Source: Chainalysis; Compiled by: Bai Shui, Golden Finance

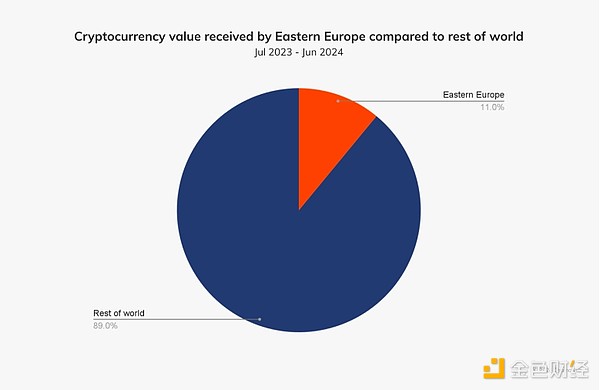

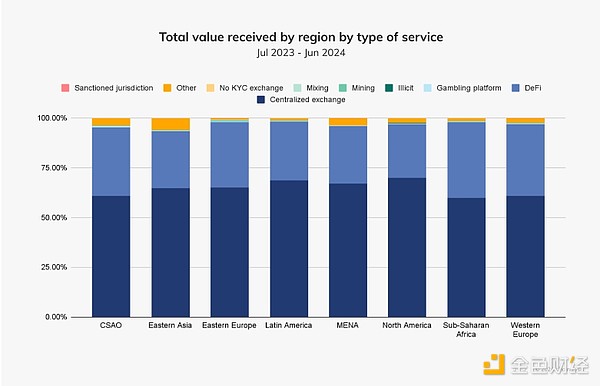

As the fourth largest cryptocurrency market, Eastern Europe received 499.14 billion between July 2023 and June 2024 The on-chain value of the US dollar accounts for 11% of the total global cryptocurrency share. Centralized exchanges (CEX) received the highest volume of cryptocurrencies in the region, reaching nearly $324 billion, while DeFi activity has grown significantly over the past year, receiving $165.46 billion in cryptocurrencies, accounting for inflows into the region one third of .

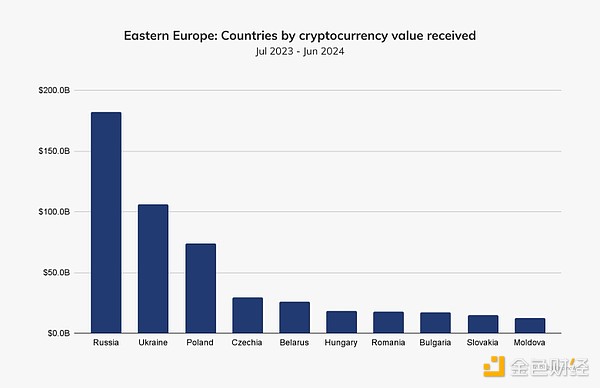

In this year’s Global Cryptocurrency Adoption Index, regional leaders Ukraine and Russia ranked sixth and seventh respectively, with Russia rising six spots from last year’s ranking. The boom in the two countries’ cryptocurrency markets is notable given the ongoing war and the tightening international sanctions regime against Russia, which leads Eastern Europe with $182.44 billion in cryptocurrency inflows, as shown below. Ukraine followed closely behind, receiving $106.1 billion in cryptocurrencies.

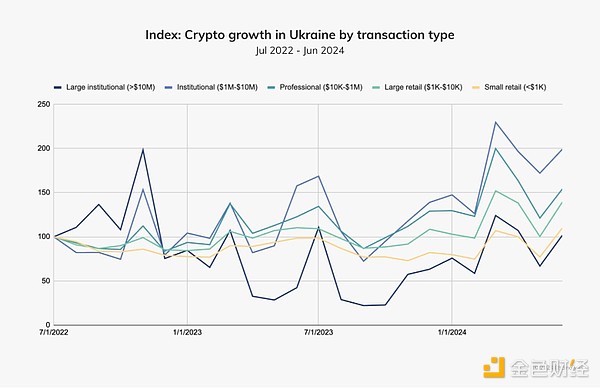

In Ukraine, institutions And professional shifts drive a large portion of the cryptocurrency market’s growth, a noteworthy development considering the country’s changing regulatory landscape.

In order to understand this For a regional perspective on the trend, we interviewed WhiteBIT, a cryptocurrency exchange originating from Ukraine and currently headquartered in Lithuania with a total of 8 offices around the world. Despite the war, WhiteBIT, like other CEXs, maintains a strong presence in the region, although some of them may have moved operations to other Eastern European countries due to security concerns.

“Institutional and professional cryptocurrency transfers have surged in Ukraine as many seek financial stability amid the ongoing war and cryptocurrencies are seen as a safer option,” the organization said. “This trend Amid global factors such as market volatility, inflation and war-related sanctions, as well as growing institutional interest in Bitcoin ETFs from the likes of BlackRock ”

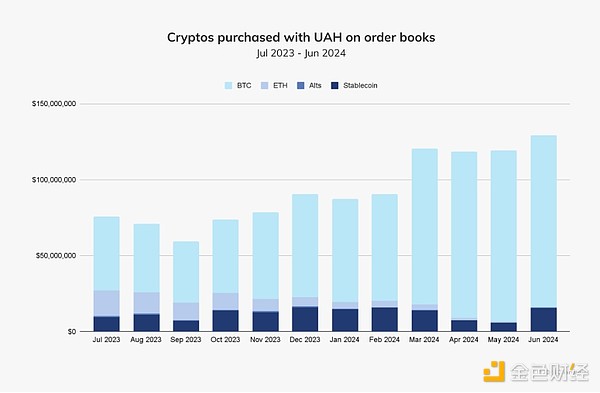

Bitcoin buying using Ukrainian hryvnia grows

A review of order book data (a list of buy and sell orders for an asset or security) shows that using Ukrainian hryvnia Bitcoin (BTC) purchases by Bitcoin (UAH) have increased over the past year, totaling $882.64 million.

Before this, Ukrainian hryvnia inflation peaked at 26.6% in December 2022 and declined steadily in the first quarter of 2023. Since consumer purchasing behavior often lags behind economic trends, Ukrainians may have been pursuing Bitcoin as an alternative store of value for the Ukrainian hryvnia.

WhiteBIT said: “In times of economic uncertainty, Bitcoin is viewed as a safer long-term investment compared to more volatile national currencies.” “Bitcoin’s liquidity and security Making it more attractive to Ukrainian institutional and individual investors seeking stability and long-term value preservation amid ongoing war and economic instability ”

Russian homegrown services are increasingly popular<. /h2>

Russia continues to receive large amounts of cryptocurrency from domestic and foreign sources. Last year, we reported growth in Russian local services, a trend that has remained stable this year. The Russian Local Services Growth Index (below) looks at the average share of web traffic for Russian services over the past two years (defined as a share greater than 50%). While traffic to CEX sites has remained relatively flat, traffic to Russian-language KYC-free trading sites has increased, peaking in the middle of last year and currently remains stable. This may be due in part to widespread sanctions on major Russian financial institutions, prompting wider use of these types of services by Russian nationals, who can move fiat to cryptocurrencies in and out of sanctioned Russian banks.

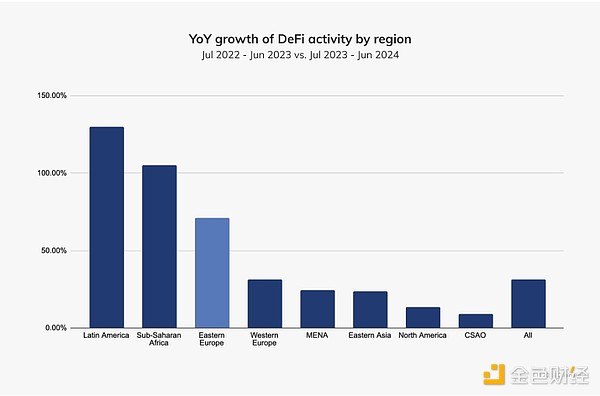

Think of reality Talk, let’s discuss a potentially positive growth indicator in Eastern Europe: the massive increase in DeFi activity.

DeFi activity in Eastern Europe increased by nearly 40% year-on-year

Last year, DeFi activity accounted for 10% of all cryptocurrencies received in Eastern Europe More than 33% of the total. In terms of global DeFi year-on-year growth, Eastern Europe ranks third globally, behind Latin America and sub-Saharan Africa.

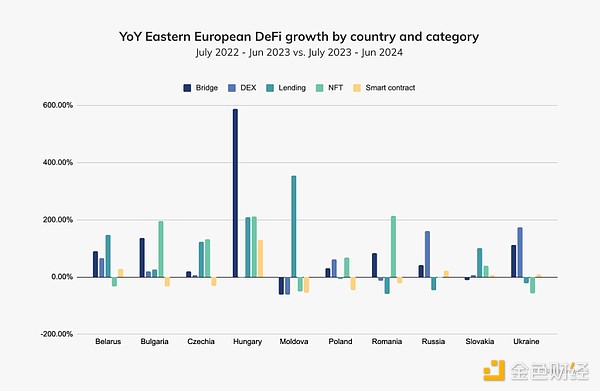

In Eastern Europe, go Centralized exchanges (DEXs) have seen the fastest growth in cryptocurrency inflows, especially in Ukraine, Russia, Poland and Belarus. Across the region, DEXs captured $148.68 billion in cryptocurrencies. Cryptocurrency sent to Ukrainian and Russian DEXs increased by 160.23% and 173.88% respectively, with Ukrainian DEXs receiving $34.9 billion and Russian DEXs receiving $58.4 billion. Several countries including Moldova, Hungary, and the Czech Republic also saw growth in DeFi lending services, capturing $11.29 billion in cryptocurrencies.

Although Hungary and Moldova Countries such as DeFi have seen explosive growth in bridges and lending, but given their relatively small markets, cryptocurrency inflows into these categories represent only a small portion of total DeFi volume in the region. Hungary, for example, saw cryptocurrencies sent via the bridge grow by nearly 600% to $151 million. While this figure is not insignificant, comparing Hungary’s bridging inflows to Ukraine’s $897 million puts this figure into a regional context. NFT growth also surged in some countries, but only to $6.9 million.

Token smart contracts (i.e. utilizing ERC-20 tokens as well as popular stablecoins such as USDT and USDC) are not included in the chart above, as all Eastern European countries have experienced significant The decline reflects a regional decline in the number of stablecoins. While stablecoins continue to grow in most other regions, WhiteBIT believes regulatory uncertainty and geopolitical tensions could lead to Eastern Europe abandoning stablecoins.

Regarding the decline in stablecoin usage in Ukraine, Anna Tutova, CEO of crypto news media group and PR consultancy Coinstelegram, said. “Many people in Ukraine buy cryptocurrencies for investment purposes, so this may be the reason for the decrease in the use of stablecoins. At the same time, many people in Ukraine use stablecoins purely for P2P transactions, as currency, as a payment method and as a means of cross-border transfers. Simple tools that they may not use for investing at all, stablecoins are often used as a store of value in countries with volatile currencies, or as a means of financial inclusion for the unbanked, as in Ukraine and other Eastern Europe. There is no need for the country, as most of the population has bank accounts and the local currency is more or less stable. Of course, the value of the Ukrainian hryvnia has depreciated significantly due to the war and over the years, but people tend to save in hryvnia. Convert to U.S. dollars. There are restrictions on the purchase of foreign currency in Ukraine until December 2023. ”

Both institutional use and grassroots cryptocurrency adoption have spread in Ukraine and Russia

