Author: Ac-Core, researcher at YBB Capital; Compiler: 0xjs@黄金财经

TLDR:

Due to the lack of unified standards, different blockchains have different architectures and consensus mechanisms, and the cross-chain asset transfer process is complex and costly. Existing third-party bridges face trust and security challenges. Centralized bridges need to maintain liquidity and pass on costs to users. One-click chain issuance is similar to solving the trilemma and is a compromise solution for asset bridging.

The market maturity is led by OP Stack and Superchain, and Base is a successful example. AggLayer is natively compatible with Ethereum and is more easily accepted, but the aggregation process needs to be safe and reliable. The success of Elastic Chain depends on the development of ZKSync. OP is optimistic in the short term and ZK is optimistic in the long term.

Against the background of insufficient industry innovation, DeFi is still the main application scenario of Rollups. At present, DePIN, RWA and large GameFi projects are less likely to appear on Rollups, while SocialFi and NFT markets may appear, but the market heat is still uncertain. The blockchain as a whole presents a Matthew effect. The trend of unlimited issuance of Rollups is worth paying attention to in the long term, and in the short term, the middle and lower layers.

1. Connecting island chains: the problem of bridges

When transferring assets across chains, each blockchain has a unique architecture, consensus mechanism, state proof, and state transition, lacking unified standards and interoperability, resulting in complex cross-chain communication and data exchange. These verification processes are usually too expensive to be performed on the chain. This limitation has led to a surge in multi-party signature committees to verify the status of other chains. Therefore, there is no universal decentralized standard or protocol that can achieve interoperability between all blockchains, limiting the free flow of assets between different blockchains.

In order to achieve cross-chain asset transfers, many third-party bridges have emerged, but these bridges face significant network security challenges related to trust issues. Even if centralized bridges can ensure complete security, they still need to maintain sufficient liquidity on each integrated chain, thus passing these operating costs on to users. Currently, the inability to meet the trust difficulty of native decentralized asset bridging and third-party bridges has led ZKsync, Polygon, and Optimism to launch more native solutions such as Elastic Chain, AggLayer, and Superchain Explainer to achieve localized multi-chain expansion.

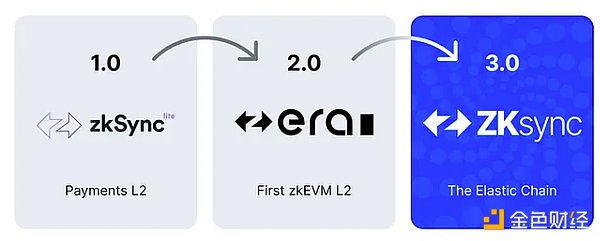

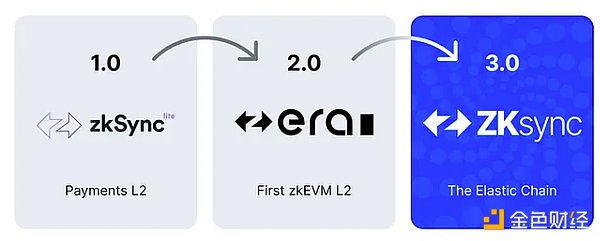

2. ZKsync3.0: Elastic Chain

Image source: zksync.mirror

In 2023, Matter Labs, the main development company behind ZKsync, released ZK Stack, a toolkit that allows developers to build their own blockchains based on ZKsync technology. In essence, these custom chains will be interconnected through Elastic Chain, transforming ZKsync 3.0 from a single Ethereum L2 to an Elastic Chain.

The ZKsync 3.0 protocol core upgrade was released on June 7, 2024 and is the most complex upgrade of ZKsync to date. It reconfigures the ZKsync L1 bridge as a shared router contract to support an expanding network of interoperable ZK chains. The ZK Stack framework enables native, trustless, and low-cost interoperability between chains.

Matter Labs said, "Elastic Chain is an infinitely scalable network composed of ZK Chains (rollups, validiums, and volitions), which ensures its security through mathematical verification methods and achieves seamless interoperability under a unified and intuitive user experience. It aims to make interoperability within the ZKsync ecosystem smoother and more efficient."

2.1 Elastic Chain Architecture

Elastic Chain does not rely entirely on ZK technology, nor can it simply add ZK proof "patches" to other non-ZK multi-chain systems. Overall, its network is implemented through three components: ZK Router, ZK Gateway, and ZK Chains.

1. ZK Router:

Core Routing Mechanism: ZK Router is the main routing component of the ZKSync 3.0 architecture, responsible for managing and coordinating communication and data transmission between different chains and nodes in the network.

Cross-chain Communication: Using efficient cross-chain communication protocols, ZK Router ensures fast and secure data transmission between different chains, enhancing the interoperability and performance of the overall network.

2. ZK Gateway:

Entry and Exit Nodes: ZK Gateway serves as the entry and exit nodes of the ZKSync 3.0 network, handling interactions between external blockchains (such as the Ethereum mainnet) and the ZKSync network.

Asset bridging: Responsible for the asset bridging and transfer between external blockchains and the ZKSync network, ensuring the safe and efficient flow of assets between different chains.

Transaction aggregation: Aggregate user transactions into batches, then generate zero-knowledge proofs and submit them to external blockchains for verification, reducing on-chain data load and transaction fees.

Middleware: It can be understood as middleware deployed between Ethereum and ZK Chains to achieve comprehensive interoperability between ZK Chains.

3. ZK Chains: Ensure the validity and security of transactions by generating and verifying zero-knowledge proofs, and submit the results to ZK Router for Rollup and coordination. They are interconnected with L1 smart contracts through ZK Gateway, are completely independent, customizable, and built with ZK Stack.

According to ZKsync, Gateway is a key component of Elastic Chain, enabling seamless settlement from ZK Chains to Ethereum. Submitting proofs and data to Ethereum through the Gateway enables the following benefits:

Cross-batch and cross-chain proof synthesis: Reduce L1 verification costs.

State delta compression: Compress small batches of data sent to the gateway and efficiently forward them to L1 in large batches.

Faster finality: Verify chain proofs and prevent conflicts for low-latency cross-chain bridging, enhanced by the staking of a large number of validators. ZK chains do not need to trust other chains.

Activity: The activity of each ZK chain is managed independently by its validators; the gateway does not affect its activity. Chains are free to leave the gateway.

Censorship resistance: Cross-chain mandatory transactions will be cheaper than regular L1 censorship-resistant transactions, making them more accessible to all users.

ZK Chains can settle directly to Ethereum without using the ZK Gateway, freely choosing to leave the ZK Gateway network without affecting the security of their chain. They can switch between using the ZK Gateway and settling directly to Ethereum. The ZK Gateway will be operated by a decentralized, trustless cluster of validators to ensure network resilience and reliability. ERC20 tokens are required to participate in this decentralized validation process. The ZKSync network governance will designate a token (likely a ZK token) for this purpose.

Validators will charge a bridge fee and a fee for each byte of state delta data published to the ZK Gateway. This incentivizes validators to join the ZK Gateway because their income can increase exponentially with the value of transactions on the chain. In addition, due to the recompression service provided by validators, settling data through the ZK Gateway will be cheaper than settling directly on the Ethereum network, which may be the reason why most ZK chains may choose to join.

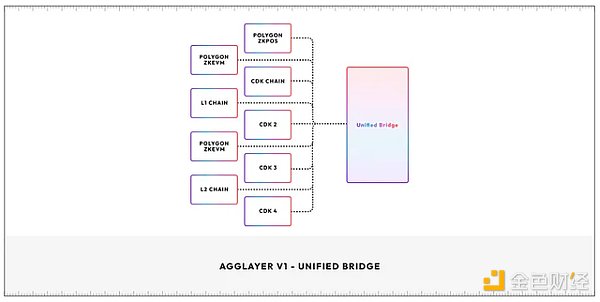

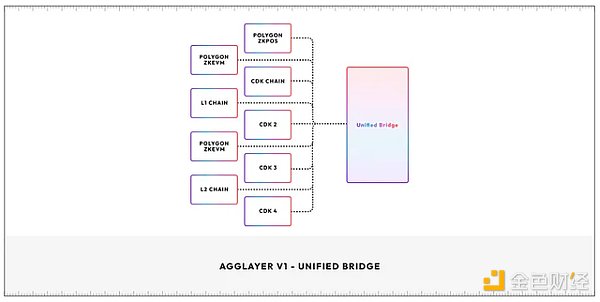

3. Polygon 2.0: Agglayer

Image source: Polygon Agglayer

3.1 The origin of Agglayer design

Similar to OP Stack and ZK Stack, blockchains created using Polygon CDK can be directly integrated into Agglayer, leveraging its unified bridging and security services to achieve interoperability with other blockchains. This constitutes the core architecture of Polygon 2.0.

The core idea of Agglayer is derived from the Shared Validity Sequencing design proposed by Umbra Research. The design aims to achieve atomic cross-chain interoperability between multiple Optimistic Rollups. By using a shared sorter, the system can uniformly handle transaction ordering and state root publishing for multiple Rollups to ensure atomicity and conditional execution.

To achieve this, the following three elements are required:

Shared sorter: Receives and processes cross-chain transaction requests.

Block construction algorithm: The shared sorter is responsible for building blocks containing cross-chain operations and ensuring their atomicity.

Shared fraud proof: Implement a shared fraud proof mechanism between related Rollups to perform cross-chain operations.

Since the existing Rollups already have the ability to pass messages between Layer 1 and Layer 2 in both directions, Umbra only adds a MintBurnSystemContract (Burn and Mint) to supplement these three components.

Workflow:

Burn operation on chain A: can be called by any contract or external account, and is recorded in burnTree after success.

Mint operation on chain B: after successful execution by the sequencer, it is recorded in mintTree.

Invariants and consistency:

System Operation:

The shared sorter is responsible for publishing the transaction batches and declared state roots of the two Rollups to Ethereum. It can be centralized or decentralized (such as Metis). The sorter receives transactions and builds blocks for Rollup A and B. If the transaction on A successfully interacts with MintBurnSystemContract, it tries to execute the corresponding Mint transaction on B. If the Mint transaction succeeds, it includes both the Burn transaction on A and the Mint transaction on B; if it fails, it excludes both transactions.

3.2 Agglayer Core Components:

In Polygon 2.0's Agglayer, Unified Bridge and Pessimistic Proofs are its core components.

1. Unified Bridge

Technical framework:

Cross-chain communication: The core of Unified Bridge is to achieve seamless communication between different chains, and to achieve data and asset transfer between different Layer2 solutions and the Ethereum mainnet through cross-chain communication protocols.

Liquidity aggregation: The bridge aggregates liquidity from different Layer2 solutions, allowing users to freely transfer assets between chains without worrying about liquidity fragmentation.

Implementation logic:

Message passing: Unified Bridge achieves cross-chain communication through a message passing mechanism. Messages contain relevant transaction information and are passed between chains through a bridge protocol.

Asset locking and release: When a user locks an asset on a chain, Unified Bridge releases an asset of equal value on the target chain. This process uses smart contracts to ensure security and transparency.

Interoperability Protocols: To ensure interoperability between different chains, Unified Bridge uses standardized interoperability protocols. These protocols define how to process cross-chain transactions, verify transaction validity, and resolve potential conflicts.

Source: Aggregated Blockchains: A New Thesis

2. Pessimistic Proofs

Technical Framework:

Security: Pessimistic proof is a security measure designed to prevent fraudulent transactions. It introduces an additional verification step during transaction verification to ensure that all transactions are valid.

Delayed Verification: Unlike optimistic proofs, pessimistic proofs assume that transactions may be malicious and conduct a comprehensive verification before confirmation.

Implementation Logic:

Preliminary Verification: After the transaction is submitted, the system immediately conducts preliminary verification, including checking basic transaction information, signature validity, etc.

Deep Verification: After passing the preliminary verification, the transaction enters the deep verification stage, and the system calls a series of smart contracts to check the complexity and potential risks of the transaction.

Dispute Resolution: If any problems are found during the verification process, the system will trigger the dispute resolution mechanism. This allows users and validators to submit additional proofs to resolve disputes and ensure the final validity of the transaction.

Agglayer provides a highly secure, scalable and interoperable blockchain environment by integrating Unified Bridge and Pessimistic Proofs. These components not only enhance the security of the system, but also simplify cross-chain transactions, making it easier for users to interact across chains. For more details, please refer to YBB Capital's previous article "From Modularity to Aggregation: Exploring the Agglayer Core of Polygon 2.0".

4. Optimism: Superchain Explainer

In 2023, Optimism took the lead in opening up the one-click chain road, and its initial project was OP Stack, which established standards for a unified network. OP Stack is the launch platform for Ethereum's scaling solution Optimism Superchain, and is also the hub for interactions and transactions between all L2s built with OP Stack.

Optimism Superchain shares a common OP Stack development stack, bridge, communication layer, and security to ensure that individual chains can coordinate and operate as a unit. This structure can be divided into five different layers, each with its specific purpose and function:

Data Availability Layer: The main source of raw input for the chain is determined based on the OP stack, mainly through Ethereum DA.

Ordering layer: controls how user transactions are collected and forwarded, usually managed by a single sorter.

Derivation layer: processes raw data into input for the execution layer, mainly using Rollup technology.

Execution layer: defines the system state structure and conversion functions, with the Ethereum Virtual Machine (EVM) as the central module.

Settlement layer: allows external blockchains to view the valid state of the OP Stack chain through proof-based fault verification.

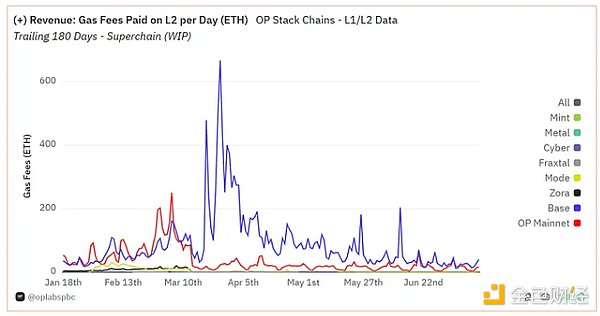

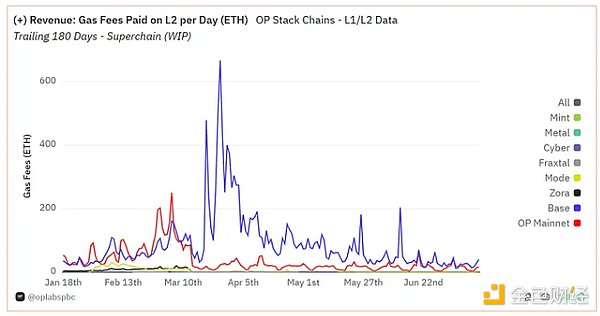

Compared with Elastic Chain and Agglayer, Optimism Superchain was the first to enter the market and occupied a considerable share. It is worth noting that Base, which was launched based on it, accounts for a large part of the daily gas expenditure, reflecting its high on-chain activity.

Source: Dune Optimism — Superchain on-chain data

5. Subjective thoughts on one-click chain issuance

5.1 Competitive analysis of AggLayer, Superchain, and Elastic Chain

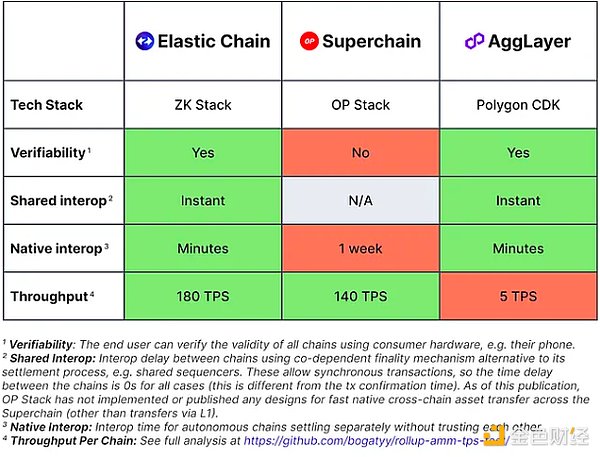

(The content of this section only represents the author’s personal opinion.)

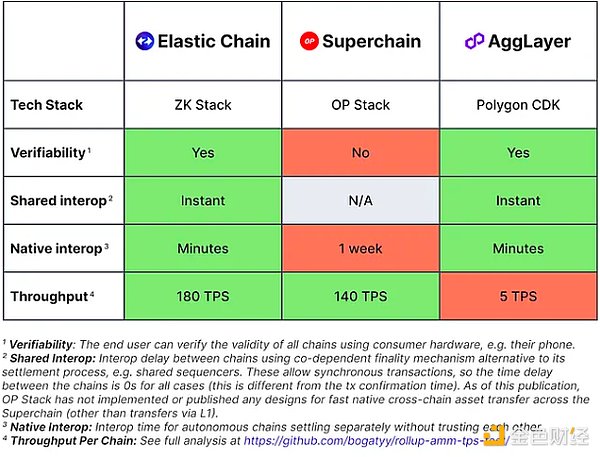

The above three expansion plans continue the narrative of their respective Rollup expansion. From the perspective of market maturity, OP Stack and Superchain took the lead in occupying the market, and Base is the most successful representative among them.

AggLayer has the advantage of native compatibility and can run directly on the existing Ethereum network without major modifications to the underlying protocol. This makes it more acceptable to existing Ethereum users and developers. The challenge is to ensure the security and reliability of the aggregation process.

The initial judgment on Elastic Chain is to look at the development of the ZKsync ecosystem and community building. If ZKsync itself cannot develop, Elastic Chain may face challenges in attracting developers and maintaining community enthusiasm. From both market and technical perspectives, OP is bullish in the short term and ZK is bullish in the long term.

However, the inherent problem of these three solutions is the relatively centralized nature of Rollup. Recently, a Rollup-based expansion solution has emerged as a potential competitor. It moves the sorter directly to L1, Ethereum itself, eliminating the need for an additional sorter or complex verification step for L2. Despite some potential MEV issues, this more native expansion method is worth paying attention to for future development.

Source: ZKsync — Introduction to Elastic Chain

5.2 Future Trends and Application Innovation of Rollup

Overall, with the promotion of "one-click chain issuance", the number of Rollup as the main expansion solution of Ethereum will continue to increase. Even if the Bitcoin ecosystem prospers in 2023, its non-native expansion also borrows many Ethereum expansion concepts. In the case of limited market innovation, Rollup application innovation and impact may be limited.

For each VM chain, TVL is a key indicator no matter how the market changes, so the earliest applications may be various DeFi protocols. In addition, SocialFi protocols and NFT trading markets may also appear.

In other areas, DePIN may have difficulty developing on Rollup and L1, and a leader may appear on Solana. The RWA concept is more likely to develop on L1, and there is insufficient confidence in Rollup. GameFi will also rise, but large-scale games will only have a chance on Rollup with GameFi as the core. Therefore, the most certain application at present is still DeFi-related.

However, the Matthew effect is obvious in the blockchain industry. With the advent of the multi-chain era, resources will be concentrated on the head projects, the strong will always be strong, and the weak will be eliminated.

YBB Capital research report original text link

Wilfred

Wilfred