Author: Tim Craig Source: DLNews Translation: Shan Ouba, Golden Finance

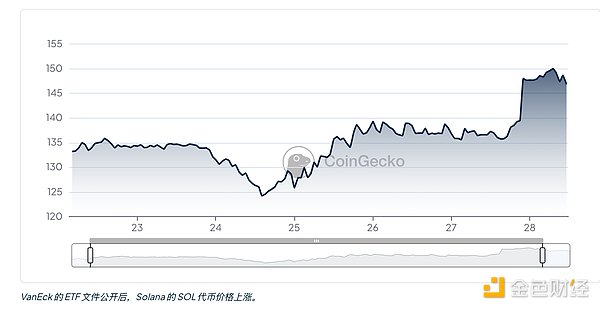

VanEck's application to launch a Solana spot exchange-traded fund (ETF) surprised the market in many ways.

The asset management company submitted the application for the ETF on Thursday. It is worth noting that VanEck's Solana spot ETF plan is unprecedented because it has no corresponding US Solana futures market.

But the application also lists a specific risk not seen in other ETF applications: concentrated holdings of SOL tokens.

VanEck's application states that as of the end of November last year, the top 100 wallets holding SOL tokens contained approximately one-third of the circulating SOL tokens.

"Due to this concentration of holdings, large-scale sales or distributions could have an adverse effect on market prices."

The decentralization of tokens, that is, the distribution of a particular cryptocurrency among its holders, is important to both investors and regulators.

Compared to bitcoin and ethereum, SOL tokens are less distributed, and concentrated holdings could be a hurdle to approving the VanEck Solana ETF.

SEC Commissioner Caroline Crenshaw cited bitcoin’s concentrated holdings as one of the reasons she opposed approving a bitcoin spot ETF in January.

The top 107 bitcoin wallets hold about 16% of bitcoin’s circulating supply, about half of Solana’s.

The top 100 ethereum wallets hold about 19% of ethereum’s supply.

Solana’s Decentralization

Matthew Sigel, head of digital asset research at VanEck, dismissed those concerns, arguing that the network itself is decentralized. “No single intermediary or entity operates or controls the Solana network,” Sigel said in a post on the X platform shortly after the filing became public.

Sigel said a diverse user base maintains the infrastructure that supports transactions on the Solana network. According to data from Solana's data platform Solana Beach, the Solana network consists of 1,509 independent so-called nodes. Of these, the top 20 nodes have enough power to attack the network if they unite.

Other risks

ETF applications must list risk factors that could adversely affect the price of their underlying assets.

Another Solana-specific risk listed by VanEck is the blockchain's unique Proof of History (PoH) mechanism.

Proof of History enables Solana to process transactions faster than other blockchains such as Ethereum. However, issues with PoH have led to several lengthy network outages in recent years.

“PoH is a new blockchain technology that is not widely used and may not operate as expected,” the application reads.

VanEck’s Solana ETF application also lists many of the same risks as its Ethereum ETF application.

These risks include the “extreme volatility” of crypto assets, the immutable nature of crypto transactions, and the impact that a fork could have on the value of ETF shares.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance