Currently, the Bitcoin market is in a counter-intuitive position - most short-term holders are still losing money, but the average price is still 2 times higher than before. At the same time, many volatility indicators are severely affected at this time, indicating that greater market volatility may be on the way.

Summary

Despite the lack of price appreciation, a significant number of investors have made profits in the market. Short-term holders have borne most of the market's losses.

Combining on-chain pricing models and technical indicators, this article will define and explore a range of possible scenarios for the future development of the market.

Volatility indicators continue to be hampered by unprecedented levels, indicating that investors do not have a strong desire to invest at present, and that market volatility may increase in the future.

Market profitability remains strong

As the price of Bitcoin fell to $60,000, fear and pessimism permeated the market.

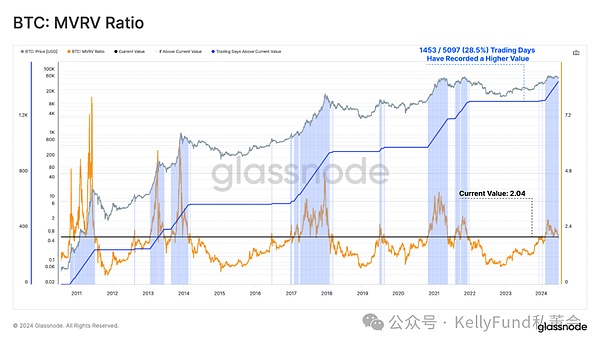

However, judging by the MVRV ratio, investors' overall profitability remained strong, with an average profit of more than two times per Bitcoin. This multiple usually marks the demarcation between the "enthusiasm" and "euphoria" stages of a bull market.

Figure 1: Bitcoin's MVRV ratio

Combined indicators determine market expectations

Since Bitcoin hit an all-time high in March, its price has been consolidating in the range of $60,000 to $70,000. The market lacks a clear trend and investors are hesitant.

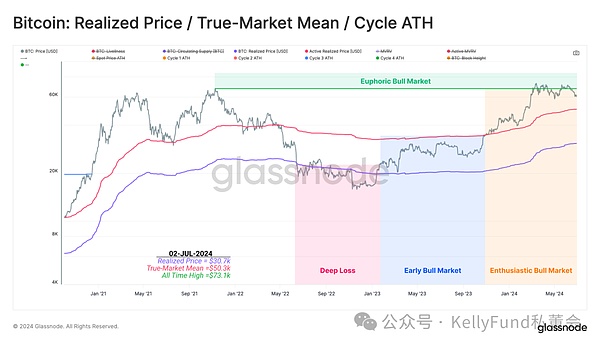

To determine the current price cycle position, we use a simplified framework to analyze the market:

Deep bear market: The trading price is lower than the actual price.

Early bull market: The trading price is between the actual price and the real market average.

Bull market enthusiasm period: The trading price is between the historical high price and the real market average.

Bull market euphoria period: The price is higher than the historical high price of the previous cycles.

Currently, after several short periods in and out of euphoria, the bull market is still falling back to the level of the previous enthusiasm period. Currently, the average cost basis of active investors is about $50,000, which is the current real market average.

If the macro bull market continues, $50,000 will still be the key price threshold to keep the market excited.

Figure 2: Relationship between realized price, real market average price and historical high price of the previous cycle

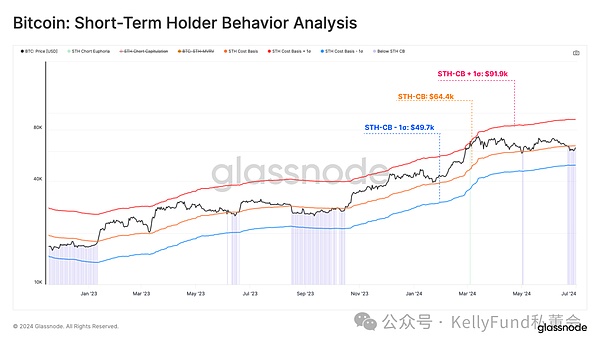

The behavior of short-term holders has an important impact on market volatility. By superimposing its cost basis with the ±1 standard deviation level, we find that:

Large amounts of unrealized profits indicate that the current market may be overheated, with a current value of $92,000.

The break-even line for the short-term holder group is $64,000. At this time, the spot price is below this line, but the market has an upward trend.

Large amounts of unrealized losses indicate that the current market may be oversold, with a current value of $50,000. This is consistent with the real market mean and is a bull market critical point.

Figure 3: Analysis of Short-term Holder Behavior

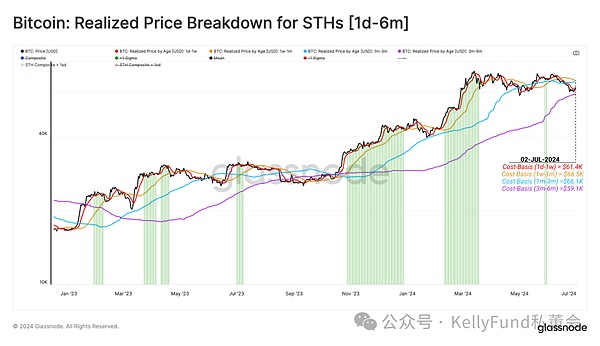

Currently, the subgroups holding coin for 1 day to 1 week, 1 week to 1 month, and 1 month to 3 months are all losing money. This shows that the current consolidation range is basically unprofitable for these short-term holders.

Among all short-term holders, the group holding coin for 3 months to 6 months is still the only subgroup that has maintained unrealized profits, and their average cost basis is $58,000. This cost basis is consistent with the price low of this market correction, proving once again that this is a critical threshold that deserves special attention.

Figure 4: Realized price breakdown for short-term holders (holding time 1 day-6 months)

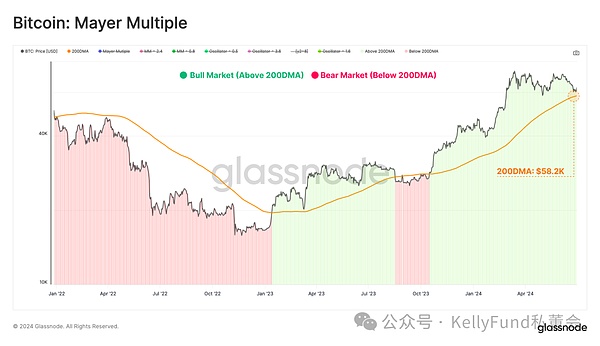

Mayer Ratio is a widely used indicator for market analysis that assesses the ratio between the current market price and its 200-day moving average. The 200-day moving average is often used as a simple indicator to assess bullish or bearish momentum, and a break above (or below) this indicator will be an important turning point in the market.

The 200-day moving average is currently at $58,000, which again coincides with the on-chain price model.

Figure 5: Bitcoin's Mayer Multiple

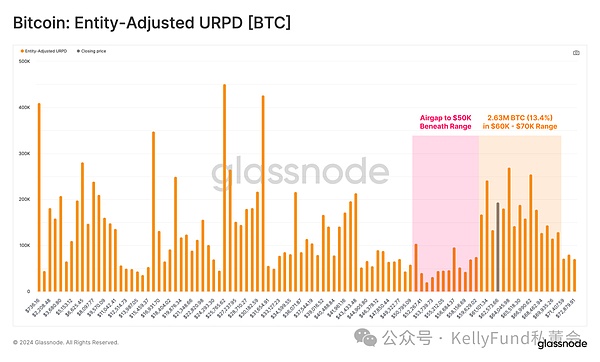

URPD is used to assess the concentration of Bitcoin supply around a specific cost basis.

Currently, there is a large concentration of Bitcoin suppliers between $60,000 and the all-time high, and the spot price is hovering at the lower price limit of these suppliers. This is also consistent with the cost basis model of short-term holders.

Currently, about 2.63 million Bitcoins (13.4% of the circulating supply) are in the $60,000-$70,000 range. Therefore, only a small price fluctuation can significantly affect the profitability of investors' portfolios.

Overall, this also shows that after the price falls below $60,000, investors will be extremely sensitive to any subsequent declines.

Figure 6: Bitcoin URPD (after entity adjustment)

Expected future volatility

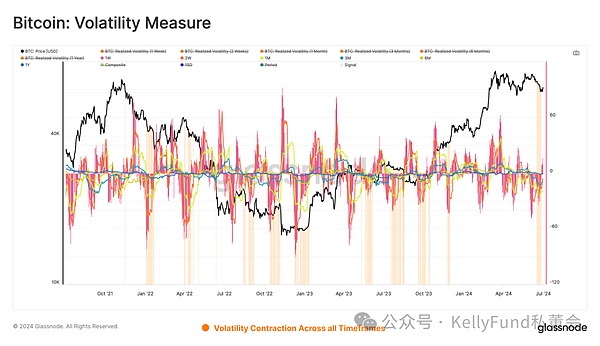

After a few months of small fluctuations, the market volatility has dropped significantly in many rolling window time frames. To visualize this phenomenon, we introduce a simple model to find this calm before the storm - this decline usually indicates that volatility may increase in the future.

