Token Supply DesignWhen designing a token economy, determining the token supply involves estimating the value of the company or project, as well as deciding the proportion of tokens to be sold to investors and their valuation . The overall token supply design consists of two key factors.

The first factor is to consider the financial interests of investors. Projects are able to raise funds by making them attractive to investors by providing favorable conditions to ensure they are willing to invest. Early investors expect to be rewarded upon launch, a reward for their money and trust. Allowing investors to use (stake or sell) the purchased tokens from the beginning of the project is critical. Releasing a portion of the token pool at the time of listing can help convey a message to investors and, in turn, influence financing negotiations. However, the initial supply should not be excessive, as high supply may prompt investors to sell quickly, causing prices to fall.

The second factor is the use of tokens for system needs and ecosystem development. In addition to token distribution, ensure there are sufficient reserves and token pools for ecosystem operations, rewards (such as staking or airdrops), and reserves for the normal operation of the project. These tokens are used internally to provide liquidity or the initial reward pool and should be allocated appropriately to minimize early selling pressure and meet initial system needs, including marketing. Proper token distribution assures investors that the team has a long-term plan for project development. The number of tokens allocated for system operations may exceed the circulating supply on the secondary market. This is a safe approach as ecosystem tokens typically do not increase supply immediately.

Once the token is on the market, such as a centralized exchange (CEX) with an order book or a decentralized exchange (DEX) with automated market making , it will affect the price of the token.

Important mechanism of token distribution

When designing token economics, many project founders often set static values in the early stages. However, tokenomics can also be designed dynamically to adapt to changes in system needs. These dynamic changes can affect the token pool and respond to the need to expand the system in a timely manner. One example is adjusting market capitalization as the system develops to avoid overly high initial valuations.

In addition to determining an appropriate initial token supply, other mechanisms that influence project launch should also be considered. In addition to designing a proper initial token distribution, incentives and mechanisms to reduce supply pressure should also be kept in mind. Planning ahead is crucial as it allows for greater flexibility in building distribution mechanisms and a more equitable and sustainable ecosystem.

Attribution

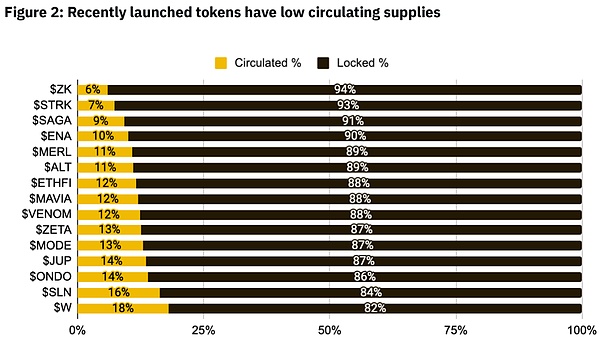

A key mechanism is attribution. Release tokens in stages over a period of time, reducing the possibility of a massive sell-off. Importantly, vesting reduces selling pressure and spreads it over time. When a large number of tokens are in the vesting stage and therefore not yet in circulation on the market, this may indicate limited supply and potentially higher value. Additionally, large releases may indicate a future decline in value due to a sudden increase in supply or a massive sell-off of the token.

Attribution has three main functions:

For founders,team assignments that set vesting periods demonstrate their long-term commitment. It can provide assurance to other stakeholders in the project and build their confidence in the quality of the project.

From an investor's perspective, it serves as a protection mechanism to prevent sudden fluctuations in the market, contributing to a greater stability.

For the community, vesting allows for a fairer distribution of tokens and more equitable and democratic conditions for participation. It can also serve as an incentive for community participation. Project creators can manipulate attribution by shortening their time frames as users complete tasks and reach certain milestones within the system. This type of attribution is called dynamic attribution or event-driven attribution. In this mechanism, users receive tokens after specific events or when the project reaches milestones. Scheduled events and subsequent attribution are part of a marketing strategy that, when executed correctly, can drive activity on a project. It can respond to price changes or minimize negative trends, having a significant impact on the liquidity and stability of the token market.

In contrast to dynamic vesting, classic vesting, also known as time-based or linear vesting, releases a certain amount of money at regular intervals (such as monthly or yearly) amount of tokens until all tokens are released. Currently, we are seeing a trend toward longer vesting periods, reflecting a more strategic and long-term mindset among project creators.

Source:

https://messari.io/report/analyzing-solana-s-growth

https://messari.io /report/airdrops

Airdrops

Special It is in the early stages of a project that finding and building a loyal community is crucial. This provides the basis for subsequent development and long-term loyalty to the project. One mechanism that has become very popular in Web3 recently and attracts participants significantly is airdrops.

An airdrop involves distributing tokens to the community to draw attention to the project and attract community interest. In the early stages of a project, they serve as part of a marketing campaign, often requiring users to meet certain conditions, such as joining a Telegram group, retweeting a post on Twitter, or playing a demo game in the GameFi realm. In later stages, it is beneficial to reward community members such as holders or stakers for actions that benefit project dynamics.

The emergence of airdrops is partly driven by laws and regulations as an alternative to initial coin offerings (ICOs) without being classified as illegal securities offerings. , distribute tokens to a large number of users.

The success of the airdrop is obvious. New projects in Web3 quickly gain visibility through this mechanism. New users are particularly attracted by airdrops from various new projects, which familiarizes them with the ecosystem and fosters long-term loyalty, contributing to its continued growth. A good example is Solana’s native token SOL, which has increased in value by 500% since the beginning of 2023. This period was primarily driven by decentralized finance (DeFi) airdrops and significant growth in application development on the network.

Airdrop strategy and its impact

The effect of airdrop is obvious , but project creators may still want to know which specific airdrop rules best suit their project’s needs. As always, the key is to tailor the rules to individual needs, depending on whether we want to incentivize a specific group in the community or the community as a whole, whether we prefer regular token distributions, or based on the development of the project and the dynamics of its value changes to operate them. However, there is some data that suggests some methods are better than others.

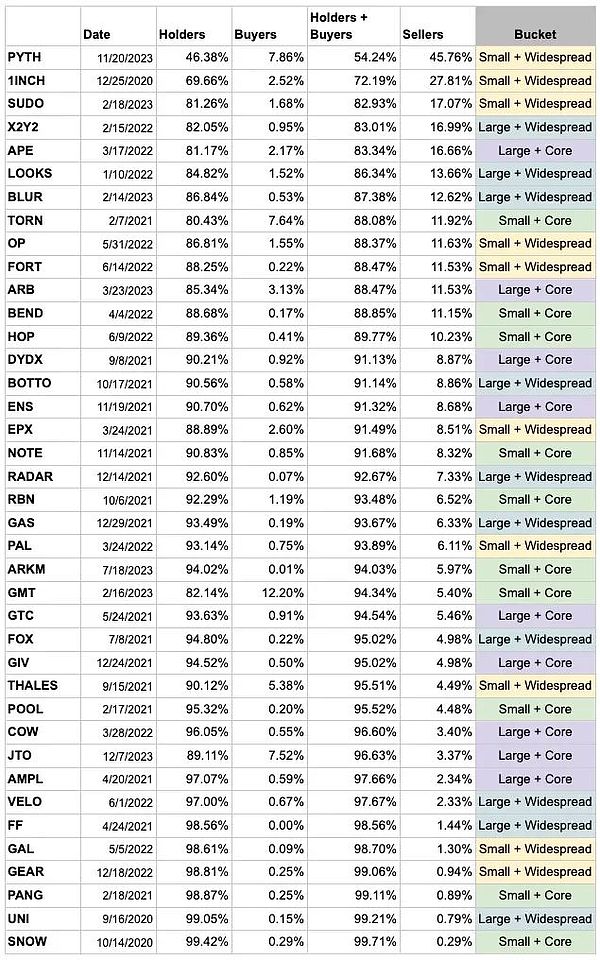

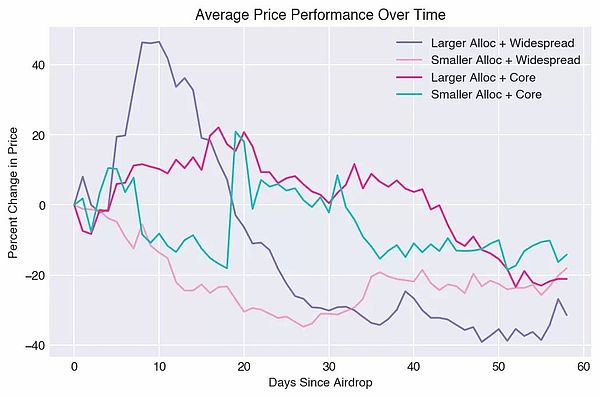

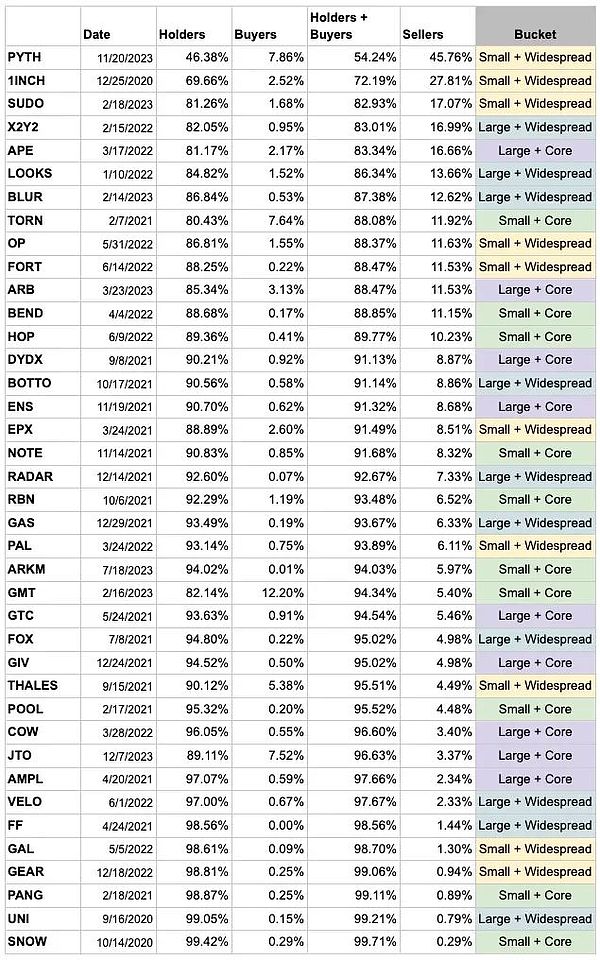

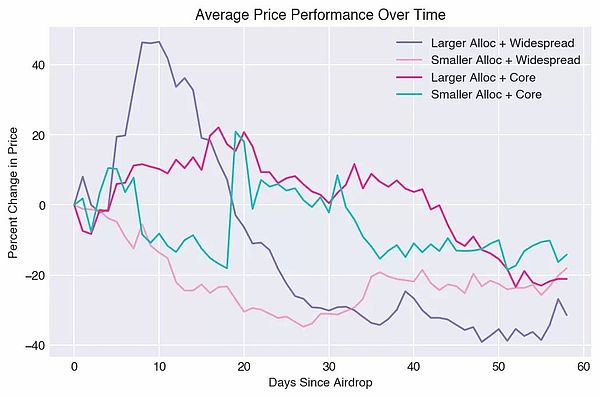

Targeted airdrops vs. broad distribution: Data shows that smaller, targeted airdrops to core users are better than large-scale The effect is better if it is widely distributed. Specific groups in the community are selected for rewards, and their participation can be interpreted as meeting certain criteria or stacking up. For example, small token distributions to core users (such as UNI and PYTH) show higher retention rates and lower volatility than wider distributions.

