Author: Xiyou , ChainCatcher

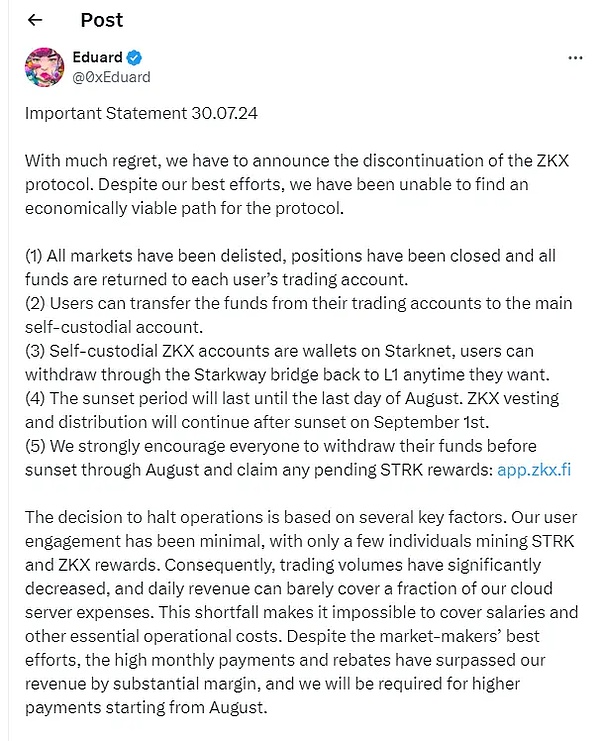

On July 31, Eduard, the founder of StarkNet's head derivative ZKX, announced that he would shut down the platform because he could not find a viable economic path, and all user funds would be returned to the trading account.

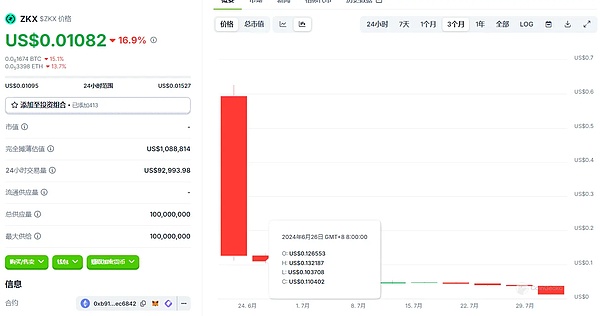

According to CoinGecko data, since the announcement of the closure, the ZKX token has fallen by more than 50%, and is now quoted at $0.01.

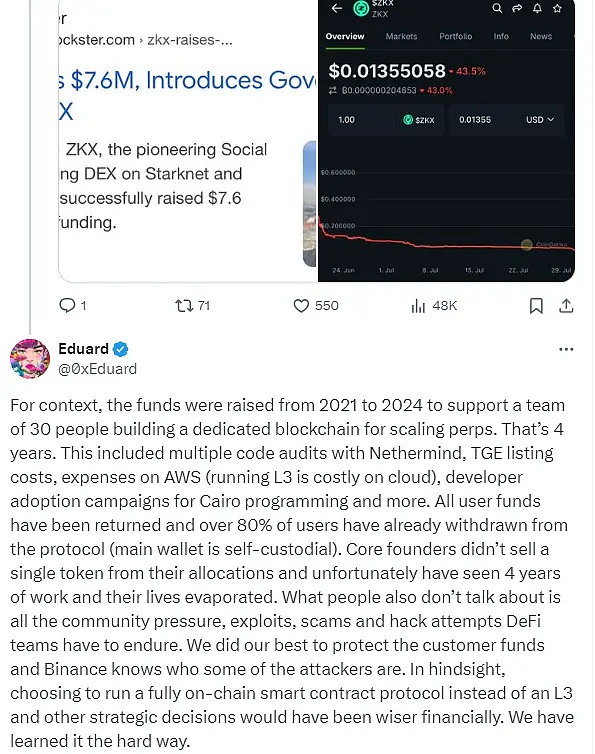

But the news of ZKX's closure has continued to ferment in the crypto community. The project just issued the token ZKX a few weeks ago and announced that it had received a large amount of financing of $7.5 million supported by top institutions such as GCR, Amber Group, and Crypto.com. It was surprising to choose to shut down at this time.

Investor @Ye Su posted on social media that when ZKX collapsed, as an investor, he did not receive any news in advance.

He added that the team claimed that they had no money, refused to provide any financial or expenditure details, and was unwilling to communicate with our investors. Most projects will consider how to transform and actively communicate in difficult times. On the contrary, Edward took money from early supporters without any communication, showing no moral standards and losing the right to start a business in the industry in the future.

ZKX chooses to shut down the platform because the income cannot pay the market maker and server fees

Why shut down the ZKX platform? The announcement released by founder Eduard wrote that at present, the user participation of the ZKX platform is extremely low, and only a very small number of users participate in it to obtain STRK and ZKX incentives. The transaction volume has declined significantly, and the daily income can no longer cover the cloud server expenses to maintain the normal operation of the website. Only a small part of it can be paid, resulting in the inability to pay wages and other operating costs normally.

It emphasized that the fees and rebates that need to be paid to market makers every month have also greatly exceeded its income, and it has been required to pay higher fees since August. However, the token ZKX has not met expectations since its listing. As the main force cashes out, the price has fallen all the way. With the current value of the ZKX token, it can no longer support the continued operation of the protocol.

The news that Eduard announced the closure of ZKX caused an uproar in the crypto community, and many people expressed confusion, because just a few weeks ago, ZKX had just completed the token TGE and announced the completion of a new round of financing of US$7.6 million.

On June 19, ZKX announced the official issuance of the token ZKX, and simultaneously launched exchanges such as Gate.io, Bitget, and KuCoin. On the same day, ZKX announced a new round of strategic financing from major investors such as Flowdesk, GCR, and DeWhales, totaling US$7.6 million. The investment institutions can be said to have a strong background.

Less than 40 days later, the ZKX platform was shut down, which made the crypto community users feel very puzzled: Why is the ZKX token short of money when it was not launched a few weeks ago? How did it spend all the $7.6 million in financing in 40 days?

The $7.6 million financing is suspected of fraud, and the actual circulation of TGE tokens is greater than the official document

The $7.6 million financing announced on the day of the token TGE (June 19) hides "word games".

In response to @ZachXBT's question about the whereabouts of the $7.6 million in financing, ZKX founder Eduard explained that the $7.6 million financing is actually the cumulative amount of funds raised from 2021 to 2024, and it is not a recent event.

The funds have been used for nearly four years of team operations to support a team of 30 people to build a dedicated blockchain L3 for expansion perps, including multiple token audits, token TGE listing costs, AWS fees, and development-related publicity activities.

It stated that the cloud servers running the L3 network are extremely expensive, and in hindsight, it may be financially wiser to choose to run a fully on-chain smart contract protocol instead of L3 and other strategic decisions.

At this time, users realized that the $7.6 million in financing announced on the day of ZKX listing was a word game, which made users mistakenly believe that the new round of financing was $7.6 million. The real situation is that this $7.6 million financing amount actually includes $4.5 million in seed round financing in 2022. The actual financing amount is only $3.1 million, which may not have occurred in June, but was just to cooperate with the ZKX token TGE.

Chain detective @ZachXBT said that Eduard's behavior was to guide and trick users into buying tokens at TGE.

On August 1, Jin Kang, partner of Perlone Capital, tweeted that ZKX was a scam.

Jin Kang pointed out three major problems with ZKX: the team closed the project due to insufficient funds 6 weeks after TGE, the token unlocking plan was suddenly changed during TGE, and the actual circulating tokens during TGE exceeded the official documents, causing the price to plummet.

And said: "If this is not a scam, then what is this?"

He pointed out in a tweet that the ZKX token fell by more than 50% in the 24 hours after the TGE. The ZKX team blamed the market makers for the error, claiming that the market makers could not stabilize the price at $0.7 and one of the market makers sold the tokens during the TGE.