The model evaluates the 30-day change in actual volatility over the 1-week, 2-week, 1-month, 3-month, 6-month, and 1-year timeframes. When this change is negative in all time windows, it indicates that market volatility is decreasing.

Figure 7: Bitcoin market volatility measurement

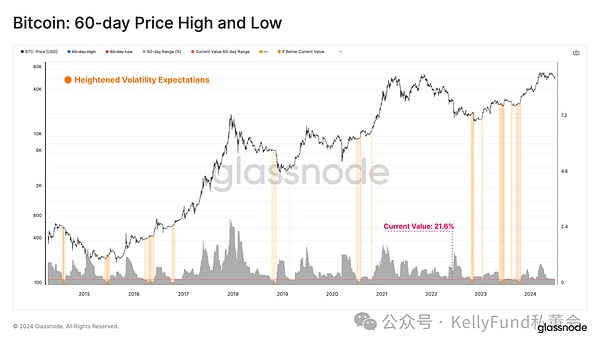

Another way to assess market volatility is to calculate the percentage difference between the highest and lowest prices over the past 60 days. From this indicator, we can see that market volatility has decreased to a rare level. In the past, this often occurred after a long period of consolidation and before the arrival of large market fluctuations.

Figure 8: Bitcoin price 60-day high and low

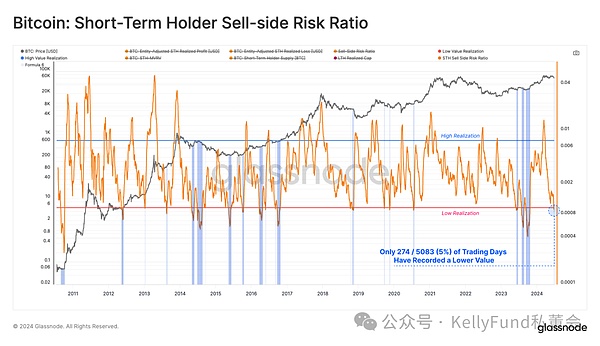

Finally, we can use the sell-side risk ratio to further assess market volatility. It assesses the absolute value of the sum of realized profits and losses locked in by investors relative to the size of the asset (realized market value). We can discuss this metric under the following framework:

High sell-side risk ratio indicates that investors are making huge profits or losses when they sell Bitcoin. This situation usually occurs after a highly volatile price trend, indicating that the market is in urgent need of rebalancing.

Low seller risk ratio indicates that most sales of Bitcoin have small profits and losses, indicating that the market has reached a certain degree of balance. At this point, the "profit and loss potential" within the current price range has been exhausted, and there is no significant volatility in the market environment.

It is worth noting that at present, the seller risk of short-term investors has fallen to a historical low - only 274 days (5%) of 5083 trading days have shown a lower level of market depression. This shows that a certain degree of balance has been established during the consolidation of Bitcoin prices and suggests that volatility may increase in the near future.

Figure 9: Short-term holder-seller risk ratio

Summary

Currently, the Bitcoin market is in a counter-intuitive position - despite the price being 20% below the all-time high, investors are uninterested. The average Bitcoin holds up to 2x unrealized profits. However, new buyers are surprisingly mostly at a loss.

In this article, we analyze this using a combination of on-chain and technical indicators and derive three key price ranges that will rekindle investor interest.

If Bitcoin falls below the $58,000 to $60,000 range, it will cause a large number of short-term holders to lose money and push the price below the 200-day moving average.

If it continues to hover in the $60,000 to $64,000 range, the market will continue its previous sideways trend.

If it can break through the $64,000 level, a large number of short-term investors will turn losses into profits. In this case, investor sentiment in the market may rise.

From the current spot price and on-chain indicators, volatility has been declining in multiple time windows. Among them, indicators such as the seller risk ratio and the 60-day price range have fallen to historical lows. This indicates that the current sideways trend will not last long, and the market is about to start a new price breakthrough to the next range.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Hui Xin

Hui Xin Bitcoinist

Bitcoinist