Written by: Will Awang

The myth of getting rich in the crypto market exists every day. Most players come here not to double their money, but to turn over. In this dark forest, crypto market makers, as the top predator closest to money, are becoming more and more mysterious.

Price manipulation, pump and dump, and cutting leeks are synonymous with crypto market makers, but before giving crypto market makers these "derogatory" hats, we need to face up to the important role they play in the crypto market, especially for early coin listing projects.

In this context, this article will explain what market makers are, why we need market makers, the DWF incident, the main operating mode of crypto market makers, and the risks and regulatory issues from the perspective of Web3 project parties.

I hope this article will be helpful for project development, and we welcome discussions and exchanges.

1. What is a market maker?

The world's leading hedge fund CitadelSecurities defines it this way: Market makers play a vital role in maintaining continuous liquidity in the market. They achieve this by providing buy and sell quotes at the same time, thereby creating a market environment with liquidity and market depth, allowing investors to trade at any time, which injects confidence into the market.

Market makers are crucial in traditional financial markets. On Nasdaq, there are an average of about 14 market makers per stock, with a total of about 260 market makers in the market. In addition, in markets that are less liquid than stocks, such as bonds, commodities, and foreign exchange markets, most transactions are conducted through market makers.

Crypto market makers refer to institutions or individuals who help projects provide liquidity and buy and sell quotes in the order books of crypto exchanges and decentralized trading pools. Their main responsibility is to provide liquidity and market depth for transactions in one or more crypto markets, and to make profits by taking advantage of market fluctuations and supply and demand differences through algorithms and strategies.

Crypto market makers can not only reduce transaction costs and improve transaction efficiency, but also promote the development and promotion of new projects.

Second, why do we need market makers?

The main goal of market making is to ensure that the market has sufficient liquidity, market depth, and stable prices, so as to inject confidence into the market and promote the completion of transactions. This will not only lower the entry threshold for investors, but also encourage them to trade in real time, which in turn brings more liquidity, forms a virtuous circle, and promotes an environment where investors can trade with confidence.

Crypto market makers are particularly important for early coin offerings (IEOs), because these projects need to have sufficient liquidity/trading volume/market depth, both to maintain market heat/prominence and to promote price discovery.

2.1 Providing Liquidity

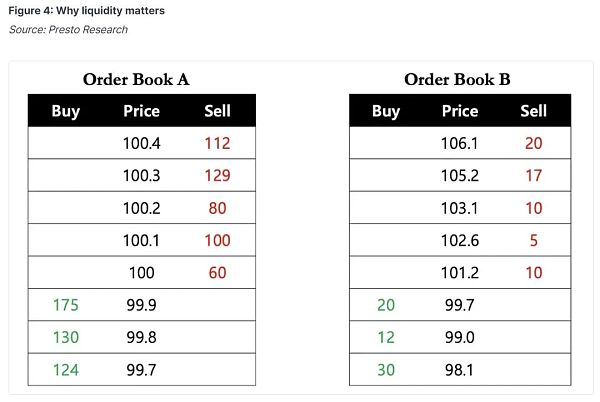

Liquidity refers to the degree to which an asset can be quickly converted into cash without wear and tear, and describes the degree to which buyers and sellers in the market can buy and sell with relative ease, speed, and low cost. Highly liquid markets reduce the cost of any particular transaction and facilitate the formation of transactions without causing significant price fluctuations.

In essence, market makers facilitate investors to buy and sell tokens faster, in larger quantities, and more easily at any given time by providing high liquidity, without interrupting or affecting operations due to huge price fluctuations.

