer CLO, graduated from the University of Michigan with a major in business analysis, and received a JD master's degree from Harvard Law School. With 16 years of work experience, he has served as a legal consultant at Free Press, New Aemrican Foundation, Virgin Hyperloop Project, Protocol Lab, and as a law professor at the University of Nebraska-Lincoln. Possess relatively profound legal foundation. Joined Uniswap Lab in November 2020.

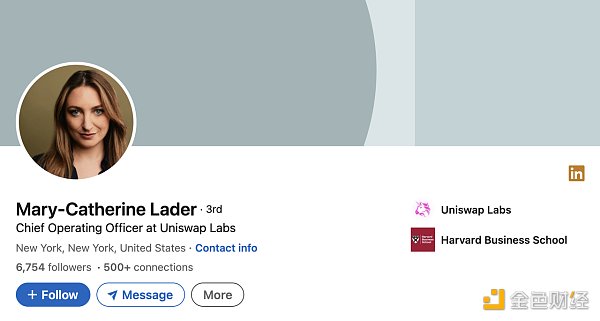

< p style="text-align: left;">Mary-Catherine Lader: Chief Operating Officer COO, graduated with a BA in history from Brown University, an MBA from Harvard Business School, and a JD from Harvard University. Joined Goldman Sachs as an investment analyst in 2018, joined Blackstone in 2015 as global chief operating officer, and joined Uniswap in June 2021 to lead the growth, strategy and operations of Uniswap Labs.

< p style="text-align: left;">Justin Wong: Chief Financial Officer HOF, graduated from Cornell University with a bachelor's degree and an MBA from McCombs School of Business in Texas. He joined the Peace Corps in 2004 and then worked for Deutsche Bank, Siemens, Virgin Hyperloop and other companies. He once founded The F Suite, a private community dedicated to bringing CFOs together to solve insurmountable problems, but it was only open for 9 years. months, joining Uniswap in March 2021.

< p style="text-align: left;">Raphaela S.: COO of Uniswap Foundation, Bachelor of Economics, worked as an analyst at Bank of America, FF Venture Capital, Blue {Seed} Collective investment assistant, started to enter in 2018 In the blockchain industry, he once served as Vice President of Livepeer. He joined Uniswap in October 2022 as Chief Growth Officer to promote the growth and use of the Uniswap protocol.

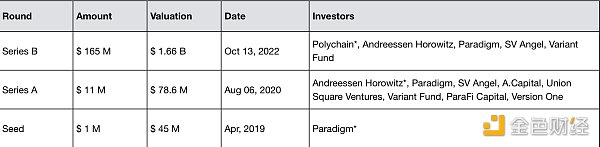

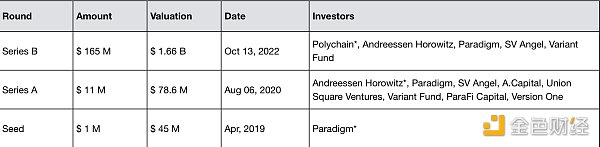

1.3 Investment and Financing Background

Paradigm has been accompanying Uniswap from 0 to 1, in resources and ecological construction , funding, and development. Uniswap’s success today is inseparable from Paradigm’s support and help.

2. Product situation

2.1 Code and developers

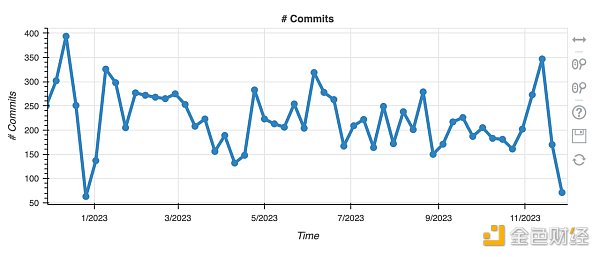

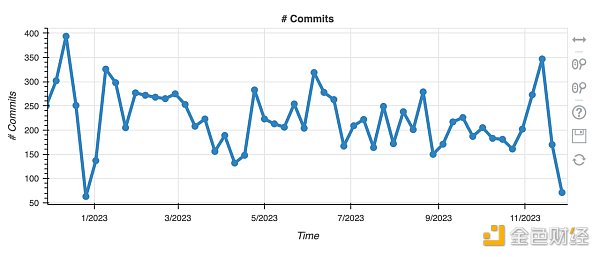

Code submission status

Number of developers

Looking at changes in code submissions and the number of developers, The overall progress of Uniswap is currently stable, and the number of developers is also maintained within a reasonable range. It can be determined that Uniswap's Roadmap implementation and technical operations are very stable.

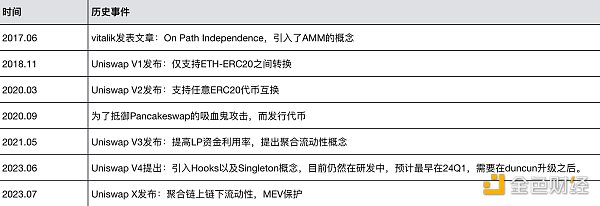

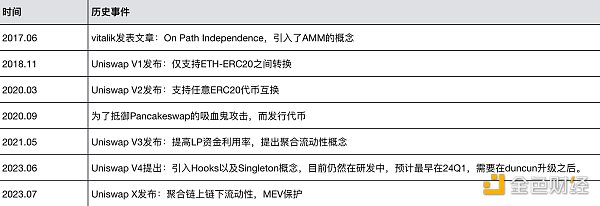

2.2 Product Evolution

As a popular decentralized trading platform (DEX), From V1 to V3, Uniswap has experienced several major upgrades, and each version has brought new features and improvements. In addition, Uniswap has released a V4 draft, which introduces Hooks and Singleton functions, which can greatly improve the reliability of Uniswap. Combinatoriality releases more underlying value, increases more profit opportunities, and optimizes capital utilization.

Evolution from V1 to V3

Uniswap V1, released in November 2018

Simple model: adopts the automated market maker (AMM) model, allowing users to interact directly with intelligent Contract trading, rather than the traditional market of buyers and sellers;

Decentralization: completely decentralized, no centralization Control entity;

Support is limited to ERC-20 tokens: V1 only supports exchange between ERC-20 tokens;< /p>

Uniswap V2, released in May 2020

ERC-20 trading: Introducing the direct exchange of ERC-20 token pairs, not just the exchange of ERC-20 and ETH;

Price oracle: Built-in price oracle, which can help other applications obtain cumulative price information of token pairs and prevent price manipulation;

Lightning transactions: This feature allows users to lend any amount of ERC-20 tokens within a short period of time from the beginning to the end of the transaction;

< /li>

Uniswap V3, released in May 2021

Centralized liquidity: allows liquidity providers to specify a custom price range, increasing capital efficiency while reducing the risk of impermanent losses;

-

Multi-tier rates: Provide different rate levels (such as 0.05%, 0.30%, 1.00%), and liquidity providers can choose different rates;

Liquidity position NFT: Each liquidity position is represented as an NFT, making the management and transfer of liquidity more flexible;< /p>

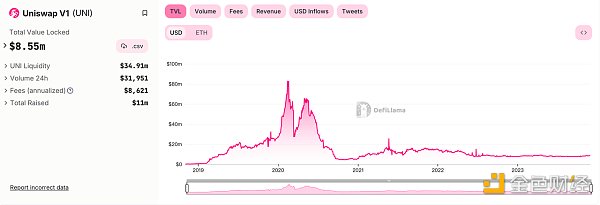

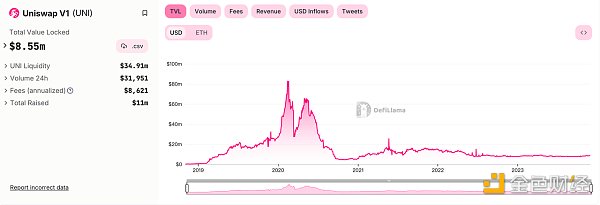

User flow to V3

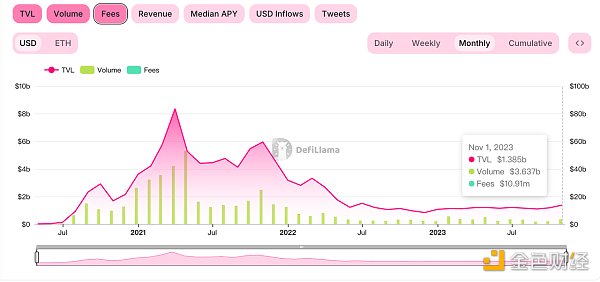

We can see from the picture above that the current Uni V1 is no longer used. A large number of LP prefers V3. Uniswap V3 is essentially an improvement of the V2 version, providing LP with more flexible liquidity ranges and rate options, but this improvement has not changed from the lowest level mechanism. V3 is fully compatible with V2, so subsequent There is a high probability that the LP will give priority to V3.

Significant advantages of V3

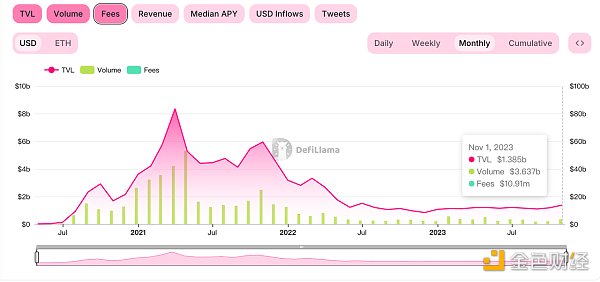

Intercept the transaction data of V2 and V3 in the same time period. In November 2023, use V2 The transaction volume carried out is 3.637 billion U.S. dollars, and the handling fee is 0.3%, which is 10.91 million U.S. dollars shown on Defillama. Therefore, users do not count slippage, and each transaction fee is 0.3%; V3 transaction volume is 36.041 billion U.S. dollars, nearly ten times that of v2, and fee income is 44.12 million U.S. dollars, which is converted to 0.12%, which is the average Transaction costs dropped by 60%.

V3 improves capital utilization, reduces handling fees, and increases LP income by introducing market mechanisms. The Hooks of V4 bring programmability to Uni. This property will enhance the composability of the pool and provide a lot of room for imagination. It is also the current trend of separation of front and back ends that is becoming more and more obvious, so the programmability of the LP pool is , it becomes particularly important to allow each transaction to bypass the front-end but not be able to bypass the LP pool setting.

In other words, competition on the front end will intensify in the future, and there will be various competitions on the front end of a variety of LP pools that adapt to different programming functions. , further breaking away from the limitations of Uniswap's official front-end, and truly promoting the most original feature of the blockchain - composability, and Singleton is a product that emerged to reduce the Gas consumption caused by this multi-path search.

What are Hooks?

Originally, we executed a transaction, directly called the transaction function, and then found the optimal path to trade. Now when we make a transaction, we need to first call the Hook before the transaction. This Hook is a smart contract that can perform a given operation within a block, then execute the transaction, and finally execute the Hook again, which means we want to execute A transaction needs to execute the function function in front of the LP pool of the corresponding path. Developers can innovate on top of the liquidity and security of the Uniswap protocol to create custom AMM pools through hooks integrated with v4 smart contracts.

What is a Singleton?

In V3, we need to search different pools (that is, different contracts) for multi-link (ETH→USDC→USDT, involving two contracts) token swaps. If all tokens are stored in one contract, then multi-link swaps of tokens only need to be performed within one contract, which will greatly reduce the gas consumption of creating LP. This is called Singleton by Uni.

2.3 Market Development

Development History

Social media

Operational data

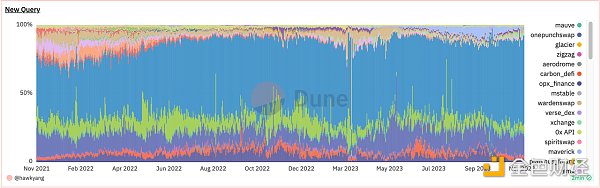

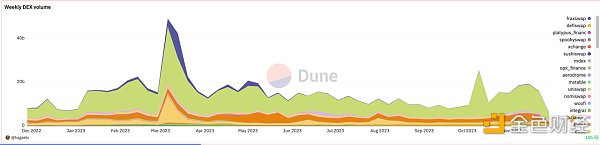

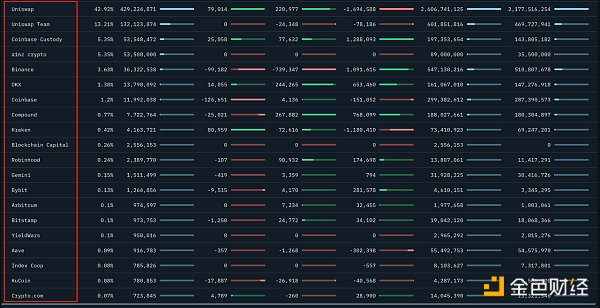

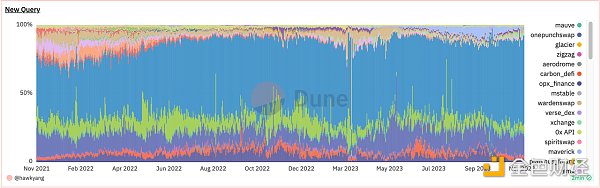

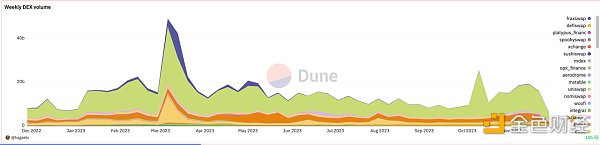

The current spot DEX market share occupied by Uniswap is about 65% (using Dune as the statistical caliber, due to different Inconsistent coverage of contracts on websites may lead to deviations), we believe that with Uni’s unremitting innovation, V4’s programmability, composability, and further improvements in capital efficiency, Uniswap will still occupy a favorable position in the next round of Dex competition. Regarding The specific situation of the same track will be listed in the Market and Competition Department.

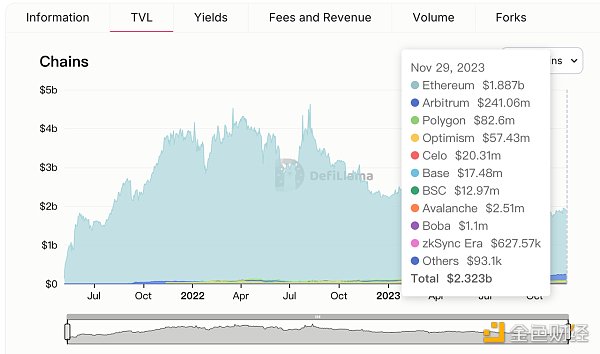

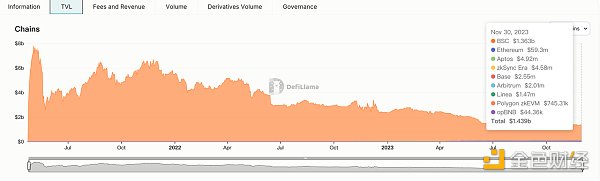

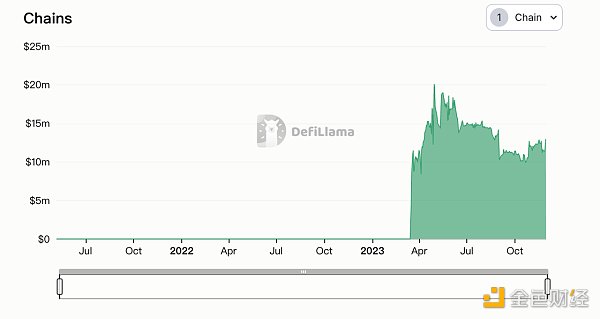

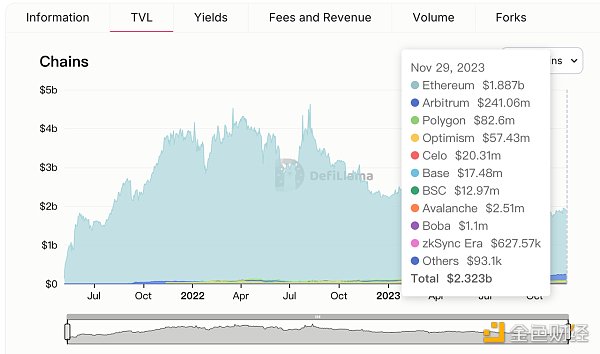

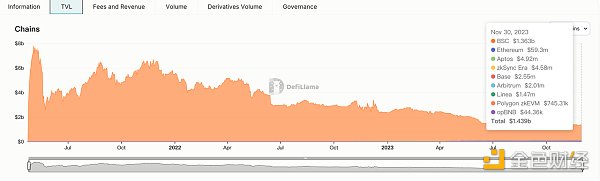

TVL data

In terms of TVL, a large amount of TVL on V3 is still concentrated on Ethereum, but At present, its share is gradually declining, and on-chain activities are gradually migrating to Layer 2. With the arrival of the Dencun upgrade, the share of the main network will further decline, and the activity of Layer 2 will also further increase.

3. Economic model

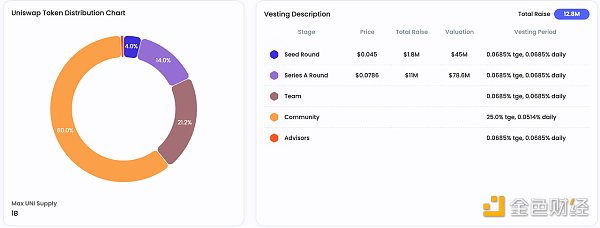

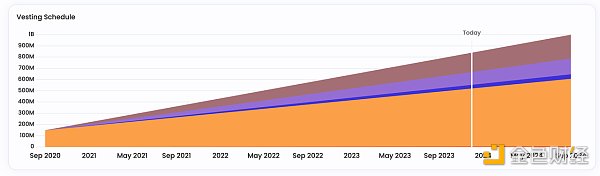

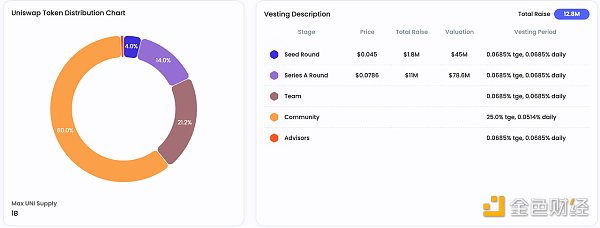

3.1 Token distribution

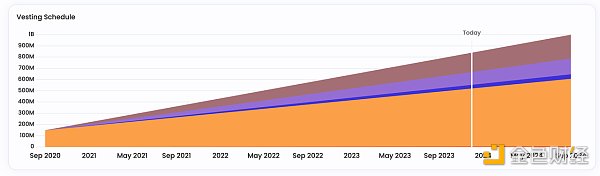

1 billion Uni will be completely released at the end of August 2024. At this time, it will be fully circulated. The subsequent selling pressure will mainly come from the commUnity part.

< p style="text-align: left;">Uni tokens are mainly allocated to Community. This part is mainly used for ecological development, community developer contributions, Grants, etc.

3.2 Currency Holding Address Analysis

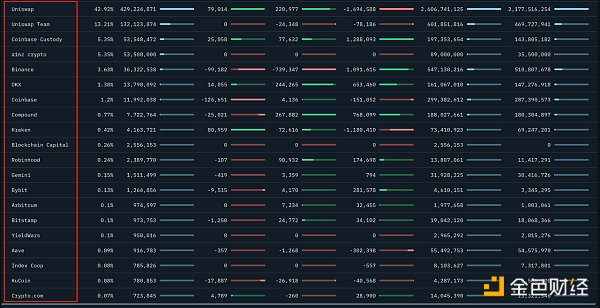

Nansen statistics: The VC with the most currency holding addresses currently is a16z, occupying approximately 5.35%, approximately 53.5 million tokens. Far more than the 2.5 million tokens of the second-place VC Blockchain Capital

a16z has always maintained a supportive attitude towards Uniswap. It has not sold a single token in the past month, which represents its support for Uniswap. The optimism about the market outlook and recognition of Uni’s influence. The exchange currently holding the most Uni tokens is Uniswap, and the centralized exchange is Binance.

3.3 Token usage

Uniswap’s token, usually called Uni, has Several main uses:

Governance

Uni token holders can participate in the Uniswap platform governance. This includes voting on protocol improvements, fee structure adjustments, and other key decisions. This decentralized governance structure allows Uni token holders to directly influence the future direction of Uniswap.

Liquidity incentives

Uniswap sometimes incentivizes users to provide liquidity by rewarding Uni tokens sex. Users provide liquidity by depositing tokens into Uniswap’s liquidity pool to support the platform’s token swap functionality. In return, they may receive Uni tokens as a reward.

Voting and representation rights

Uni token holders can not only vote to participate in governance Decision-making can also represent the interests of small token holders. This amplifies the voices of users of all sizes in the Uniswap community.

Protocol fees

Although Uniswap does not currently charge fees for transactions, in the future Uni will Coins may be used to incentivize users to participate in governance, for example by allocating a portion of transaction fees to these users.

Community Fund

Uni tokens can also be used to support community projects and proposals that and proposals aimed at improving the protocol and expanding its use.

4. Market and Competition

4.1 Market Overview

Uniswap is facing fierce competition, not only facing competition among DEXs, but also among CEXs. Because the largest base is CEX, it is very difficult for Uniswap to cannibalize CEX. The main difficulty is that DEX cannot provide the same performance, liquidity, UI/UX and product depth as CEX.

< p style="text-align: left;">On the DEX track alone, Uniswap has gone from a 37% market share during the bull market last year to nearly 65% today. This is mainly due to the upgrade of V3 and its value. Market recognition.

< p style="text-align: left;">In terms of (weekly) trading volume ratio, Uniswap is also in a well-deserved leading position, and in the DEX track, once liquidity accumulates and user habits are developed, there will be more Obvious Matthew effect.

4.2 Track Project

Currently comparable to Uniswap is Pancake swap with a market share of 15.4%, Curve The market share is 5.1%. Since Pancake is the code of Fork Uniswap, its original competitiveness is relatively weak. Even Pancake is currently taking the Game route and has built a game market.

< p style="text-align:center">

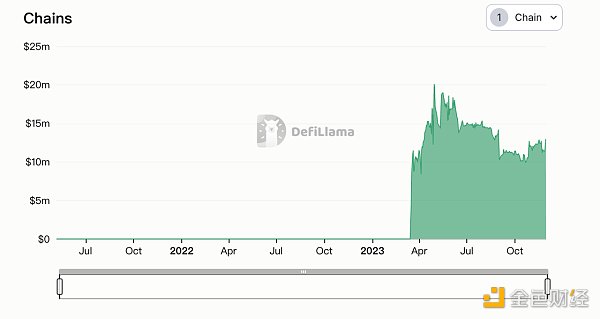

The current Pancakeswap TVL is US$1.43 billion and supports 9 chains. Its basic base mainly comes from BSC, and it has almost no dominance in other chains.

< p style="text-align: left;">Although Uniswap has also deployed the protocol on BSC, using PancakeSwap on BSC may be rooted in the consensus of BSC users. It is also difficult for Uni to challenge Pancake, but the turning point may appear in v4 The version is online, and we still need to continue to monitor it.

4.3 Advantages and risks

Uniswap’s competitive advantages

Capital advantage, Uniswap is fully supported by Paradigm, the team has high execution ability, development progress is stable, and the version launch rhythm is good ;

Technical advantages, the release of the V4 version will further improve capital efficiency, composability, and programmability, allowing LP to sink into Infrastructure in the DeFi world;

First-mover advantage, first-mover advantage to gain high market share, especially after the launch of V3, the market share has increased from 37% increased to 65%, Pancake’s threats and challenges are smaller;

Risks faced by Uniswap

Legal risks are mainly the license-free mechanism of DEX and the risk of issuing securities that the token may face if the share of the token is increased in the future;

Code risk, even if the code is audited, there are still potential risks that may lead to total loss of funds;

Progress risk, there may be development progress that is lower than expected, causing the token price to be lower than expected;

Iterative risk, the V4 version may bring more hidden dangers on the chain, which will have higher requirements on the front end, which requires the front end to screen the LP pool for users;

5. Summary

Uniswap has been the leader of DEX in the industry since its launch, occupying the largest market share. Through iterative upgrades of the AMM mechanism, price oracles and centralized liquidity, Uniswap has allowed DEX to be accepted by more and more people. With the upgrade of Dencun and the recent launch of the Uniswap V4 version, Uniswap's market position in the DEX field will be further enhanced.

Although the UNI token has not performed well for a long time, its potential has not been reduced. Instead, it has been developing with Uniswap. Under the premise of improvement, especially if there are almost no competitive products, UNI has a large room for growth. Once the market overall rises and enters a bull market, it is very likely to usher in a huge explosion.

JinseFinance

JinseFinance