Source: PentaLab

Project name: Vertex Protocol

Token: VRTX

Current market value: 46.7 million US dollars

6-month estimated market capitalization: US$56.5 million

Road potential: 21%

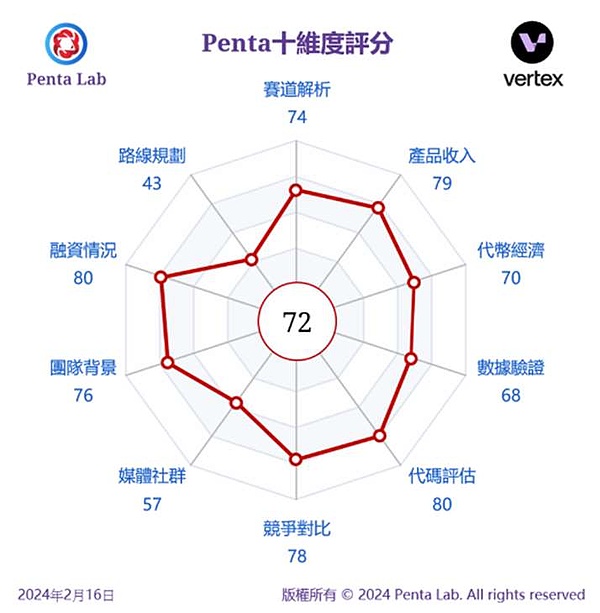

Penta ten-dimensional score: 72

Data as of: February 2024 16th

Download the full report: pentalab.io

Vertically integrate three mainstream Defi products, with the lowest DEX transaction fees. Vertex Protocol is a decentralized exchange (DEX) built on the Arbitrum network. It uniquely integrates the three most popular DeFi products: spot, perpetual and integrated currency markets. Users do not need to be isolated from each other. Switch between DeFi applications to buy and sell assets, use leverage to go long or short on derivatives contracts, and borrow/lend from asset pools. Regardless of the product, market makers (Maker) can enjoy free trading fees and receive a 0.005% fee rebate on Vertex, while the fees for liquidity providers (Taker) are 0.02%, which is comparable to that of centralized exchanges.

Universal cross margin and hybrid CLOB/AMM mechanisms improve trading efficiency. For Verte, the investment portfolio is the user's margin, which can be used to maximize returns and hedge risks. By combining AMM and off-chain order book (CLOB) quotations, CEX's low gas fee and high-frequency trading capabilities are effectively obtained by complementing each other's strengths, while maintaining the characteristics of DEX and avoiding the possible problems of the two isolated models.

The upcoming V2 version will provide users with more long-tail assets and is expected to become the leader in the long term. V2 will be a product that spans multiple chains, allowing user assets on different blockchains to share the same Vertex liquidity order book. Users will not need to leave Vertex’s product page to transfer assets distributed in Assets on different chains can be called in at any time to act as liquidity for trading or LP. At the same time, V2 will also provide users with more long-tail asset classes for trading, a wider selection of margin collateral, an independent and isolated margin system and fewer gas fees. We expect these advantages will make Vertex the long-term leader.

The voVRTX token captures real income and creates a growth flywheel with token trading incentives. The Vertex protocol allocates up to 44% of VRTX tokens through the transaction reward plan. At the same time, the VRTX tokens obtained from mining can be pledged to form voVRTX, and the more active the trading activities during the pledge period and the longer the pledge time, the more The more voVRTX you have, the higher the proportion of USDC transaction fees you receive. Real income attracts users to join, encourages users to hold VRTX tokens for a long time, participate in staking and increase transaction activity, forming a positive cycle.

Valuation: Our research found that the DEX perpetual contract track is still in the enclosure stage, and the trading volume of each company fluctuates greatly, which is mainly affected by changes in the price of the underlying assets. Coin rewards, on-chain status, etc. We are optimistic about Vertex's cross-margin and hybrid CLOB/AMM mechanisms, and believe that with the increase in trading types and the release of the next version V2, it has the opportunity to become the DEX leader in perpetual contracts in the long term. However, Vertex stated that V2 may not necessarily be available in the next six years. Going online within a month, we currently have a six-month target circulation market value of US$56.5 million based on V1's seven-day annualized trading volume since December 2023, which is US$148 billion, and the average ratio of 0.0038 times, which is compared to the current market value of US$46.7 million. The dollar has 21% room to rise.

Main risks: Risk of intensified competition, V2 version update not as expected.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph