Author: David C, Bankless; Compiler: Tao Zhu, Golden Finance

There are still 24 days until the Bitcoin halving, which is a key event and catalyst for Bitcoin in past cycles, often would make it a record high.

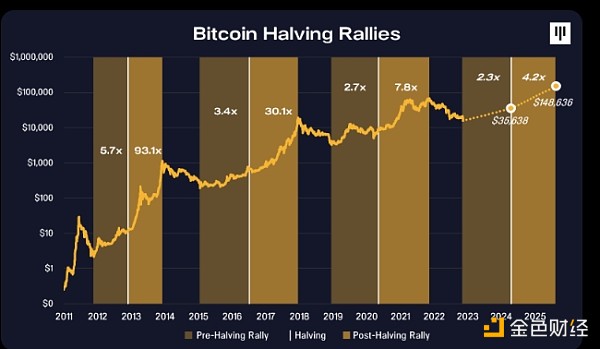

Historically, halving events will reduce the new supply of Bitcoin by half. As demand continues or grows, the new supply tightens, causing the price of Bitcoin to rise sharply and A record high.

Of course, we have reached some all-time highs, which has caused both excitement and unease in the market. If we reach these heights so early, will we also peak early?

Some say yes.

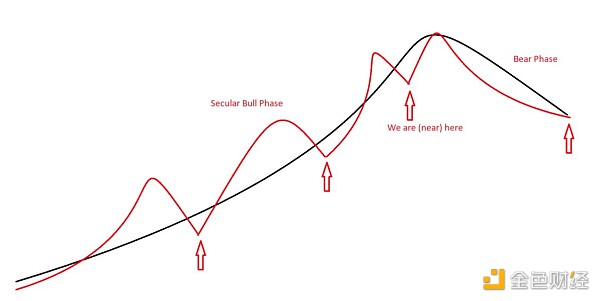

Bob Loukas is an experienced Bitcoin trader and one of the earliest supporters of Bitcoin’s 4-year cycle theory, He believes the current cycle is progressing faster than usual. His theory is that Bitcoin is in its final 4-year cycle, part of a broader 16-year pattern that new technologies follow.

This pattern is known as a "left-shift cycle," in which the top of the cycle occurs before the midpoint and will usher in an extended bear market. Debate over this theory has gained traction on Twitter over the past few months.

Cyclic Behavior of BTC

Historically, Bitcoin’s market cycle It exhibits a rhythm related to the halving event, bottoming out on average 1.3 years (477 days) before the halving event and peaking on average 1.3 years (480 days) after the halving event.

This pattern emphasizes the critical role of the halving in Bitcoin price dynamics, marking the beginning of a bull phase leading to new all-time highs.

Looking at how this relates to this cycle (Bitcoin’s fourth major cycle), two deviations stand out.

First, 11/9/22 is the bottom at $15,855, 2024 There are 587 days left before the halving on April 20, 2020, which is much earlier than the average of 477 days.

Then, for the first time ever, Bitcoin broke out to a new all-time high ahead of its halving in early March.

Similarly, the length from trough to peak is only an average, and even cyclical markets must deal with macro changes and black swan events, but despite this, The breakout of all-time highs before the halving suggests that the cycle may have broken its rhythmic pattern.

How is this cycle different?

In addition to the early ATH breakout, This cycle is different in 3 major ways.

Fewer corrections: Historically, cycles have experienced large corrections of 30-40% on the way to all-time highs, but this time, the decline has been smaller, with the correction so far not exceeding 25%. Due to this continued “up only” behavior, many believe these corrections indicate that BTC is accelerating this cycle.

Institutional Participation:The addition of Bitcoin ETFs has certainly impacted flows this cycle. While ETFs make it easier for more traditional retail and institutional investors to invest in Bitcoin, there are concerns that these products could drive up prices too quickly , and expectations of continued institutional inflows and wider acceptance may push the market to peak early.

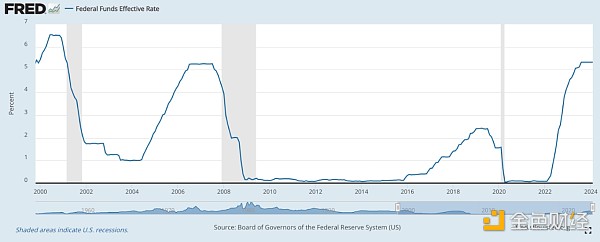

Macro conditions: With interest rates at their highest levels in 23 years and many fearing a recession is coming, There is no doubt that we are in a unique macro environment. If the global economy deteriorates, people tend to liquidate risky assets. It’s worth noting that Bitcoin has never experienced a true global recession.

Still a 24/7 asset. While the United States, and especially its ETFs, do account for a significant amount of cryptocurrency trading, Bitcoin remains a globally accessible asset that can be traded 24/7. This availability means that a lot of money still comes from other parts of the world. Global market participants who have become accustomed to and anticipate the rhythm of a four-year cycle may overcome the challenges observed from U.S.ETFs Trends and flows.

Still a store of value: Bitcoin’s story as a store of value is greater than ever More eye-catching. For example, Japan recently raised interest rates for the first time since 2007 due to record inflation levels, but in the same week, the government announced that they were considering incorporating Bitcoin into their pension fund – one of the largest in the world. Events like this signalthat Bitcoin is being seriously considered as a store of value and indicate that more investors continue to favor long-term holding There is Bitcoin.

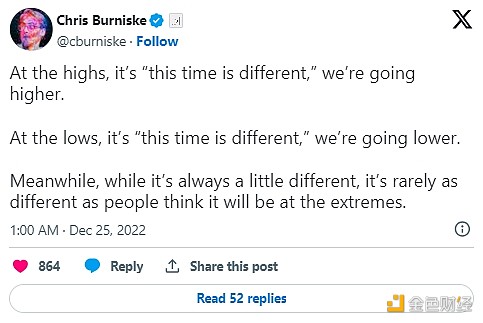

Every cycle is different (or so they say): People say, every time , this time it’s all different. In 2021, it was NFTs and Tesla bidding for BTC that prompted this; now, it’s ETFs and the left-shifting cycle. Buthuman psychology remains the same.

Despite the new dynamics, the core of Bitcoin remains: it Always present and viewed globally as a store of wealth, the novelty of each cycle evokes a familiar response, keeping its fundamental role intact.

What should you do now?

Nothing right now, unless you haven’t outlined a sales strategy yet, then create one ASAP!

With the halving As we approach, people are keeping a close eye on the price, which is expected to continue rising until the halving occurs. But despite expectations, there are still those who believe the halving is a “sell the news” moment. Bitcoin's behavior after the halving is also unpredictable; sometimes, its price drops after a few months, and other times, it keeps climbing. Still, it always ends up higher.

Therefore, it is particularly important to develop a clear strategy. Being prepared allows you to respond to market changes with confidence, whether the halving pushes up prices or causes a sell-off. We’ve written about some strategies you might consider.

Overall, ensures regular profits.

Research and analysis conducted by Pantera Capital, the first Bitcoin fund, shows , $140,000-150,000 may be the top of this cycle. Whether you agree or not, make sure you have a goal in mind.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Edmund

Edmund JinseFinance

JinseFinance Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph