On July 26, NFTcollector zamunda.eth tweeted about his recent bad experience .

Three months ago, zamunda.eth purchased the CrypToadz NFT numbered #3243. It has been fine for a few months, but today zamunda.eth suddenly found thatOpenSeaadded a "suspicious activity" mark to the NFT, which affected it zamunda.eth will no longer be able to sell the NFT on OpenSea (other trading platforms can be used normally).

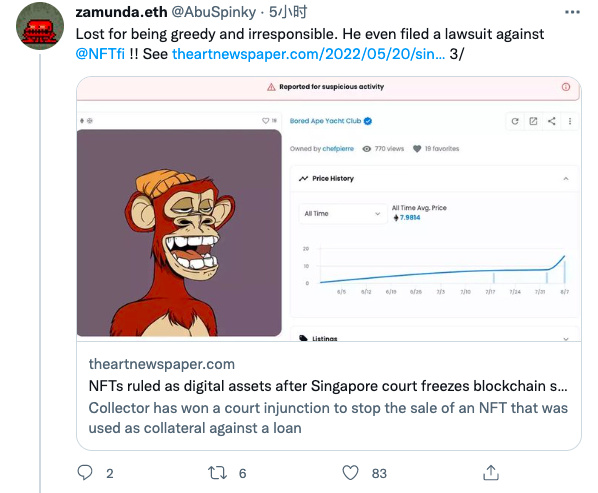

After some investigation, zamunda.eth discovered that the person who filed the report with OpenSea was a former holder of the NFT (let's call him "Trumpy " ). "Tiantan " once mortgaged multiple high-value NFTs on the NFT lending platform NFTfi and lent encrypted assets, but when the agreed repayment period came, he failed to fulfill the repayment obligation in time (maybe he bought the bottom), so These NFT collaterals have also entered the liquidation sale process, and zamunda.eth is one of the takers of this wave of sales.

Since then, the "temper" who lost all NFTs submitted a large number of targeted reports to OpenSea, including the report against CrypToadz #3243. After OpenSea accepted it, it marked the relevant NFT as "suspicious activity" logo.

It is worth mentioning that Temperament also filed a lawsuit against NFTfi for one of the transactions involving BAYC. However, according to zamunda.eth’s follow-up disclosure, the details of the two transactions are different (the terms of each loan transaction of NFTfi are different, which need to be negotiated and unified by both parties). In this deal on CrypToadz #3243, the party who borrowed from Temper even extended the repayment period, but Temper defaulted again.

zamunda.eth finally stated that OpenSea froze the relevant NFT based on the malicious revenge of "temper-tempered" without asking any reason, which caused real damage to the interests of buyers.

Briefly summarize the five subjects involved in this matter, in order of appearance:

- "Quick temper", the former holders of these NFTs.

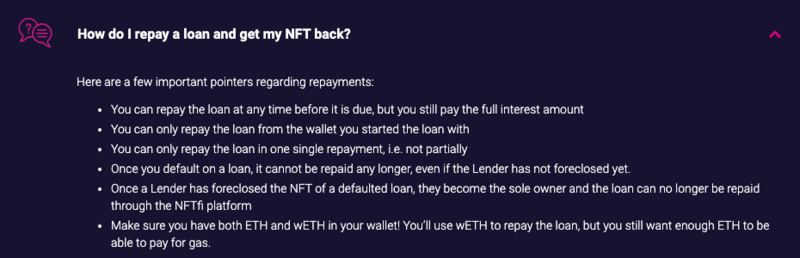

- NFTfi, a lending platform, allows borrowers and lenders to execute transactions in accordance with negotiated agreements. The borrower can temporarily borrow a certain amount of liquidity by mortgaging NFT, repay the loan (and pay interest) and get back the NFT when the agreed period arrives; the lender can withdraw the loan and obtain interest income when the agreed period arrives, if the borrower cannot For smooth repayment, the lender has the right to control (delay or liquidate) the NFT as collateral; NFTfi, as an intermediate platform, is responsible for hosting the relevant NFT through smart contracts during the agreed period.

- The passer-by lender, the user who lent funds to Temper, who chose to foreclose on Temper after multiple defaults, executed liquidation on CrypToadz #3243.

- OpenSea, the trading platform, is also the platform that was later frozen by CrypToadz #3243.

- zamunda.eth, the receiver.

Odaily Planet Daily Note: Some repayment details of NFTfi

The current situation is that zamunda.eth, as an ordinary NFT collector, bought CrypToadz #3243 without knowing it, and because of the "suspicious activity" mark, he could not normally sell the NFT in OpenSea, and his interests were actually violated.

Why does this problem occur?

- Let’s talk about “temper tantrum” first. If zamunda.eth’s words are true (only unilateral statements are available for the time being), “temper tantrum” is obviously the main responsible party. It deliberately reported due to loan defaults, resulting in the circulation of NFTs that no longer belong to them. Restricted, indeed unauthentic.

- The second is NFTfi. As a lending platform, there is no problem in its own business operation. The real problem is that the entire liquidation execution process of NFTfi does not seem to be regarded as a normal transaction by OpenSea, but as suspicious activities according to the report of "temper".

- Then there is the passer-by lender. As the counterparty of the "temper-tempered", he once extended the repayment time limit and chose to take the liquidation route when the borrower has not yet repaid the money, which is reasonable.

- Finally, there is OpenSea. As the largest NFT trading platform currently on the market, OpenSea adopts a stricter risk control mechanism. We flipped through OpenSea's fraudulent activity reporting page and found that when filling in the relevant report information about "NFT stolen", it is necessary to describe in detail the specific NFT, blockchain, address, reason for theft and other related information. Although it is impossible to know how OpenSea will review after receiving relevant reports, we can try to speculate based on this case, if the relevant NFT exists in other transfer records outside the OpenSea platform ("Temperament" was transferred to NFTfi, and then transferred to passer-by lenders) may be flagged as "suspicious activity" by OpenSea.

Odaily Planet Daily Note: Users like zamunda.eth who hold NFTs with the "suspicious activity" logo can also appeal for unlocking, but according to my personal understanding, the efficiency of relevant appeals is not high, and it may even take months.

In summary, the answer seems to be clear. A major contradiction in the incident is thatOpenSea somehow did not regard the liquidation execution process of NFTfi as a normal transaction, but determined it to be a suspicious activity.

Of course, as a platform independent of NFTfi, it is not difficult to understand that OpenSea implements risk control based on its own standards rather than external records. However, this deviation in judgment objectively caused this small tail friction on the NFT lending business, and it also gave us the opportunity to re-examine the NFT lending business from the perspective of the entire industry chain. With the further expansion of the NFT lending business, there will inevitably be more and more related default events. For upstream lending platforms that rely on trading platforms to perform liquidation, it may be necessary to do some B-side cooperation and communication with trading platforms, so as to reduce the possibility of similar incidents.

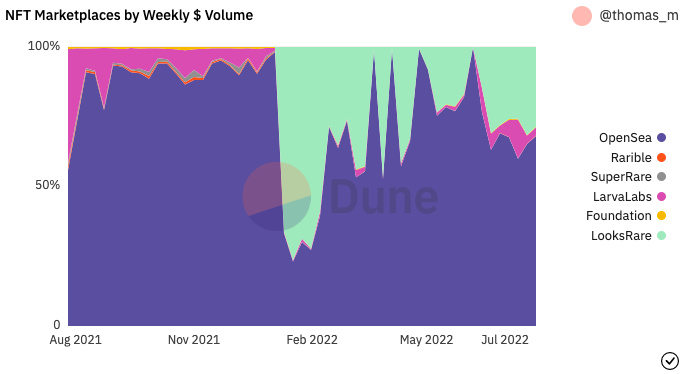

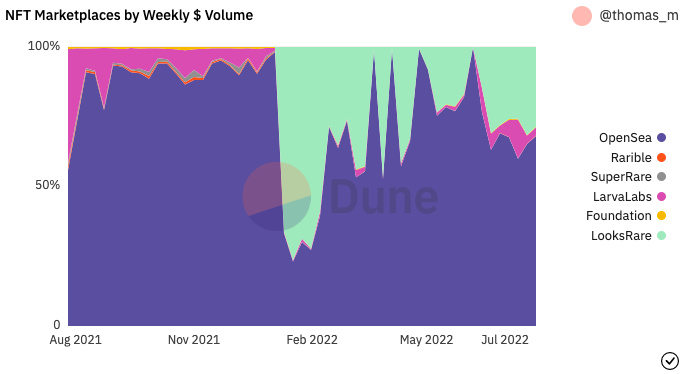

In addition, another key reason why zamunda.eth is so angry is that OpenSea currently still occupies the vast majority of the entire NFT transaction market. In this incident, zamunda.eth can choose other trading platforms, but due to OpenSea's traffic "monopoly", other trading platforms will inevitably discount sales efficiency, so the "suspicious activity" logo is so lethal. To a certain extent, this can also be regarded as a monopoly risk for the entire NFT industry. From the perspective of the healthy development of the market, perhaps we really need more trading platforms.

JinseFinance

JinseFinance