Author: Liu Jiaolian

Cathie Wood of Ark Invest is an industry leader An old acquaintance. She has always been known for her bold predictions. For example, just in October 2023, Sister Mu said bluntly in an interview that according to the market forecast of Ark Fund, by 2030, the unit price of Bitcoin is expected to reach a maximum of US$1.48 million. (Refer to Liu Jiaolian's 2023.10.15 article "Ark Fund predicts that BTC may reach a maximum of 1.48 million U.S. dollars in 2030")

And Sister Mu is in the Bitcoin spot ETF We also work very hard in the publishing competition. Ark Fund was one of the first funds to apply for spot ETFs, which directly or indirectly contributed to the SEC's approval of spot ETFs on her application deadline, without delaying the deadline for big-name funds such as BlackRock. At present, Ark Fund's Bitcoin Spot ETF (NYSE: ARKB) has also successfully ranked among the "big four" Bitcoin spot ETFs in the US stock market, second only to BlackRock's IBIT, Fidelity's FBTC and Bitwise's BITB. (Refer to Liu Jiaolian's 2.11 article "U.S. Bitcoin ETF holdings cross the 200,000 BTC mark, becoming the most popular ETF in Wall Street history!")

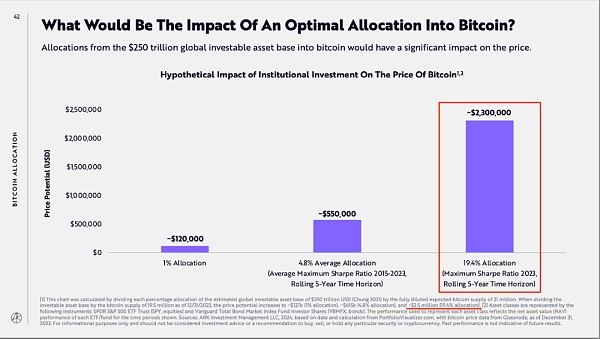

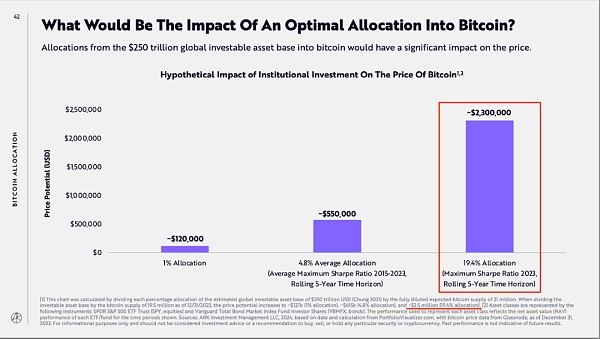

Now, Sister Mu Mu and the Ark Fund she leads have made another shocking statement! According to the latest predictions in Ark Fund’s latest “Big Ideas 2024” report, if U.S. institutions allocate Bitcoin in accordance with the guiding principle of maximizing the Sharpe rate in the five-year rolling time window through 2023, then 2.5 million people around the world will 19.4% of US$100 million in investable assets will be invested, which is expected to push Bitcoin to a position of US$2.3-2.5 million.

The Sharpe rate is a professional term in the financial field. It measures the expected return of an investment per unit of risk. Low risk, high return, high Sharpe ratio. On the contrary, when the risk is high and the return is low, the Sharpe ratio is low. Readers can review Liu Jiaolian's article No. 1.13 "A Robust Strategy for Allocating BTC to Outperform U.S. Stocks" to learn more.

Let's take a closer look. In the chart above, Ark Fund actually gives two numbers. One is $2.5 million and the other is $2.3 million. Why is there this difference? We need to take a good look at its algorithm.

The footnote said that if the 250 trillion U.S. dollars of investable assets are multiplied by the ratio of 19.4%, and then divided by the final total number of Bitcoins of 210,000 , it can be calculated that the final value of each Bitcoin is approximately US$230,952,380, or approximately US$2.3 million.

If divided by the approximately 19.5 million Bitcoins produced by the end of 2023, the calculated result will be 248,717,948 US dollars, or approximately 2.5 million US dollars. .

Of course, the more "modest" thing about Mujie's team this time is that they did not give an estimate of the time. Unlike last October, when both the price of $1.48 million and the time of 2030 were given, it is difficult to ensure that the prediction is correct. Readers can review the "Uncertainty Principle in Trading Markets" proposed by Liu Jiaolian (2021.3.20 article).

Therefore, don’t look at the 2.3-2.5 million they predicted this time, which is nearly double the 1.48 million last time. It seems even more outrageous, but on the contrary There is a greater probability that the prediction will come true. Because this time the time point is not given at the same time as the price, it is more consistent with the uncertainty principle. As long as you give it long enough and enough opportunities, one day there will be a probability of achieving your goal.

After all, this price is far from surpassing the $10 million estimate given by Hal Finney back in 2009 when Bitcoin was first born. Worth it.

JinseFinance

JinseFinance