The former Worldcoin now seems to be a joke.

A year ago, this project, which was born with a golden key, was still highly sought after. It won hundreds of millions of dollars in financing with the halo of OpenAI founder Sam Altman's re-entrepreneurship. Although the identity information device Orb was controversial, the vision of UBI has always been deafening. In just less than a year, suspected fraud, word-of-mouth collapse and business bottlenecks have repeatedly appeared in the discussion of the project.

Is it the sovereign rules or the defects of human operation that caused the project to collapse? The hard-core vision of Worldcoin is as hazy as a castle in the air.

Let's take a brief look at Worldcoin. When it was first built, the project envisioned that by collecting identity information to confirm the existence of individuals, a global distribution system that can achieve universal basic income was built. In terms of the main body, Worldcoin consists of the Worldcoin Foundation and Tools for Humanity, of which the former focuses on community governance and the latter is the actual technical development subject. The Worldcoin technical implementation framework consists of three parts: global identity ID, global currency, and the wallet that carries the two, corresponding to WorldID, WorldCoin (WLD), and WorldAPP respectively.

On July 24, 2023, Worldcoin officially launched the token WLD. When it was launched at that time, the currency ushered in a lot of controversy, mainly due to the high degree of centralization of the token, 5 market makers held 91.74% of the total circulation, and the fixed pricing of the implied call option; secondly, the token showed a typical high market value and low circulation characteristics. Considering the luxurious financing lineup of the project, users suspected that this was another retail investor takeover project.

In addition to the token, the unique iris biometrics of the orb device has also set off a controversy in the market about the protection of privacy data. The centralized manufacturing of the orb device and the suspected backdoor have caused people to doubt and attracted the attention of government regulators. In the commercial construction, the black market industry chain spawned by the unique market operation mechanism has once again triggered the so-called "neo-colonial exploitation".

Despite facing various controversies, WLD has become a hard-core AI concept coin in the crypto sector due to its special relationship with OpenAI. Due to the popularity of AI this year, WLD has also taken advantage of the trend. In February, under the influence of SORA, WLD soared 160% in a single week, from US$2.5 to US$6.77, and in March it rose to US$10.8, setting a record high. But then, affected by market sentiment and news, WLD fell all the way and is now reported at US$2.87.

WLD price trend, source: Coinmarketcap

From the perspective of the project itself, Worldcoin has achieved certain results so far. According to official website data, World ID users have covered up to 160 countries/regions, with more than 6 million ID verifications, 38 countries/regions have been certified for orb devices, and 3,154 orb devices have been manufactured. Although it is far from Sam's original goal of reaching 1 billion users by the end of 23 years, the data is satisfactory for a new project in the identity recognition track.

Even so, from a long-term perspective, the regulatory conflicts and data security that weigh on the project have not been resolved, and there is even a trend of intensification.

Worldcoin's official website claims that it has been allowed to operate in Europe, Argentina, Mexico, Singapore, Hong Kong, Japan and South Korea, but at its core, the project's operations started in underdeveloped areas. Kenya was once the main area for WorldID applications. However, the Kenyan government quickly issued a ban and temporarily suspended Worldcoin's registration and certification in the country. France, Germany, Spain and other regions have successively investigated and restricted Worldcoin. In March this year, Portugal's data regulator CNPD ordered Sam Altman's Worldcoin project to stop collecting biometric data for 90 days to prevent serious damage to citizens' data protection rights.

Just recently, Hong Kong once again expressed opposition to Worldcoin. After investigating six locations involved in the Worldcoin project, the Privacy Commissioner for Personal Data (PCPD) of Hong Kong said that during its operation in Hong Kong, Worldcoin scanned the faces and irises of 8,302 people for verification, but the collection of facial images was unnecessary to verify the authenticity of the participants because the iris scanning device operator was already able to conduct such verification in person at the operating location, which made scanning or collecting facial images an unnecessary step. It was finally concluded that Worldcoin's collection of face and iris images was unfair and illegal, and violated Hong Kong's data protection principles.

The opposition is not groundless. As early as the Worldcoin testing phase, there were reports that hackers installed password-stealing malware on the devices of multiple Orb operators, giving them full access to the back-end data of Worldcoin operators.

For all of the above, Worldcoin did not sit idly by. Regarding data security issues, in March of this year, Worldcoin launched a personal hosting plan, where World ID registered users can store and encrypt biometric data on their mobile phones instead of operating the backend, and registered users can request to delete the iris code. In addition, the founding team of Worldcoin is also actively negotiating with local governments in the hope of alleviating regulatory concerns. It can still be seen that the sensitivity of biometric information is still difficult to dispel in a short period of time, and the mainland of China and the United States, where users are most concentrated, are also difficult to promote due to regulations, which undoubtedly limits the sustainable development of the project.

In addition to regulatory issues, just recently, accusations surrounding the price of the currency have also been pinned on Worldcoin.

According to the white paper, within 15 years after the launch of the token, the initial supply of Worldcoin is capped at 10 billion. After the agreed 15 years, users can decide whether to turn on the inflation mode through governance, and the maximum annual inflation rate is stipulated to be 1.5%. The maximum circulating supply at the initial launch will be 143 million WLD, of which 43 million WLD will be allocated to users who use Orb verification in the Pre-Launch stage of the project, and 100 million will be lent to 5 market makers operating outside the United States. The loan period is three months, and the market makers can choose to purchase WLD tokens to repay when the loan expires. It can be seen that this mechanism implicitly controls the price fluctuation of tokens.

Excluding the tokens in the hands of market makers, the actual initial circulation was 43 million at that time. In October 23, due to the expiration of the market maker lending agreement, Worldcoin announced a renewal but withdrew 25 million WLD tokens, further reducing the circulation. But only one year after the issuance, according to the data returned by the Orb API, the actual circulation of WLD has reached 276 million, and the inflation rate is as high as 541%, which shows the speed of depreciation.