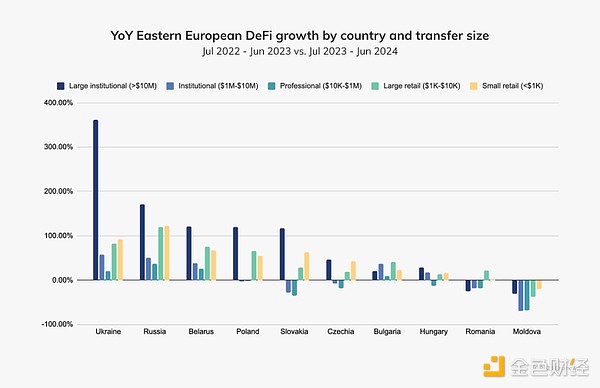

The scale of DeFi transactions over the past year reveals two main trends, especially among regional leading countries such as Ukraine and Russia. Ukraine saw a 361.49% increase in large institutional trades (i.e. transactions over $10 million), driving the growth of DeFi in the country. Likewise, Russia, Belarus, Poland, and Slovakia have the fastest growth in DeFi and large institutional transfers.

On the contrary, Ukraine's Large-value retail transactions (between US$1,000-10,000) and small-value retail transactions (under US$1,000) grew significantly, with increases of 82.29% and 91.99% respectively. Small retail transactions often indicate grassroots adoption, and given the region’s geopolitical instability and Ukraine’s recent recovery from inflation, these small transactions may indicate investors using cryptocurrencies to enhance their daily purchasing power.

What is happening with DeFi raises another consideration: While increased DeFi activity generally indicates that the cryptocurrency market is maturing, investors may also turn to DeFi because of the Greater convenience, speed and control over your assets. When cryptocurrency users face regulatory uncertainty, they are likely to choose the path of least resistance.

The future of cryptocurrencies in Eastern Europe

Last summer, the European Union began to launch the Market Regulation of Cryptoassets (MiCA). And its so-called stable currency system will begin to apply on June 30, 2024. On December 30, 2024, MiCA will fully apply to all crypto-asset service providers operating within the EU. There are indications that Ukraine is working towards adopting MiCA standards, given its status as a candidate for EU membership.

Oleksandr Bornyakov, Deputy Minister of Digital Transformation of the IT Industry of Ukraine, said: “The adoption of blockchain technology and the inclusion of crypto-assets in the regulatory framework could be an important step for Ukraine to support its economy, especially during the ongoing war with Russia. "A regulated crypto economy can generate tax revenue for the government, attract and retain startup talent, and make the country a competitive player in the global digital economy. Well-designed crypto legislation will help transform the crypto industry." Moving out of the so-called 'grey zone' and into a legal framework will enhance legitimacy and trust in this emerging market."

In response to Western sanctions and concerns over trade difficulties with countries such as China, the Russian government has After a year-long ban on cryptocurrencies, legislation was passed in September to legalize cryptocurrency mining and allow the use of cryptocurrencies for international payments. Russian central bank officials and Russian lawmakers have made clear their strong desire to reduce reliance on the U.S. dollar to lessen the impact of sanctions imposed over the invasion of Ukraine.

This is what WhiteBIT has to say about the future of cryptocurrencies in Eastern Europe. “Given the rapid development of blockchain technology and the increasing focus on regulatory frameworks, we believe the crypto industry has significant growth potential. Eastern Europe, as part of the global market, is emerging as a key region for blockchain adoption. It is a region rich with opportunities Times, acceptance of new regulations and technological advancements can be a catalyst for the development of digital assets across the region.”

A Ukrainian regulator shared the same optimism. “Looking at the promising field of digital assets in Eastern Europe, we believe Ukraine has the potential to become a key player, given the high adoption and interest in cryptocurrencies,” said Yurii Boiko, member of the State Securities and Stocks Commission of Ukraine and Markets Commission. “We have a population of millions with high levels of IT literacy, expanding national digitization, a strong technology ecosystem and a drive for innovation. Combined with a favorable regulatory environment that we are actively working to establish, this will make Ukraine a leading player in the Eastern European region for digital asset development and future enablers of implementation.”

We will continue to monitor trends to see how MiCA and other regulatory efforts impact cryptocurrency adoption in Eastern Europe in the coming year.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Huang Bo

Huang Bo CryptoSlate

CryptoSlate Finbold

Finbold Cointelegraph

Cointelegraph