Source: 6th man, as of May 20, 2024

Research Conclusion

Airdrops targeting core users

Wide distribution of tokens may be costly , especially if the recipient tends to sell them quickly. Instead, it is more effective to focus on core users who contribute liquidity mining and usage to the project. Data shows that rewarding these core users leads to higher retention rates. Attempting to convert non-users via airdrops is unlikely to have a significant effect. By incentivizing the core community, it not only promotes stronger holder retention, but also stimulates buying momentum and drives up prices. Furthermore, motivational psychology confirms thatthe exclusivity of a reward enhances its perceived value because it is not available to everyone. SThis sense of exclusivity can increase the subjective evaluation of the reward.

Tend to small-scale airdrops

The size of airdrops has less impact on price and volatility, so it is preferable to keep airdrops small. Tokens play a key role in launching usage and liquidity as the project intends to continue development. Maintaining a larger reserve of tokens allows for future rewards to incentivize users and provide liquidity. Nevertheless, airdrops should still be substantial enough to effectively reward early-stage venture capital and inspire community participation.

Source:

https://followin.io/en/feed/10549481

Staking

Another mechanism worth considering is staking, which allows users to increase their capital, This inhibits the rapid sale of tokens and project abandonment. This mechanism, as well as the holding, is designed to reduce selling pressure after the project is launched.

Staking is a very positive mechanism in a project, as it allows users to generate passive income and increase their engagement time with the project. Therefore, stakers are usually motivated through other incentive mechanisms, such as participating in airdrop activities, or as a voting basis in certain decentralized autonomous organization projects.

When planning the token economy, it is worth noting that the staking reward pool is included in the ecosystem pool. A well-designed system should be self-sufficient, generating its own inflow and replenishing the staking reward pool.

Holding Behavior

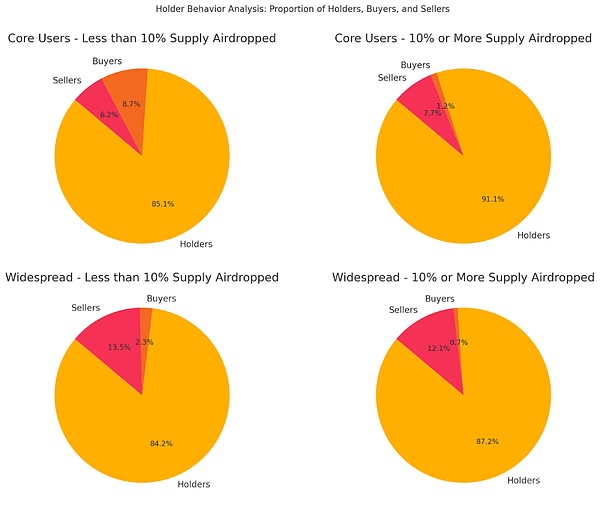

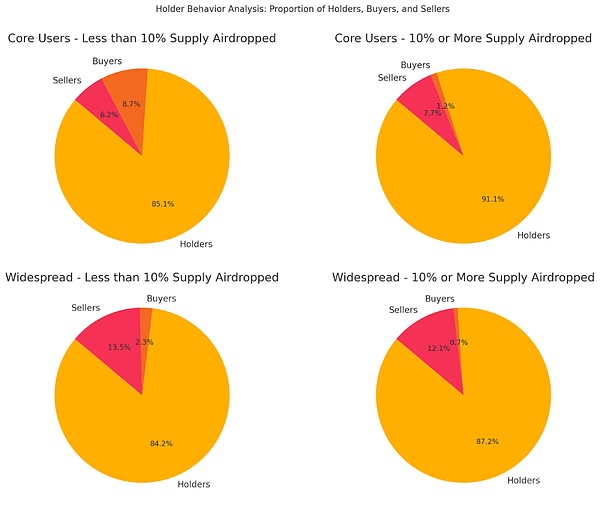

Analysis of holder behavior shows that core users tend to hold or buy more, indicating stronger community support. In contrast, widely distributed tokens see higher sell-off rates, resulting in greater volatility and price drops.

Source: 6th man, as of May 2024 20th

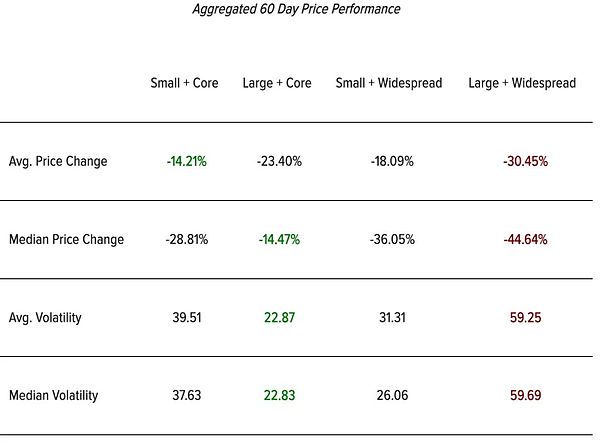

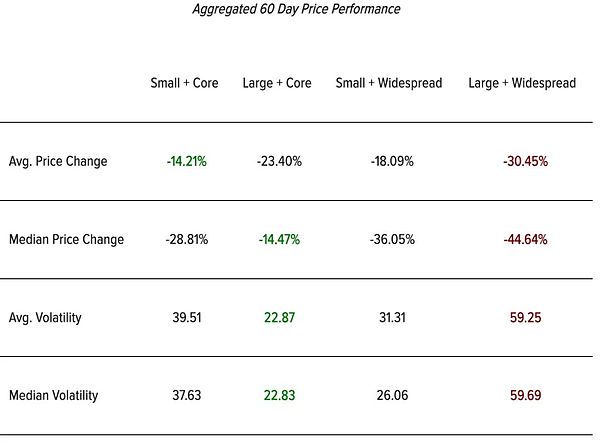

Volatility Analysis

Large Tokens that are large and widely distributed exhibit the highest volatility. The average volatility of such tokens is significantly higher than tokens with small, core user allocations. This suggests that a more conservative and targeted allocation approach can lead to more stable market behavior.

Source: 6th man

Better token economic design strategy

Based on our data analysis, market With insights and extensive experience in the Web3 industry, we have identified several strategies that can significantly improve the sustainability and transparency of the current token economy. Here are our assumptions and recommendations:

Background pair Token economy is crucial:

The context of the project determines the appropriate planning of the token economy and its liquidity. Projects will vary based on the utility of the token. Background can include DeFi, GameFi, DAO, etc.

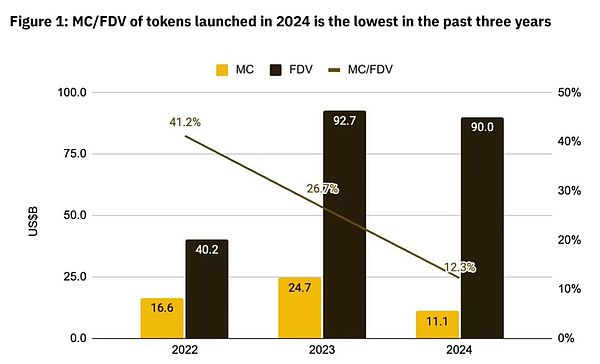

Sufficient initial circulating supply:

Ensure at least 20% of tokens are in circulation at listing , to prevent price manipulation and ensure accurate market valuations.

Balanced vesting schedule:

< ul style="list-style-type: square;" class=" list-paddingleft-2">Implement partial vesting in token generation events (TGE) , and then further vest within 6-12 months. This approach supports ongoing participation and fair price discovery.

Transparent token distribution:

< ul style="list-style-type: square;" class=" list-paddingleft-2">Provides information about the token distribution model, vesting schedule and Clear details of the token’s role in the ecosystem.

Automation and auditing processes:

Plan incentive mechanism:

Effective token distribution methods:

Verification:

By adopting these strategies, projects can build a more sustainable and transparent ecosystem.

Building a well-structured token economic framework that seamlessly integrates with the project's philosophy and context can be a challenge for its creators. Many teams turn to replicating known solutions and traditional static strategies. If you want to know why this approach is doomed to fail in the long run, read the article Tokenomics Explained: Tokenomics Depends on the Context.