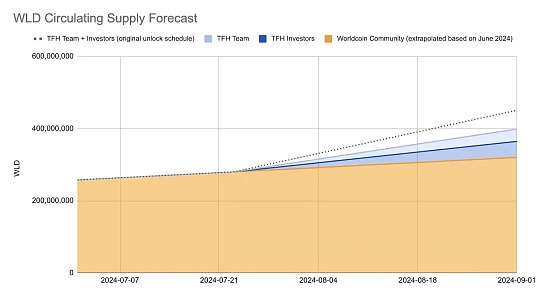

From the perspective of token release, all community tokens will be unlocked in the first year, and institutional unlocking will be started from the second year, which will last for two years. According to the token unlocking schedule, the tokens belonging to early teams and investors such as Tools for Humanity will be unlocked from July 24, with 6.62 million WLD tokens unlocked daily, equivalent to about 18 million US dollars, and the unlocking will last for 730 days. Previously, on July 10, in order to attract more people to register IDs, the project announced that the claim period for unclaimed WLD reserved tokens could be extended by one year, which once again increased the implicit selling pressure.

With large amounts of unlocking and selling pressure prepared, the WLD market reacted violently, sliding all the way to $1.9, returning to its initial launch price. In response, the project quickly rushed to put out the fire. On July 16, Tools for Humanity announced a change in the unlocking schedule of WLD tokens held by TFH investors and team members. The unlocking schedule of about 80% of TFH investors and team members' WLD tokens will be extended from 3 years to 5 years, and will remain locked in the first year. Thereafter, daily linear unlocking will be carried out in the next four years. In terms of quantity, the number of releases in this part has been reduced from the original approximately 3.19 million to 2 million, and the total daily unlocking has dropped from 6.62 million to 5.4 million.

Changes in WLD circulation supply, source: Worldcoin official website

Although there is no significant difference in the order of magnitude, due to the extension of the unlocking, WLD still rose 45% to $3.13, setting a record high price this month. On the other hand, it is precisely because of the "just right" artificial changes before the unlocking, the typical wash-out behavior of the negative impact and the rapid rise after the negative impact, that WLD was accused of fraud by industry insiders.

DeFi Squared published a long article on X, pointing out that the WLD team manipulated and misled prices by changing the issuance volume, market maker contracts, and issuing announcements before unlocking. It believes that the team claimed to maintain a low circulation rate to prevent excessive price changes from affecting the UBI income of all people. However, it is expected that by next year, early investment VCs and other institutions will release 1 billion tokens, while the UBI allocation is only 600 million. The total number of tokens occupied by venture capital accounts for 60% of the circulation, which undoubtedly hurts the interests of token holders and is not in line with the original intention of the team.

It is worth noting that in April this year, the Worldcoin Foundation also announced that it would sell 500,000 to 1.5 million WLDs to institutional trading companies operating outside the United States every week in the next six months.

It also mentioned that although it has not been confirmed, every time a good news is announced, a member of the team or venture capital is using insider information to preemptively trade. On-chain detective ZachXBT also agreed with his point of view, accusing Worldcoin of running a scam under the guise of humanitarianism to allow team members to profit.

It is undeniable that WLD is already a typical high-FDV low-circulation token. As a project supported by top investors, the phenomenon of subsequent liquidity takeover is inevitable. This has nothing to do with its vision, but is determined by the economic model. From the perspective of model setting, similar to other crypto projects, the project party cannot obtain positive commercial profits from it, and the coin price is the core of maintaining the stability of the network.But on the operational side, the project party also needs to pay operating expenses and hardware construction costs, etc. It is reported that the cost of each Orb device is about US$4,000. The profit method chosen by the operating team is also the same, selling WLD. From the data, only a single operator occasionally sells a total of 20,000 WLD tokens on the exchange every week.

And who will pay for these expenses? From the perspective of holders, nearly 25% of circulating WLD is held in the Korean exchange Bithumb, which means that the vast majority of holders are Korean retail investors, which are also the group that is directly affected. If the camera is pulled to South Korea, the popularity of Worldcoin in South Korea is visible to the naked eye. According to a local Orb operator, although they can only accept daily reservations of 100 people, they are full on weekdays and weekends during the available time period.

The trend of WLD held in the Bithumb exchange, source @DeFi Squared

It is certain that most investors buy WLD for the beautiful AI story behind it, and Sam Altman is the soul of the project. But in fact, as one of the co-founders, Sam has not spoken for the project for a long time. The only public information that can be searched on the search engine is that Sam and Worldcoin CEO Alex Blania went to the Malaysian government to communicate in April this year. There is not much relevant information released on its X platform. The soul figure seems to have been silent about the project for a long time.

Of course, Worldcoin is not without merit. It is the first to adopt advanced privacy system design, the subsequent promotion of the public chain World Chain, and the attempt to cooperate with well-known companies such as PayPal and OpenAI. There are all noteworthy points. A series of events represent that the project absolutely adheres to the concept of long-term operation, which not only has a positive impact on the promotion of the encryption field, but also allows the public to re-examine the concept of inclusiveness in the sovereign world. But from the perspective of tokens alone, the market of Worldcoin is bleak. The news of the project controls the price trend, and it eventually becomes a part of the AI dividend.

UBI, which has no blood transfusion, seems to have once again become a story of the leeks taking over. The decline of the grand vision may just confirm Romain Rolland’s famous saying, "Realism without ideals is meaningless, but idealism divorced from reality is lifeless."

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo Huang Bo

Huang Bo Cheng Yuan

Cheng Yuan Catherine

Catherine Finbold

Finbold