Author: Victor Ramirez, Matías Andrade and Tanay Ved Source: coinmetrics Translation: Shan Ouba, Golden Finance

Key Points:

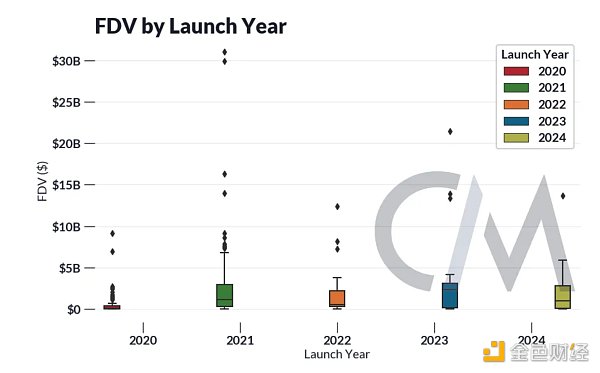

In recent years, the fully diluted valuation (FDV) at the time of launch has varied among projects: the median FDV of decentralized financial protocols was $140 million in 2020, and the median FDV of NFT and gaming projects soared to $1.4 billion in 2021, and then fell to $800 million in 2022 (for Layer 2 projects). It rebounded to $2.4 billion and $1 billion in 2023 and 2024, mainly involving alternative Layer 1 projects and Solana projects.

FDV ignores short-term market shocks, so circulation (i.e., public supply) is also important. Tokens with high FDV and low circulation, such as World Coin ($800 million market cap and $34 billion FDV), may mislead the true valuation.

Airdrops distribute tokens to promote protocol adoption, and recipients tend to sell quickly. Despite being profitable initially, most airdropped tokens depreciate in the long term, with BONK being an exception (~8x return).

Introduction

One of the most frequently discussed topics in the cryptocurrency space is token economics, the system by which token supply is distributed. Token economics represents a balancing act to ensure current and future value for a project while appeasing different stakeholders.

Crypto projects employ various token economics schemes to incentivize certain behaviors within their respective ecosystems. Part of the token supply is unlocked to the public, allowing users to own a “share” in the project and engage in price discovery. To incentivize project development, part of the token supply can be locked to early investors and team members, usually at a preferential price and before it is publicly traded. Some projects even employ airdrops to reward users based on key behaviors such as providing liquidity, voting, or bridging to Layer 2.

In this article, we will dive into the different factors of a project’s token economics and their impact on token valuation and on-chain activity.

Understanding Fully Diluted Valuation (FDV)

To understand the nuances of token valuation, we will explain some commonly used valuation metrics. Circulating market cap is the market value of an asset calculated using only the circulating supply, excluding the supply that will be distributed to early investors, contributors, and future issuances. Circulating market cap measures the market’s perception of the current token valuation. The free float supply is the tokens that are tradable on the open market. Fully Diluted Valuation (FDV) is the market value of an asset when all tokens are in circulation, hence the term “fully diluted”. FDV is a measure of the market’s future valuation of a token.

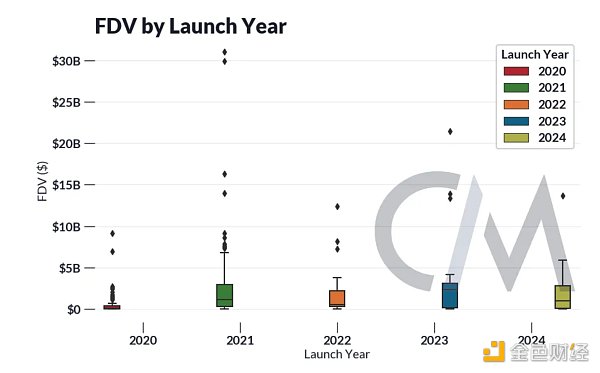

The FDV at launch can hint at the market’s expectations of the future value of the current project after its launch. Below is a chart of the launch FDV of multiple crypto tokens by project launch year.

The median FDV of major tokens launched in 2020 was lower ($140 million), but included blue-chip protocols born in the DeFi summer such as Uniswap, Aave, and well-known Layer 1s such as Solana and Avalanche. The launch FDV in 2021 jumped to $1.4 billion, mainly composed of NFT and game projects such as Gods Unchained, Yield Guild Games, and Flow. The launch FDV in 2022 fell, mainly composed of the launch of Apecoin and early Layer 2 tokens such as Optimism. The 2023 and 2024 launch FDVs rebound to $2.4 billion and $1 billion, representing the rise of a new wave of alternative Layer 1s like Aptos and Sui, and Solana projects like Jupiter and Jito.