Conclusion

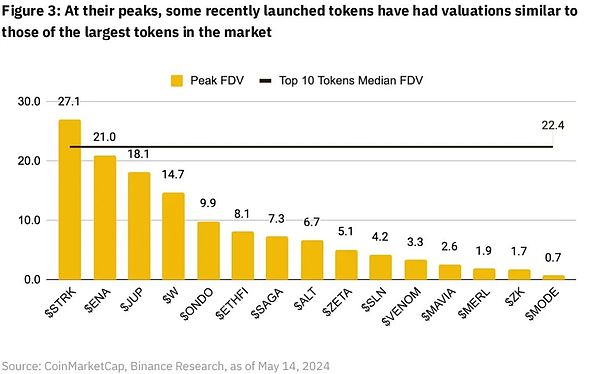

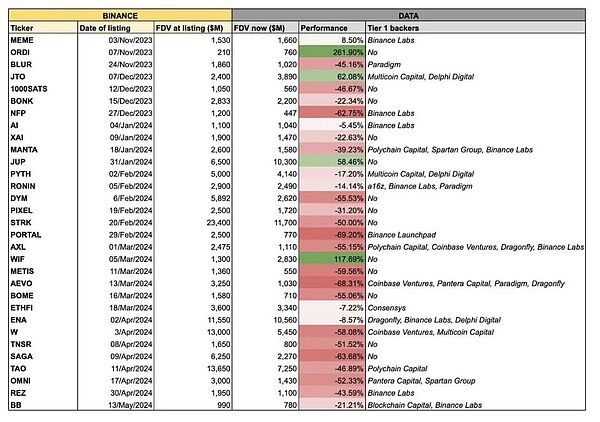

High FDV and low circulation Token trends have shown their limitations. In the dynamically changing Web3 landscape, new trends continue to replace old ones, and token distribution strategies are no exception. Among the many projects, some can find their "foothold" and be profitable, while others will fail and fall to the bottom. However, it is not advisable to blindly follow past successes. Proper planning of token economics and token distribution strategies should be based on a deep understanding of project needs, constraints, and expectations. These factors should guide the direction and mechanisms chosen. Being clear about the project’s context and success metrics, and aligning its token economy with them, is key to success. Rrather than sticking to hard-wired models, consider unique allocations and more dynamic solutions that can adapt to changes in the system and evolving needs.

Recognizing the three main needs of creators in token economic support, Tokenomia.pro and TokenOps comprehensively cover them:

Design Phase

Token Economic Development:

Economic mechanism design:

Psychological portrait of Agents:

Incentive mechanism:

Full coverage:

Verification phase

Mathematical specifications:

Create a digital twin:

Verified by simulation:

Verify economic security:

Simulation analysis and suggestions:

If you are interested in evaluating the token economics of an existing project or validating your own project hypothesis, you You can use the token economic simulation tool-TPRO Network[https://tpro.network/]. It allows you to simulate changes in price dynamics, token supply, the number of tokens bought and sold, and the behavior of various Agents in primary and secondary markets. This tool enables you to observe how projects perform under specific demand and sales conditions.

Observe and respond:

Many sustainable tokens Economic needs are met by TokenOps, a platform dedicated to token operations and lifecycle management. TokenOps helps streamline the token creation process, providing transparent and balanced token distribution, real-time analytics, and tools to effectively manage vesting schedules. TokenOps solves key problems identified in the current market:

Transparency of token distribution:

TokenOps provides detailed reporting and tracking tools to enhance transparency and build investor trust. By providing a clear view of token allocation and distribution, projects can ensure accountability and promote investor confidence. Their platform uses open source and fully auditable smart contracts, ensuring every step is secure and visible to stakeholders.

Balanced vesting schedule:

TokenOps provides the possibility to build flexible and customized vesting schedules nature, balancing early investor rewards and long-term project sustainability. This helps prevent large-scale sudden unlocks that could disrupt the market.

Innovative distribution methods:

Substantial initial circulating supply:

JinseFinance

JinseFinance