“So I think the halving is important, but it’s just One of many factors that determine the occurrence and timing of a bull market. The combination of various measures of global liquidity, HODL waves and other catalysts can play a greater role," Alden said, adding:< /p>“I am optimistic about the next two years due to expectations of halving, improving global liquidity, and the fact that so many coins have turned to strong hands in a bear market, so a relatively small increase in demand is likely to Driving prices higher."

Markus Thielen, CEO and chief analyst at 10x Research, said The current rally "Definitely comparable to the bull market of 2020 and 2021," which initially peaked in April 2021.

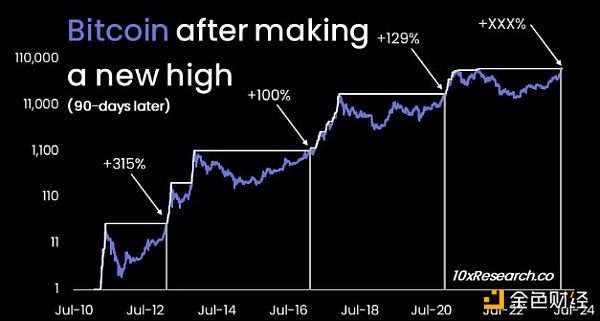

When it comes to tools like quantitative analysis, Thielen has been bullish on the price of Bitcoin after the cryptocurrency broke out to multi-year highs on March 13, 2024.

Based on historical price changes and Bitcoin’s recent highs, 10x Research expects Bitcoin to reach 77,000 by early April USD and will reach USD 99,000 by May 2024.

“We saw a wave of intraday selling as Bitcoin hit a new high of $68,300, but every attempt to push the price lower was met with relentless buying ," Thielen wrote on March 14.

The analyst noted that each time Bitcoin experienced a new price breakout in February 2013, February 2017, and November 2020, the price could rise by 189% after 180 days. Ultimately, Thielen noted, Bitcoin will peak in nine to 11 months after its historical breakout.

Bitcoin hits new bull market high 90 days later. Source: 10x Research

Thielen forecast, between December and February 2025 , or within 9 to 11 months after the March 13 breakout, Bitcoin could rise to an eye-popping $146,000.

“While corrections and retracements can happen at any time, traders can use the breakout level – $68,300 – as their new line, and we can argue that at this " The analyst added:

“While Bitcoin has the potential to climb to $146,000 this summer, we are currently Maintaining the $125,000 price target as we expect this bull run to continue into 2025." eToro cryptocurrency analyst Simon Peters emphasized that the current Bitcoin rally is Bitcoin posted its first parabolic rise and hit an all-time high ahead of the block reward halving.

Peters said that the main reason for this breakthrough was the launch of a spot Bitcoin exchange-traded fund (ETF) in the United States on January 11, 2024.

Peters emphasized: “Demand for Bitcoin is rapidly outpacing new supply, which is what we are seeing in Something we've never really encountered in previous cycles." He added, In launching the ETF Previously, demand was primarily driven by retail investors, whereas the current cycle will be "more institutional."

Peters said that Bitcoin miners are the only natural sellers because they have been actively selling BTC since August 2023.

“This suggests to me that miners have sold off on the current rally in preparation for the upcoming block reward halving,” the analyst said, adding that since Spot ETFs are in high demand and all the sell-offs are "good bids." ”

“If we do see a slowdown in spot ETF inflows, it could be a sign that the market has peaked and lost Momentum, but it’s worth noting that while ETFs have been a major contributor to the rally so far, they are not the only players in the space. Other entities such as MicroStrategy and Bitcoin whales also continue to accumulate. ”

At the same time, Exness Financial Market Strategist Li Xing believes that macroeconomic development will drive Bitcoin this year The rise in prices.

The analyst said that In addition to spot Bitcoin ETFs In addition to the launch of Bitcoin, other economic developments, such as expectations of weaker monetary policy and lower interest rates in the United States and elsewhere, may increase Bitcoin’s appeal as an alternative store of value.

“In addition, Geopolitical risks and uncertainty about the U.S. election are likely to continue to boost demand, marking the beginning of a sustained bull market ahead. Start," Li added.

The Bitcoin halving is scheduled to occur every 210,000 blocks, or approximately every four years, and is intended to maintain Bitcoin's deficit and offset the currency Inflation.

Since its launch in 2009, Bitcoin has experienced three halving events in 2012, 2016 and 2020, with its miner incentives reduced from the original 50 BTC to the current 6.5 BTC. Coming soon The 2024 Bitcoin halving will further reduce mining rewards from 6.5 BTC to 3.125 BTC.

Historically, Bitcoin halvings are associated with post-halving rallies. For example, Bitcoin’s It surged approximately 3,000% within 17 months after the 2016 halving, reaching the historical milestone of $20,000 in December 2017.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bernice

Bernice JinseFinance

JinseFinance JinseFinance

JinseFinance Cheng Yuan

Cheng Yuan