Not All FDVs Are Equal

While FDV is useful for assessing long-term value, it does not take into account short-term market dynamics that can come into play due to liquidity and supply shocks. Therefore, it is necessary to view FDV in relation to its circulating supply (i.e., public supply).

Tokens with high circulating supply relative to total supply, such as Bitcoin, are highly liquid, and market participants do not anticipate future supply shocks from token issuance—as over 90% of all Bitcoins have already been mined. Tokens with low circulating supply relative to total supply mean that much of their FDV is illiquid. Therefore, tokens with high FDV and low circulating supply may represent an inflated and false total valuation. An extreme example is World Coin, which has a market cap of ~$800M but a FDV of ~$34B, a 50x difference.

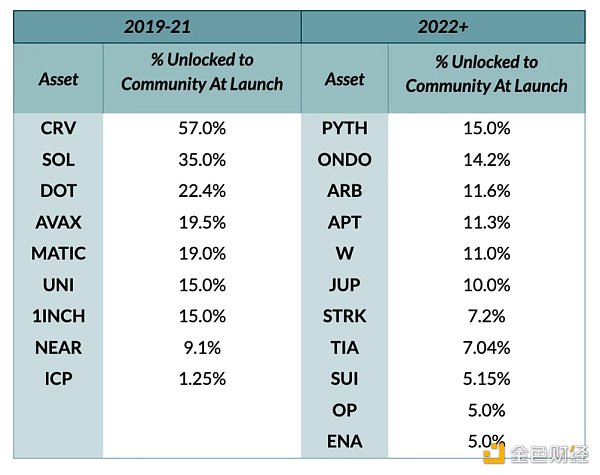

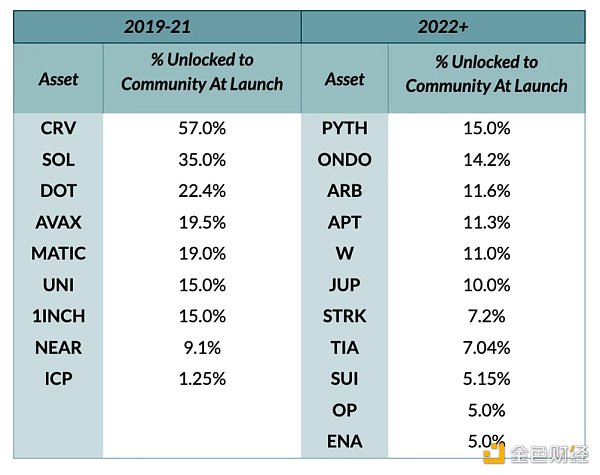

Generally speaking, we see industry standards trending toward unlocking 5-15% of the token supply to the community, with the rest of the supply locked up for the team, investors, foundations, grants, or other unlocking events. Projects launching before 2022 tend to have more diverse allocations.

Tokens with high FDV and low circulation have always been criticized by the crypto community. A historical example is FTX's token FTT, which FTX used to inflate its balance sheet by counting its illiquid shares as assets. Token projects with high FDV and low free float at launch have been criticized as a tool to enrich early investors and other insiders at the expense of retail users. This can cause market sentiment to turn nihilistic, leading to a large influx of retail money into memecoins, which tend to have a larger supply available to the public early on.

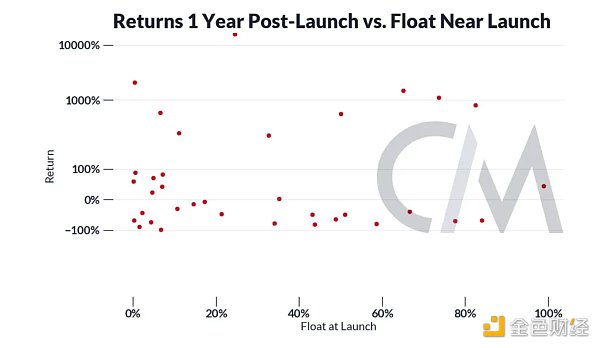

But is low free float the only reason for poor price performance?

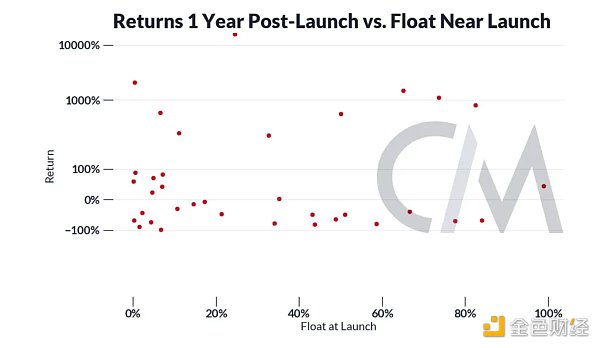

We find that free float at launch has no significant effect on the appreciation of a token one year after launch. This is fairly consistent with our previous findings, which show that sudden shocks to free float have no consistent directional effect on price.

Airdrops and Protocol Activity

Some protocols use airdrops to distribute tokens to the community and mitigate the risk of low circulation. Airdrops reward early users by giving them tokens based on certain desired behaviors that promote the growth of the protocol, similar to crypto stimulus checks for early users. In previous SOTN, we found that most addresses cashed out airdropped tokens shortly after receiving them.

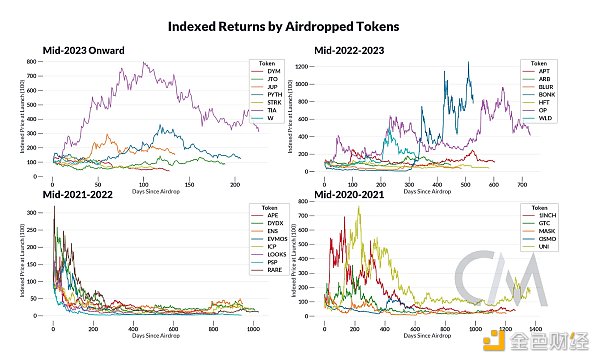

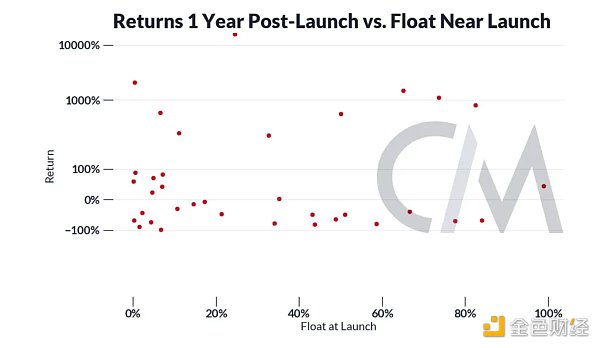

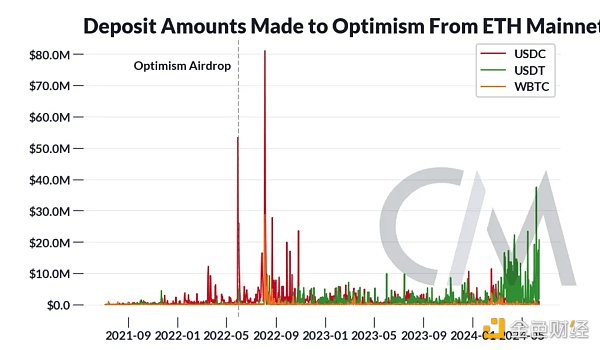

While airdrops provide a nice windfall, most airdropped tokens lose their long-term value.

Taking the first trading day after the airdrop as a reference point, only about a third of the tokens have maintained their value since the initial airdrop. The median return for holding airdropped tokens to date is -61%. However, some airdropped tokens such as BONK (~8x) have appreciated.

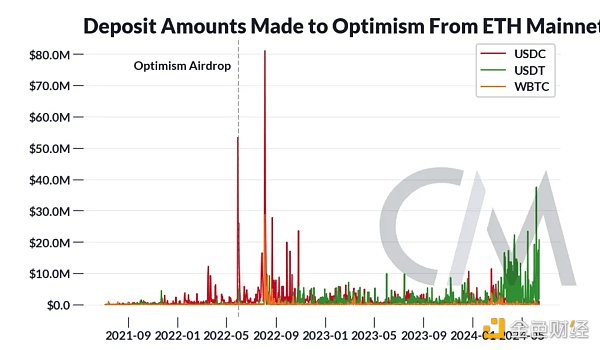

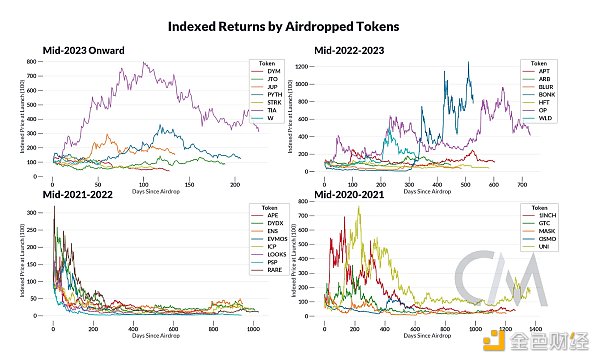

Token rewards are ultimately just a way to kickstart network activity, but do they actually lead to actual usage? Measuring actual economic activity can be tricky because each protocol has different uses and metrics for measuring those uses. As an illustrative example, we can look at the Layer 2 project Optimism and use the amount deposited into the network as a rough proxy for user activity.

We saw a surge in calls to deposit into the Optimism Gateway Bridge following the airdrop. Activity tapered off over the following year, in line with the overall decline in crypto activity. In short, airdrops may boost protocol usage in the short term, but it remains to be seen whether they can create real, sustainable long-term growth.

While the anticipation of an airdrop can incentivize early adoption of a protocol, it does not necessarily lead to sustained user activity. Complicating this is the emergence of airdrop farming, a way for users to earn tokens by generating excess activity on-chain. Recently, airdrop farming has become increasingly industrialized, with sybil farms, where a small number of people generate activity in large quantities by faking multiple on-chain identities. This has led to project teams allocating rewards to mercenaries with no long-term benefit.

Protocol teams have begun to fight back against sybils by developing methods to identify sybils and deny rewards. Notably, LayerZero is offering sybils the opportunity to self-identify, taking a small portion of their allocated tokens at the cost of risk. With large airdrops coming up for EigenLayer and LayerZero, it remains to be seen whether airdrops will achieve their intended goals, or whether projects will abandon them altogether.

Conclusion

In many ways, cryptocurrencies lay bare the motivations of every market participant. Token economics can be viewed as the art of translating those motivations into the success and sustainability of a protocol. Allocating token supply, incentivizing behavior, and ensuring long-term value is a delicate balance that each project handles differently. It will be interesting to see how users and teams continue to adapt as market forces evolve and new metastates emerge.

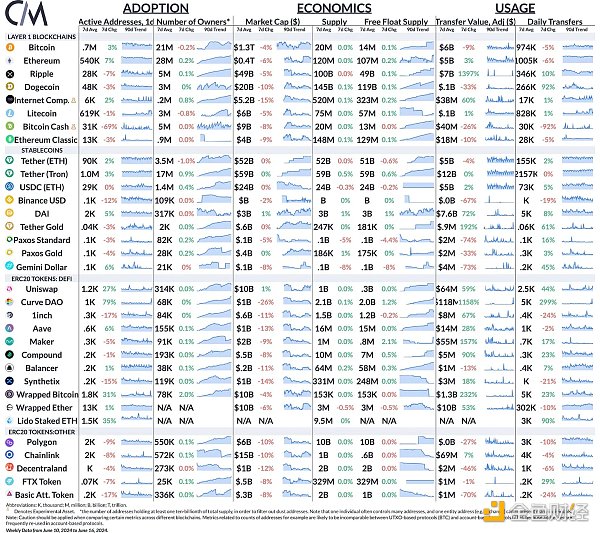

Network Data Insights

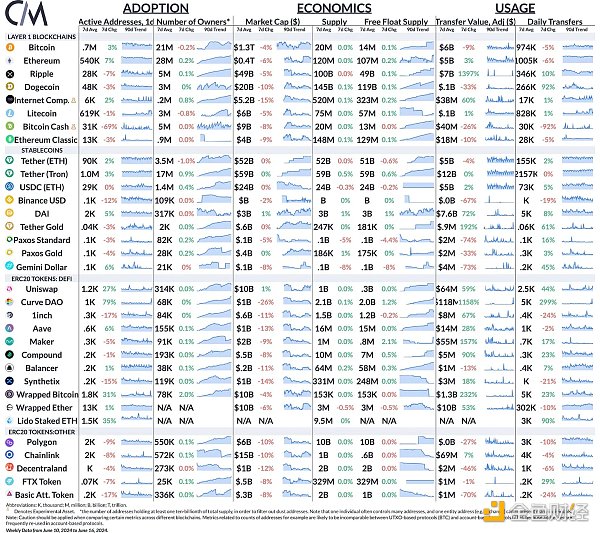

Bitcoin daily active addresses rose 3% this week, while Ethereum active addresses rose 7%.

JinseFinance

JinseFinance