Written by: TechFlow

These days, you must have seen the guy in the picture above a lot - long hair, big beard and glasses, full of rock temperament.

His name is Murad Mahmudov. He was not considered a crypto KOL before, but in recent days, with intensive analysis and comments on him on the Internet, he has become the king of Meme orders.

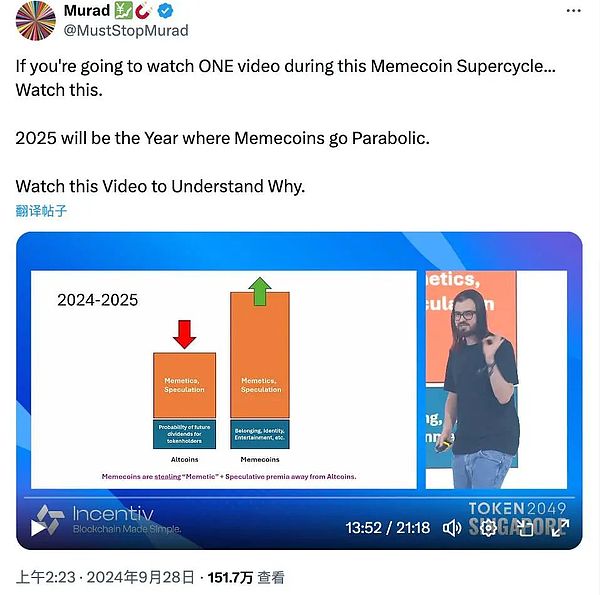

What made him famous was his speech "Meme Coin Super Cycle" at this year's Singapore 2049 Conference, which has been played 1.76 million times as of press time.

If you haven't heard of this guy yet, you might as well watch this video. You will find that he is CX (marketing) Meme coins to you with extremely formal theories, detailed data and determination that overflows the screen. The essence of his remarks is full of emotional value, and there is a taste of shocking:

For example, the total market value of Meme coins will exceed one trillion US dollars, and Bitcoin will reach 200 trillion US dollars in 20 years. You need to subvert the investment logic to welcome this new cycle and embrace Meme ...

The speech itself has been watched by many people, but few people mention Murad's past:

It was because of learning Chinese that he had the opportunity to stay in China for a year.

That year, Murad was 17 years old. In 2013, Bitcoin experienced its largest annual increase to date, nearly 6,000%.

At the same time, old investors must know that China was undoubtedly the center of the cryptocurrency circle that year, and the domestic awareness of mining and Bitcoin gradually heated up. In such an environment, Murad used his own words in the interview:

"I was in the right place at the right time."

In the circle of foreigners in Beijing, Murad met OKcoin's Employee No. 5, an American, and also learned about cryptocurrency from him.

And OKcoin is the predecessor of OKX.

Obviously, Murad was exposed to the cryptocurrency circle earlier; the "right time" he mentioned has another deeper meaning in his words ---- before the historic crash of "94" in 2017, that is, before the bubble burst, he learned about encryption in China, which influenced his subsequent life, views and work.

Later, Murad joined Goldman Sachs and became a consultant, but his early experience deepened his understanding of BTC as a store of value.

Don't forget that memes were not flying all over the sky at that time, and the ancient consensus of "Bitcoin Gold Lite Silver" was unbreakable.

So, Murad should have originally belonged to the Bitcoin Cult, not the Meme Cult.

Working as a fund, exposed during the epidemic

The turning point of fate was in 2017.

Although the entire cryptocurrency circle was in a bloodbath because of the 94 incident that year, Murad founded Adaptive Capital, a smaller crypto hedge fund company in the same year.

If you search for images in the search engine, you can still find the company's promotional page; Murad is responsible for investment and trading-related positions. If you don't take it seriously, this position looks like a so-called "trader".

Being on the front line, Murad must have accumulated a lot of experience in trading and market observation.

But if you walk by the river often, you will get your shoes wet. Especially beside the dangerous river of cryptocurrencies, which are unpredictable and change faster than the weather.

In 2020, the COVID-19 pandemic swept the world and the international situation changed suddenly.

During the same period, the crypto market also experienced sharp rises and falls. Murad's Adaptive Capital suffered a huge blow after the price of Bitcoin fell by more than $1,000 on March 13 of that year. The company also sent an open letter to all investors, telling them that the fund would be closed and planned to return the remaining capital to its limited partners.

Adaptive Capital blamed it on CEX stopping service when the price plummeted, which made it impossible to operate positions in time and led to liquidation:

"We use some respected exchanges every day, but these platforms and tools stopped operating during the sell-off, seriously hindering our ability to take corresponding actions."

In the words of the leeks, it is the classic exchange "pulling the cable".

It is impossible to determine right or wrong, but Murad, as the head of trading and investment of this fund, was obviously hit by the cable-pulling incident, which may also lay the groundwork for his future search for on-chain Meme and more on-chain opportunities.

Super cycle, one speech to fame

In 2022, Murad was more active on social media and posted "I'm back".

He firmly believes that this industry will absorb more funds and believes that the bear market is the best time to plan the next bull market.

It was also at about the same time that different memes began to emerge, and Murad also noticed these.

Everyone knows the story afterwards. The long-haired guy stood on the stage of 2049 and started a passionate speech on "Memecoin Supercycle", which triggered the entire CT to watch and discuss.

Before this, Murad's story was not well known. But as the saying goes, "those who provide emotional value to everyone must have traffic", Murad's remarks in his speech have made him gain extraordinary popularity, such as MEME will reach a market value of 1 trillion, and the price of Bitcoin will rush to 200 trillion US dollars in 20 years.

In this cycle, Meme is rampant, and Meme continues to enter the top 50 in market value. Against the background, Murad's super cycle speech gives every Meme player the rationality and legitimacy of holding positions, and he is not just shouting orders.

For example, he has a slightly academic tone but is easy to understand to characterize most crypto tokens---if a token is neither a value storage tool nor an income distribution tool, then it is a Memecoin.

To borrow the words of Twitter user @0xWendy99:

"What makes this Princeton guy different is that his 'orthodoxy' is much stronger than Ansem's. His speech has the flavor of a regular army. "Tokenized community", "Token is product", meme is no longer a vassal or a low-end thing. Theory guides meme, and system drives speculation, which makes retail investors call it high-end and institutions call it reasonable."

With his early trading experience and strong marketing skills, Murad became famous in the super cycle.

It's lonely at the top, and the butt determines the head?

Fame brings troubles, and Murand is no exception.

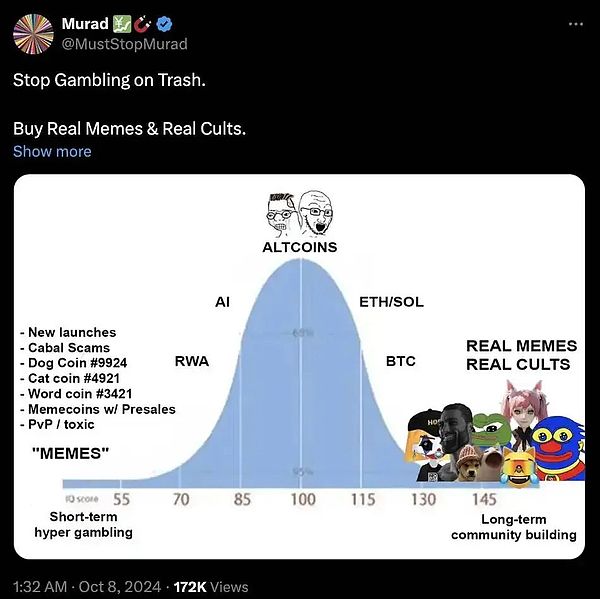

After becoming popular, Murad often called out orders and analyzed the quality and worthiness of various memes.

This move also constantly makes people wonder whether Murad is so determined to be a meme bull. Is there any interest behind it?

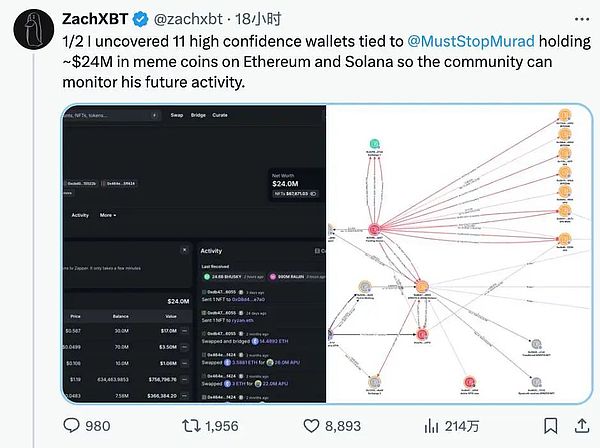

The well-known on-chain detective ZachXBT will certainly not be absent, and a few days ago he dug out 11 wallet addresses that are suspected to be highly associated with Murad. These wallets hold memes worth a total of about 24 million US dollars on Ethereum and Solana.

Data shows that some of these addresses purchased a large amount of Meme coins SPX from June to August, and received a return of more than 60 times in 4 months; this also coincides with the ranking of Meme coins recommended by Murad in a public post:

However, there is also a classic and correct statement circulating in the currency circle:

If you buy a coin and don't go to CX, it is a very stupid behavior.

Murad bought and CX, which to some extent can be regarded as unity of knowledge and action; as for whether it is a conspiracy to buy first and then call on the leeks to carry the sedan chair, or purely believing in the Meme cult and wanting everyone to believe in themselves, it is a matter of opinion.

Currently, the community is also engaged in a heated debate over the detective's behavior of digging out Murad's holdings.

Some Twitter users believe that ZachXBT's behavior can prevent his followers from being dumped by him. Slorg, the project leader of Solana's tool Sol Incinerator, questioned: "Do you really think these things are hidden?", implying that this information is public and there is nothing wrong with digging it out.

And there are also voices against digging out the cards:

Taproots Wizards co-founder Udi Wertheimer said that it is crazy to publicly confiscate someone's wallet to prevent potential illegal behavior; some users also do not agree to "draw a target" on Murad in advance, especially when Murad has done nothing wrong.

Buying and selling tokens and conducting transactions are not lawless in themselves;

But it is lonely at the top. When a CX die-hard bull suddenly has a lot of traffic and potential influence, people will inevitably target him and put him under a microscope to try to dig out more information.

Whether it is for their own traffic popularity or to uphold justice and punish rat warehouses, people will inevitably be surrounded by gossip when they are popular, and it is naturally lonely at the top.

We cannot conclude whether Murad is a simple die-hard bull or a master of manipulating leeks, but he himself said in an interview: "For some tokens, I will definitely sell some at the end of 2025 and the beginning of 2026... But for other coins, I plan to hold them for a long time to cross the cycle."

But there is a saying that goes, the peak produces false supporters, and the dusk witnesses devout believers.

After a super cycle, whether the new king of shouting orders Murad holds Meme or BTC, time will naturally give the answer.

Attachment: Wallet address highly related to Murad issued by the on-chain detective

ETH

0x6b411100c72ba2445e50ffd20839c28b3546de7c

0xcbd0dee0c3eed152c3398b062361becc4a15522b

0x13fc38ec99a8217a06d1dc6db8c0bf0ee97ebf7f

0x71b4fd11eef705ba60176e7c034cd1a4f97ae02d

0x30b46a659761b576a00028b44d1e37fdc64b034d

0x5b1569db2 34a0f2884814a3f7184f01cf641b0c6

0x464e0a666734ba93e231d929ace538eaf05ff424

0xdb47714727cba70f0408ba30dc4ea0b5ac436055

SOL

7QZGS7MQ4S6hRmE8iXoFTXgQ2hXVUCho2ZhgeWvLNPZT

GyBkVYkHBPMapyQeueQ6d44YthwqYiX4ajgnGLqq9P7r

2xn57hPD2v6ighJFPXNPSoiGUXkW4KKo8Hb3NpXmHZvZ

Monitoring dashboard:

https://dune.com/0xtoolman/murad-buys-and-sells

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance XingChi

XingChi JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Alex

Alex JinseFinance

JinseFinance