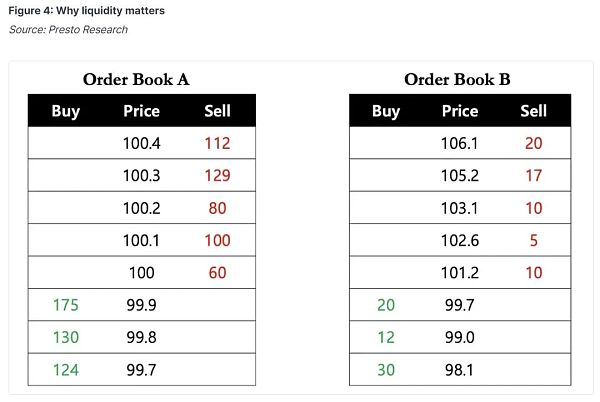

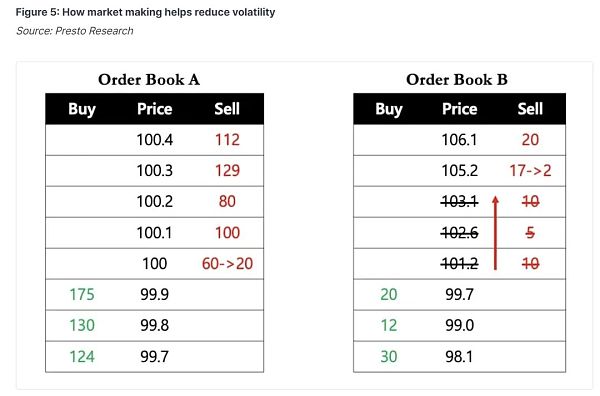

For example, an investor needs to buy 40 tokens immediately. He can buy 40 tokens immediately at a unit price of $100 in the high liquidity market (order book A). However, in the low liquidity market (order book B), they have two options: 1) buy 10 tokens at $101.2, 5 tokens at $102.6, 10 tokens at $103.1, and 15 tokens at $105.2, with an average price of $103.35; or 2) wait for a longer period of time for the token to reach the desired price.

Liquidity is crucial for early listing projects. Operations in low liquidity markets will affect investors' trading confidence and trading strategies, and may also indirectly cause the "death" of projects.

2.2 Providing market depth and stabilizing coin prices

In the crypto market, most assets have low liquidity and no market depth, and even small transactions can cause significant price changes.

In the above scenario, after the investor just bought 40 tokens, the next available price in order book B was $105.2, indicating that one transaction caused about 5% price fluctuations. This is especially true during market fluctuations, when fewer participants can cause significant price fluctuations.

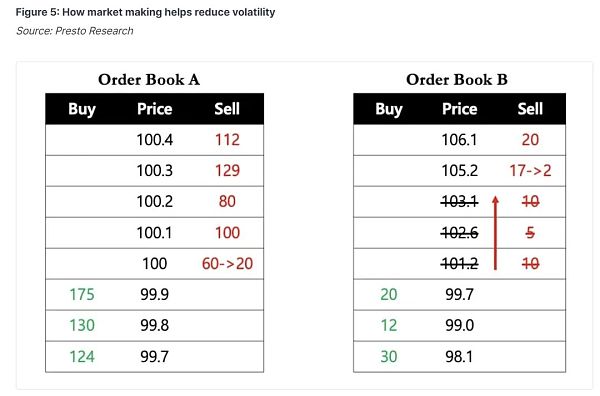

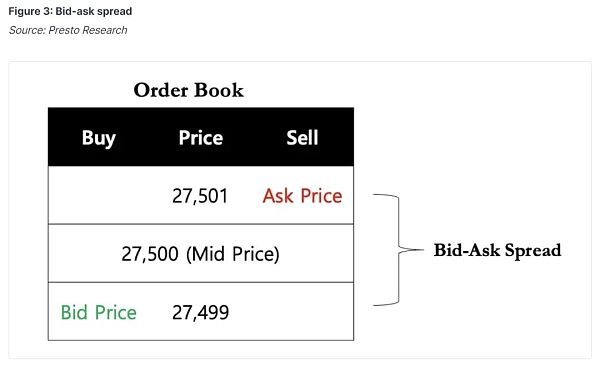

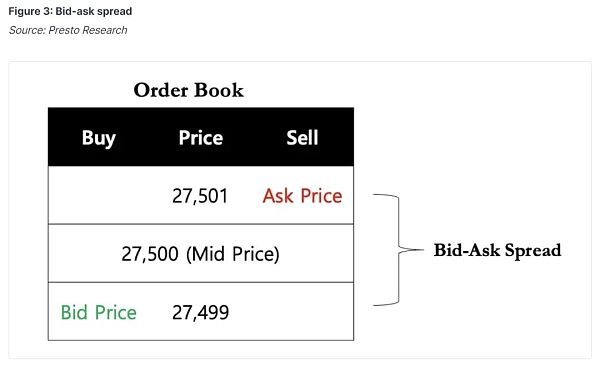

The large amount of liquidity provided by market makers forms a narrow bid-ask spread for the order book. Narrow bid-ask spreads are usually accompanied by solid market depth, which helps stabilize coin prices and alleviate price fluctuations.

Market depth refers to the available number of buy and sell orders at different price levels in the order book at a given moment. Market depth can also measure the ability of an asset to absorb large orders without major price changes.

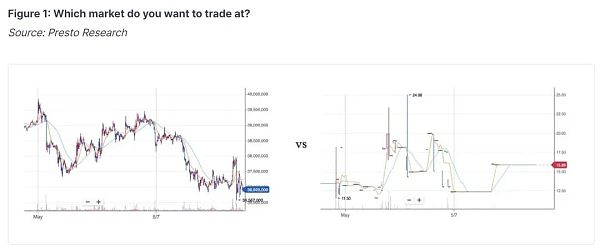

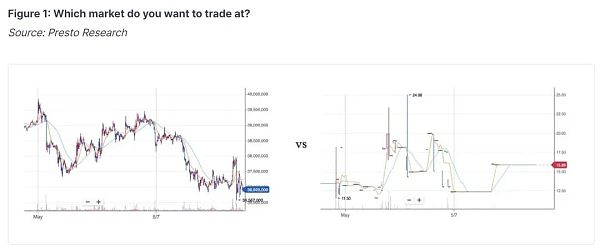

Market makers play a key role in the market by providing liquidity to bridge this supply and demand gap. Imagine which of the following markets you would like to trade in?

The role of crypto market makers: 1) Provide a large amount of liquidity; 2) Provide market depth to stabilize the price of coins, which ultimately helps to enhance investors' confidence in the project. After all, every investor hopes to be able to buy and sell their holdings in real time with the lowest transaction cost.

Three, What are the main players in crypto market makers?

Market makers can be said to be one of the top businesses in the food chain, because they control the lifeblood of project tokens after they are launched. Market makers usually cooperate with exchanges, which can easily form a monopoly, and the liquidity of the market is dominated by several large market makers.

(Crypto Market Makers [2024 Updated])

In July 2023, the encryption project Worldcoin co-created by OpenAI Sam Altman reached an agreement with market makers when it was officially launched, and lent a total of 100 million $WLD to 5 market makers for liquidity, and stipulated that the borrowed tokens must be returned after 3 months, or the tokens must be purchased at a price of 2 to 3.12 US dollars.

These 5 market makers include:

A. Wintermute, a company registered in the UK, with representative investments: $WLD, $OP, $PYTH, $DYDX, $ENA, $CFG, etc., and has invested in more than 100 projects since 2020.

B. Amber Group, founded in 2017, is a Hong Kong company. Its board of directors includes institutions familiar to Chinese people such as Distributed Capital. The team members are basically all Chinese. Participated in projects: $ZKM, $MERL, $IO, etc.

C. FlowTraders, founded in the Netherlands in 2004, is a global digital liquidity provider focusing on exchange-traded products (ETPs). It is one of the largest ETF trading companies in the European Union. It has created exchange-traded certificates based on Bitcoin and Ethereum and conducts cryptocurrency ETN trading business.

D. Auros Global, implicated by FTX, filed for bankruptcy protection in the Virgin Islands in 2023, and $20 million in assets were stranded on FTX. There was news of successful restructuring.

E. GSR Markets, founded in the UK in 2013, is a global crypto market maker that specializes in providing liquidity, risk management strategies, programmatic execution and structured products to sophisticated global investors in the digital asset industry.

Fourth, DWF Rashomon Incident

DWF Labs is the hottest "Internet celebrity" market maker in the market recently. DWF's Russian partner Andrei Grachev founded DWF in Singapore in 2022. According to reports, the company now claims to have invested in a total of 470 projects and has cooperated with approximately 35% of the projects in the top 1,000 tokens by market value in its short 16-month history.

(Binance Pledged to Thwart Suspicious Trading—Until It Involved a Lamborghini-Loving High Roller)

Let's review this incident:

4.1 Breaking News

The Wall Street Journal broke the news on May 9 that an anonymous source claiming to be a former Binance insider said that Binance investigators discovered $300 million worth of DWF Labs fake transactions during 2023. A person familiar with Binance's operations also said that Binance did not require market makers to sign any specific agreements to manage their transactions (including prohibiting any specific agreements such as market manipulation to regulate their trading behavior).

This means that, to a large extent, Binance allows market makers to trade as they wish.

4.2 DWF's Marketing

According to a proposal document sent to potential customers in 2022, DWF Labs did not adopt a price-neutral rule, but proposed to use its active trading positions to push up token prices and create so-called "artificial trading volume" on exchanges including Binance to attract other traders.

In a report prepared for a token project client that year, DWF Labs even wrote directly that the agency had successfully generated artificial trading volume equivalent to two-thirds of the token, and was working to create a "Believable Trading Pattern" that could bring "bullish sentiment" to project tokens if it cooperated with DWF Labs.

4.3 Binance's response

A Binance spokesperson said that all users on the platform must comply with general terms of use that prohibit market manipulation.

A week after submitting the DWF report, Binance fired the head of the monitoring team and laid off several investigators in the following months. A Binance executive attributed this to cost-saving measures.

Binance co-founder He Yi said: Binance has been conducting market monitoring on market makers, and it is very strict; there is competition among market makers, the means are very shady, and they will attack each other through PR.

4.4 Possible reasons

On the Binance platform, DWF is the highest "VIP 9" level, which means that DWF contributes at least $4 billion in trading volume to Binance every month. The relationship between market makers and exchanges is similar to a symbiotic one. Binance has no reason to offend one of its largest customers for an internal investigator.

V. Main operating modes of crypto market makers

Like traditional market makers, crypto market makers also make profits through the spread between buying and selling. They set low buying prices and high selling prices, and make profits from the spread, which is usually called "Spread" and is the main basis for market makers to make profits.

After understanding this foundation, let's take a look at the two main business models of market makers for project parties.

5.1 Subscription Service + Retainer + Performance Fee

In this model, the project party provides tokens and corresponding stablecoins to the market maker, and the market maker uses these assets to provide liquidity for the CEX order book and DEX pool. The project party sets KPIs for the market maker according to its own needs, such as how much price spread is acceptable, how much market liquidity and depth (Depth) needs to be guaranteed, etc.

A. The project party may first give the market maker a fixed Setup Fees as the start of the market making project.

B. After that, the project party needs to pay the market maker a fixed monthly/quarterly subscription service fee. The most basic subscription service fee usually starts at US$2,000/month, and the higher one depends on the scope of service, and there is no upper limit. For example, GSR Markets charges a setup fee of $100,000, a subscription fee of $20,000 per month, plus a $1 million loan in BTC and ETH.

C. Of course, some project parties will also pay KPI-based transaction commissions (incentives for market makers to successfully complete KPI targets in the market) in order to motivate market makers to maximize profits.

These KPI indicators may include: trading volume (which may involve illegal Wash Trading), token price, bid-ask spread (Spread), market depth, etc.

Under this model, the market-making idea is clearer and more transparent, and the project party is easier to control. It is more suitable for mature project parties that have built liquidity pools in various markets and have clear goals.

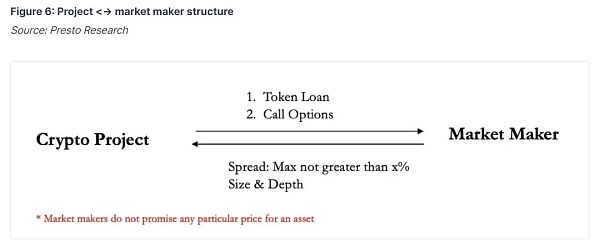

5.2 Token Loan + Call Option(Loan/Options Model)

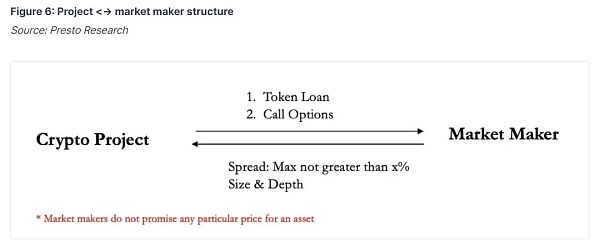

Currently, the most widely used market maker model in the market is: Token Loan + Call Option. This model is especially suitable for early coin listing projects.

Due to the limited funds on hand of the project party in the early stage of coin listing, it is difficult to pay the market making fee, and there are few tokens circulating in the market in the early stage of project coin listing. The early tokens are lent to the market maker, and the market maker will also bear the corresponding risks.

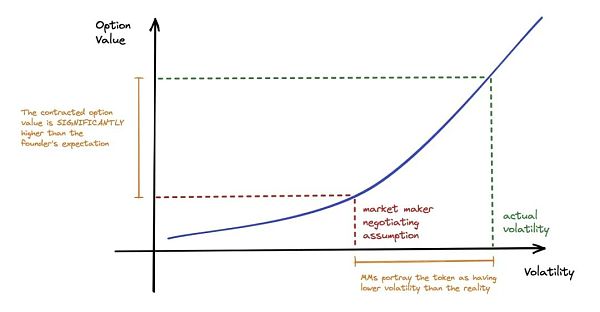

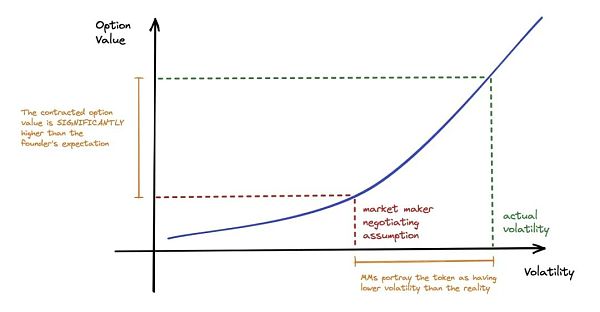

In this case, it is more suitable for the market maker to set the KPI according to the project situation, and in order to compensate the market maker, the project party usually embeds a call option (Call Option) in the market making contract to give the market maker to hedge the token price risk.

Under this model, market makers will borrow tokens (Token Loan) from the project party to invest in the market to ensure liquidity and stabilize the currency price. The market making period is generally agreed to be 1-2 years.

The call option stipulates that before the expiration date of the contract, the market maker can choose to purchase the previously borrowed tokens from the project party at a predetermined price (Strike Price). It should be noted that this option is an option given to market makers, not an obligation (OPTION not Obligation).

The value of this call option is directly related to the price of the token, which gives market makers the motivation to increase the value of the token. Let's simulate a scenario:

Let's assume that the Mfers project has found a market maker and signed a Call Option, agreeing to lend 100,000 tokens with an exercise price of $1 for a period of 1 year. During this period, the market maker has two options: 1) Return 100,000 Mfer tokens at maturity; or 2) Pay $100,000 USD at maturity (based on the $1 exercise price).

If the token price rises 100x to $100 (yes, Mfers to the Moon), the market maker can choose to exercise the option, that is, buy $10,000,000 worth of tokens at a price of $100,000, and obtain a 100-fold return; if the token price drops 50% to $0.5, the market maker can choose not to exercise the option ($100,000), but directly purchase 100,000 tokens at a price of $0.5 on the market to repay the loan (the value is half of the exercise value $50,000).

Because of the existence of call options, market makers will have the motivation to frantically push up the market and increase shipments to make profits; at the same time, there is also the motivation to frantically dump the market and purchase goods at low prices to repay the currency.

Therefore, in the token loan + call option (Loan/Options Model) mode, the project party may need to treat the market maker as a counterparty, and special attention should be paid to:

A. How much strike price the market maker gets and how much token loan amount determines the market maker's profit margin and market making expectations;

B. Also pay attention to the term of the call option (Loan Period), which determines the market making space in this time dimension;

C. The termination clause of the market making contract, and the risk control method in case of an emergency. In particular, after the project party lends tokens to the market maker, it cannot control the whereabouts of the tokens.

(Paperclip Partners, Founder’s Field Guide to Token Market Making)

5.3 Other business models

We can also see that many market makers have primary investment departments, which can better serve the invested projects through investment and incubation, provide fund raising, project publicity, listing and other services for the projects, and owning shares of the invested projects also helps market makers reach potential customers (investment and loan linkage?).

OTC Over-the-Counter Transactions Similarly, buy tokens from the project party/foundation at a low price, and increase the value of the tokens through a series of market-making operations. There are more gray areas here.

Six, Risks and Regulation

After understanding the operation mode of crypto market makers, we know that, apart from the positive significance of market makers in the crypto market, they not only cut leeks, but also the project parties are the objects of their "cutting leeks". Therefore, project parties need to grasp the risks of cooperating with crypto market makers and the obstacles that may be caused by supervision.

6.1 Supervision

In the past, the supervision of market makers was concentrated on "securities" market makers, and the definition of crypto assets has not yet been clarified, which has resulted in a relative regulatory vacuum for crypto market makers and market making behavior.

Therefore, for crypto market makers, the current market environment is a situation where the sky is high and the birds fly freely, and the cost of doing evil is extremely low. This is why we use price manipulation, pull-up and sell-off, and cutting leeks as synonyms for crypto market makers.

We see that regulation is being standardized. For example, the US SEC is clarifying the definition of Broker & Dealer through regulatory enforcement, and the introduction of the EU MiCA Act also includes market maker business under regulation. At the same time, there are also compliant crypto market makers actively applying for regulatory licenses, such as GSR Markets applying for a major payment institution license from the Monetary Authority of Singapore (allowing OTC and market making services within the regulatory framework of Singapore), and Flowdesk, which completed a $50 million financing at the beginning of the year, also obtained a license application from French regulators.

However, the regulation of major jurisdictions does not prevent some crypto market makers from operating offshore, because they are essentially large capital accounts in various exchanges, and most of them do not have any onshore business.

Fortunately, due to the FTX incident and the continuous regulation of major exchanges such as Binance and Coinbase, crypto market makers that coexist with exchanges will also be restricted by the internal control and compliance rules of the exchanges, making the industry more standardized.

We do need regulation to regulate these unethical/illegal behaviors, but before the industry explodes, we may need the industry to embrace the bubble more.

6.2 Risks

Due to the lack of regulation, crypto market makers will have an incentive to engage in unethical trading and manipulate the market to maximize profits, rather than an incentive to create a healthy market or trading environment. This is why they are notorious, and it also brings many risks.

A. Market Risks of Market Makers

Market makers also face market risks and liquidity risks, especially in extreme market conditions. The previous collapse of Terra Luna and the chain reaction caused by the collapse of FTX led to the comprehensive collapse of market makers, the collapse of leverage, and the depletion of market liquidity. Alameda Research is a typical representative.

B. Projects lack control over loaned tokens

In the token lending model, projects lack control over loaned tokens and do not know what market makers will do with their tokens, which could be anything.

Therefore, when lending tokens, projects need to think of market makers as counterparties rather than partners, and think about what might happen due to price influences. Market makers can achieve many goals by adjusting prices, such as deliberately lowering prices to set a lower price for new contracts; or passing proposals in their favor through anonymous voting, etc.

C. Unethical behavior of market makers

Unethical market makers manipulate token prices, exaggerate trading volumes through wash sales, and pump and dump.

Many cryptocurrency projects hire market makers to boost performance metrics using strategies like wash trading, where an entity repeatedly trades the same asset back and forth to create the illusion of volume. In traditional markets, this is illegal market manipulation that misleads investors about demand for a particular asset.

Bitwise famously published a report in 2019 that 95% of volume on unregulated exchanges was fake. A more recent study from the National Bureau of Economic Research (NBER) in December 2022 found that figure had dropped to around 70%.

D. Projects that take the blame

Since the project parties lack control over the lending of tokens and have difficulty constraining the unethical behavior of market makers, or have no way of knowing about these unethical behaviors, once these behaviors fall into the regulatory field of vision, the project parties that actually operate the projects will be blamed. Therefore, the project party needs to work hard on the contract terms or emergency measures.

Seventh, written in the end

Through this article, it can help the project party to understand that the crypto market makers have made great contributions in ensuring efficient transaction execution, enhancing investor confidence, making the market operate more smoothly, stabilizing currency prices and reducing transaction costs by providing liquidity.

However, by revealing the business model of crypto market makers, it reminds the project party of the many risks arising from cooperation with crypto market makers, and needs to pay special attention when negotiating terms and cooperating with market makers.

JinseFinance

JinseFinance