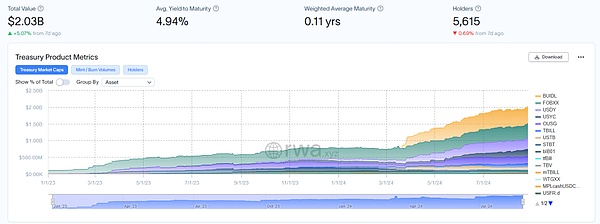

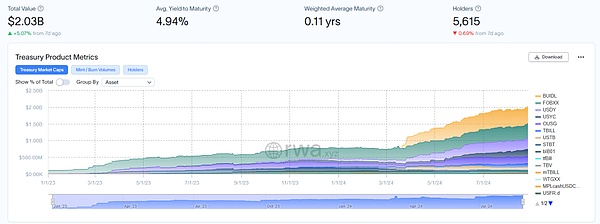

The tokenized government bond market has reached a market value of US$2 billion in just 151 days. The underlying reason for this remarkable growth is investment from a large number of institutions, the largest of which is none other than BlackRock.

That’s all changing, though, with the launch of the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). At present, the market value of BUIDL has reached US$503 million, almost crushing other investment institutions in the field of tokenized treasury.

In four months, BUIDL’s market value grew to approximately US$503 million, becoming the largest single fund in the field of tokenized government bonds.

The success of the fund not only brought a certain degree of confidence to investors, but also attracted more investors' interest in token government bonds.

In addition, the growth of other well-known funds has not been impressive. Examples include Franklin Templeton’s OnChain U.S. Government Currency Fund FOBXX, and Ondo Finance’s U.S. Dollar Yield Fund USDY.

These companies also saw revenue growth, but from a lower base, at $425 million and $364 million respectively.

The rise in the value of institutional funds not only drives the growth of market capitalization, but also brings huge credibility to tokenized government bonds.

Now, investors are more willing to get involved in this innovative financial product, allowing the traditional world of government securities to benefit from the benefits of blockchain technology.

Tokenized Treasury Bonds provide seamless transactions on public blockchains such as Ethereum and Solana by digitizing U.S. Treasury assets.

This technological breakthrough simplifies the trading of U.S. Treasury bonds and opens the U.S. Treasury market to more investors, including foreigners. It converts securities into digital tokens, lowering market entry barriers.

One of the biggest benefits of tokenization is liquidity. Tokenized securities and assets are available 24/7 for investors who want to redeem their funds, the exact opposite of traditional markets.

People can also easily get cash by exchanging their tokens for stablecoins using smart contracts, without having to go through the long waits of traditional financial markets.

Analysts in the field of tokenized treasury predict a relatively optimistic outlook. As the number of DeFi projects and DAOs interested in the asset class continues to rise, the market size may reach just over $3 billion by the end of the year.

Some companies in particular have found that tokenized treasury bonds are ideal for inclusion in their investment portfolios, as this will allow them to obtain stable and risk-free returns.

However, the market must also face headwinds. For example, macroeconomic factors, negative investor sentiment, etc. If interest rates rise too much, the allure of tokenized assets can easily disappear. There are also regulatory hurdles, and the integration of traditional finance and blockchain technology remains largely uncharted territory.

JinseFinance

JinseFinance