Author: DeMan; Source: PANews

How does RedStone provide a low-cost price source for L2?

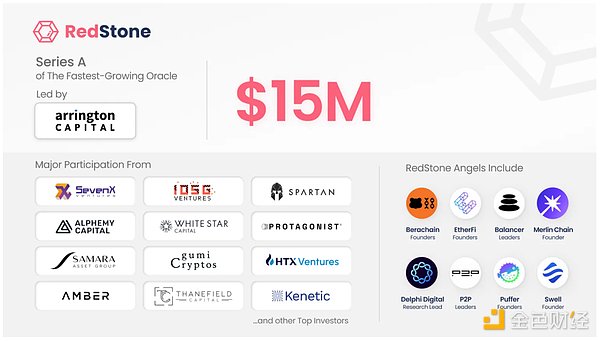

RedStone, a modular blockchain oracle provider, successfully raised $15 million in a Series A round of financing led by Arrington Capital on July 2.

Other investors in this round of financing include Kraken Ventures, White Star Capital, Spartan Group, Amber Group, SevenX Ventures and IOSG Ventures.

In addition, angel investors such as Smokey the Bera and Homme Bera of Berachain, Mike Silagadze, Jozef Vogel and Rok Kopp of Ether.Fi, and Amir Forouzani, Jason Vranek and Christina Chen of Puffer Finance also participated. Not only that, on July 4, the Zircuit mainnet has taken over the emerging oracle project Redstone.

With the total locked value of the DeFi market doubling over the past year, especially in the field of liquidity staking, which has accumulated more than $50 billion in assets, the RedStone oracle has occupied a unique position in the market with its modular design.

It can be said that RedStone's financing not only demonstrates investors' confidence in its future development, but also marks the further consolidation of its position in the field of blockchain oracles.

01.The next generation oracle RedStone

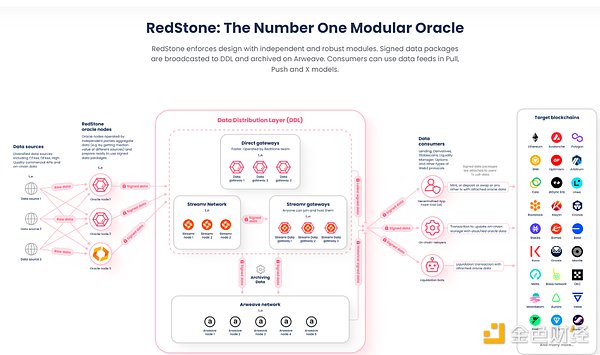

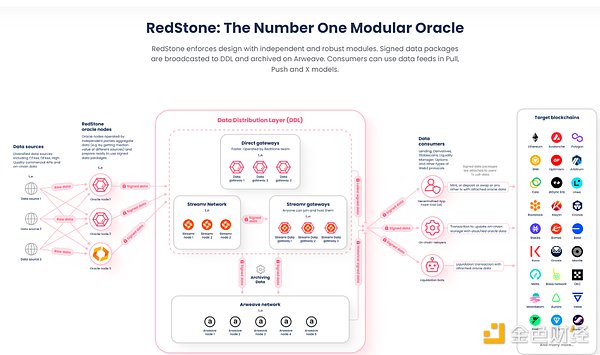

RedStone is a modular blockchain oracle, similar to Chainlink and Pyth Network, but it stands out with the unique advantages of modular design.

RedStone founder and CEO Jakub Wojciechowski emphasized that the modular architecture enables RedStone to start on new networks faster and flexibly adjust traffic according to market demand.

With the rise of the wave of liquidity re-collateralization tokens, RedStone became the first oracle to support projects such as Ether.Fi, Renzo, Puffer and Swell.

The main function of a blockchain oracle is to provide real-world data to smart contracts, ensuring that smart contracts can make decisions based on the latest external information when they are executed. The advantage of modular oracles is that their components can be updated or replaced independently, thus ensuring scalability and integration on different blockchains.

RedStone's integration with The Open Network (TON) is a typical example. Wojciechowski pointed out that TON's architecture made the integration of oracles very cumbersome, but the RedStone team spent four months to ensure the smooth completion of end-to-end integration.

According to DeFiLlama, RedStone is currently the fifth largest blockchain oracle with a total value of approximately US$3.5 billion.

RedStone was founded during the Arweave chain incubation program in 2020 and currently supports more than 60 blockchains, including layer 1 and layer 2 networks such as Ethereum, Base, Arbitrum, and Merlin Chain. In the future, RedStone also plans to support Berachain and Monad blockchains, and will launch its function as an active verification service (AVS) on EigenLayer.

It is reported that RedStone has been promoting the on-demand method for the past three years and is currently used on more than 40 L1 and L2, ahead of its competitors.

In the future, with the increase of Dencun (EIP-4844) Ethereum upgrade, liquidity pledge and re-pledge, and L2 as well as Optimistic and ZK aggregation, the demand for reliable price data in the entire industry will further surge. With its future-oriented design, RedStone is ready to continue to lead in this rapidly developing field.

Sponsored Business Content

02.RedStone's uniqueness

RedStone Oracle adopts a unique approach to store non-standard data on Arweave and transmit it to all EVM-compatible chains.

Oracles are a type of middleware that enables communication between blockchains and off-chain systems such as data providers, cloud providers, IoT devices, and payment systems. Smart contracts on various blockchains, including Ethereum, can use data provided by oracles to decide whether to execute protocols or commands. Therefore, platforms and enterprises using smart contracts rely directly on oracles to obtain data from the outside world.

However, centralized and third-party oracles do not conform to the values of blockchain technology and decentralization. The uncertainty and asynchrony of external data make it difficult to reach consensus between nodes.

In addition, the risks brought by direct access to unsecured external environments have also deterred many projects, which is the so-called oracle problem. The decentralized nature of blockchain makes it impossible to extract or push data from any external system. Blockchain nodes must be kept in isolated sandboxes, so they cannot directly access traditional services or generate data internally.

RedStone alleviates the problems faced by blockchain projects by providing flexible and affordable oracle solutions.

Its modular design is suitable for DeFi, similar to L2 of blockchain, enabling it to provide push and pull oracle data services to multiple EVM and non-EVM ecosystems, Rollup, and various application chains.

RedStone's data is cryptographically signed by the provider and can be verified on any chain that supports basic cryptographic primitives.

RedStone utilizes Arweave's new generation of blockchain storage to save large amounts of data at a low cost, enabling it to process more data at a higher update frequency.

Unlike traditional oracles, RedStone's data is stored on Arweave, and the node and partner network provides them to DeFi projects in the form of a decentralized public cache. EVM-Connector allows this data to be injected into the target chain only when needed, ensuring the integrity and security of the data.

In addition, RedStone allows multiple data providers to enter the blockchain ecosystem, each of which can apply different aggregation rules to provide services tailored to the needs of DeFi protocols. RedStone's design also ensures the integrity of the data, and data providers are required to pledge RedStone tokens as collateral to ensure that they can continue to operate and provide high-quality data.

Through its innovative approach, RedStone not only provides a secure, flexible and efficient alternative to existing oracle solutions, but also brings reliable real-world data support to application scenarios such as DeFi and smart contracts. As the blockchain ecosystem continues to develop, RedStone will continue to maintain its leading position in the oracle field.

Summary

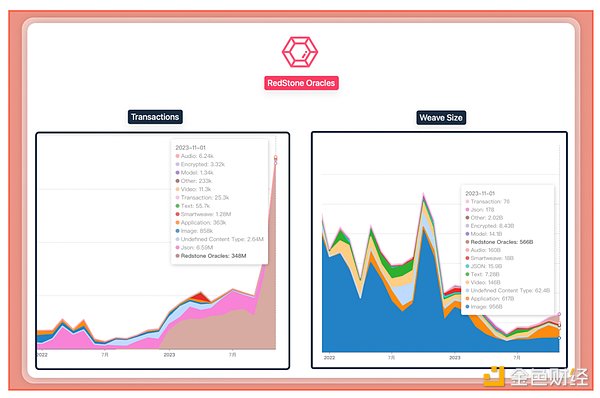

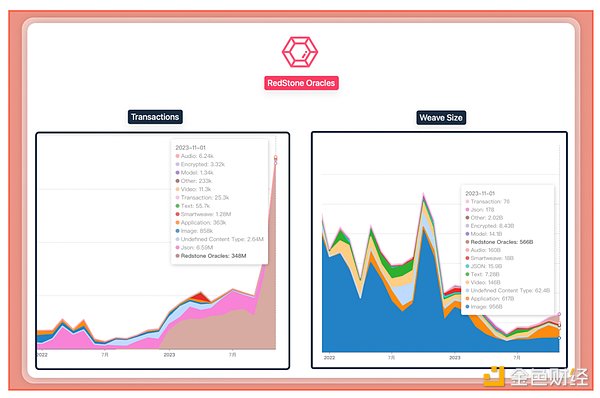

RedStone is hailed as the next generation of oracle, and looking at its performance in 2023 and early 2024, the transaction volume data has been very impressive.

This is of course inseparable from the RedStone team's hard work in the past bear market. Through carefully planned activities, uninterrupted integration cooperation, continuous polishing and exploration of product innovation, they have become the biggest contributor to the growth of Arweave's trading volume, and have gradually gained market recognition.

In the first half of 2024, RedStone handed in a good report card. Whether it is expected to become a leading project on par with Chainlink in the oracle track in the future, we will wait and see.

Alex

Alex