The truth is that before TGE, there were more than 10 million ZKX tokens in circulation, and the actual circulation volume exceeded the official documents; and in the first 9 hours after TGE, the ZKX team blocked the transfer of ZKX from Starknet, so the transactions during this period were either from the team or the market maker; and at the last minute of TGE, the token economics were changed, increasing the percentage of market makers from 4% to 8.5%.

He called on ZKX token market makers, StarkNet and the exchanges listed on the platform to reveal the truth and give the community a fair shake.

According to Coingecko data, since the launch of TGE on June 19, the price of ZKX has been falling from a high of $0.62. As of August 1, the price of ZKX has fallen to $0.01, a decrease of more than 98%.

ZKX community user Nono told ChainCatcher that the crisis of ZKX's closure had actually emerged in the community a long time ago. The Telegram community had been unmanaged at the end of June, and no administrators responded to invitations to listing on exchanges such as BingX and BitMart, and invitations to Binance Live AMA.

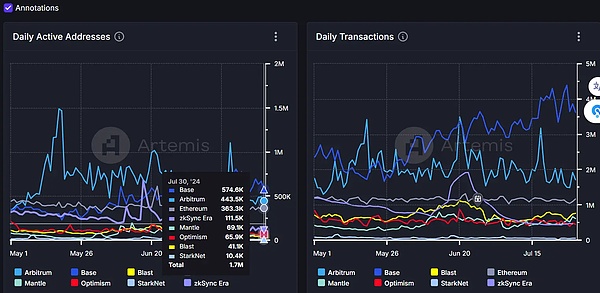

ZKX's closure has aroused concerns about the ecological activity of the underlying network StarkNet.

The closure of ZKX has raised questions about the sustainability of DeFi projects, and how to maintain user engagement and generate stable income in a rapidly developing and competitive market. However, as the representative of the leading derivatives on the StarkNet chain, ZKX's shutdown has also caused it to be caught in a public opinion storm and accused of poor ecological activity.

Some community users believe that ZKX was shut down because it was built on StarkNet, because the underlying language Cairo developed by StarkNet is too complicated, and the development-related costs will be higher, such as developer salaries and code audit costs. If it is replaced with other chains, the outcome may be different.

Developer Tom (pseudonym) explained to ChainCatcher that the key problem of ZKX's shutdown is low user participation and insufficient income. In fact, it essentially reflects the low user activity of the StarkNet network. Even with the support from top capital, it is difficult for the underlying network to maintain subsequent normal operations.

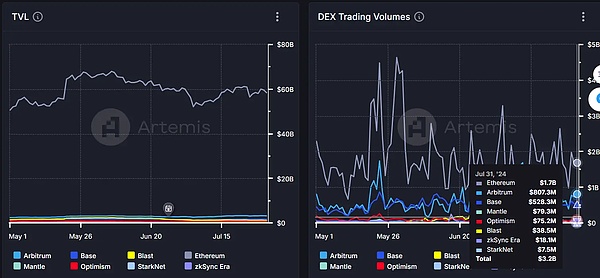

Currently, compared with Layer2 network data such as Arbitrum, zkSync, Optimism, Base, and Blast, the activity of the StarKNet network is relatively low, with only 10,000 daily active addresses, only US$7.5 million in DEX daily trading volume, and only US$1,000 in transaction fees captured daily. Multiple data rank last in Layer2.

Tutu, a player on the chain, said that it is inevitable that Starknet’s user participation will decline after the airdrop, which is also the commonality of all Layer2 networks. There are no popular or unique DApps on the Starknet chain, and it is difficult for new users to enter.

Take the user's first entry wallet as an example. It takes too much time and effort to create a wallet on Starknet. The network application still needs to use wallets such as Braavos and Argent. This is a particularly bad experience for users who are already accustomed to switching between different EVM chains. This has prevented some users from entering the ecosystem.

Now users no longer care about whether the technology behind the underlying network is complicated, but whether the user experience is smooth and simple. Starknet still has a long way to go in this regard.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinist

Bitcoinist Others

Others Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph