Written by: 0xWeilan, Source: EMC Labs

The information, opinions and judgments on markets, projects, currencies, etc. mentioned in this report are for reference only and do not constitute any investment advice.

The crypto asset market after March 2024 seems to be passively becoming a second-rate performance with the theme of "waiting". All the actors, creators and producers seem to have forgotten the plot, the plot and the original theme, and only stretched their necks waiting for a certain "audience" to enter, and whether there will be a hurricane tonight.

From mid-March to the end of August, more than five months have passed, and the price of BTC has fluctuated repeatedly in the "new high consolidation zone". During this period, the global market has experienced repeated and downward inflation, ambiguous and clear expectations of US dollar interest rate cuts, unpredictable speculations on whether the economy will have a soft landing or a hard landing, and violent market fluctuations caused by trend changes that push different investors to adjust their positions.

Against this backdrop, some BTC investors in the crypto market sold off their first big positions to lock in profits and drain liquidity, mixed with speculative short selling, panic selling, and position adjustments between Altcoin and BTC caused by changes in risk appetite due to market sentiment.

This is the essence of the market movement we observed during this period.

After 5 and a half months of turbulence, the crypto market has entered a low ebb. Spot liquidity has been greatly reduced, leverage has been cleared, the rebound has been weak, and the rebound price has gradually fallen. Investors are sluggish, and pessimism and negativity are shrouding the crypto market.

This is a result of market movement and an internal resistance in the next stage. But in our view, the greater resistance lies outside the market - the uncertainty of macro-finance, the hidden worries of a hard landing of the US economy, and the unclear trend of the US equity market.

The crypto market has entered the end of clearing, and the market value and long-short hand distribution have entered a state of accumulation, ready for upward movement. However, the funds in the market are relatively weak, and there is no confidence and ability to make independent decisions.

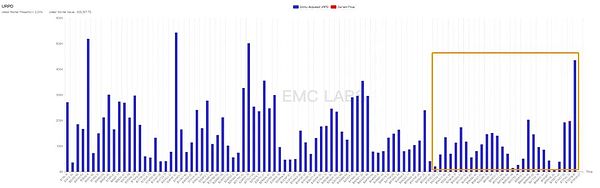

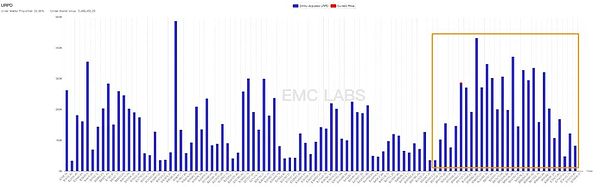

URPD: 2.91 million + BTC re-pricing

The market has been volatile for more than 8 months. When we look at the chain, we can face the orderly results of chaotic movement.

BitNetwork URPD (3.13)

BitNetwork URPD (3.13)

The URPD indicator is used to describe the statistical analysis of the price of all unspent BTC, which can effectively provide insight into the final result of chip allocation. The above picture shows the BTC distribution structure when Bitcoin hit a record high on March 13. At this time, 3.086 million chips were accumulated in the "new high consolidation area" (53,000~74,000 US dollars). As of the closing price on August 31, the number of chips distributed in this range reached 6.002 million, which means that at least 2.916 million+ BTC have been bet in this range in the past five months.

BTC URPD (8.31)

In terms of time, it took more than five months for BTC to break through in mid-October last year and reach its historical high on March 13. Now, it has been more than five months in the "new high consolidation zone" and "sideways" consolidation, with the highest price of $72,777 and the lowest price of $49,050 during this period, and the band oscillation has occurred more than seven times. This shock resulted in the exchange of more than 2.916 million chips (the real data is much higher than this, and the exchange data of centralized exchanges is not fully reflected on the chain), which greatly depleted the liquidity of the market.

BTC realized market value

Through the "realized market value" compiled by procurement cost, we can observe that after the market entered the new high consolidation zone in March, although the price failed to achieve further breakthrough, the realized market value is still growing, which means that the large-scale cheap chips have been repriced during this period. Under certain conditions, the re-priced BTC can be transformed into support or pressure.

Therefore, we maintain a neutral attitude towards the distribution of URPD. There are indeed enough chips to achieve exchange, and enough funds are optimistic about the future market at this price, but the nature of these funds is unknown. Whether it will provide support or pressure to the market in the future remains to be observed.

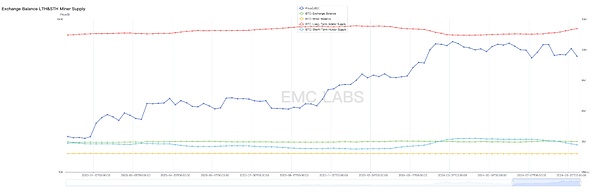

Long and short hands: big sell-offs and re-cooling

We regard the market cycle as a large turnover of long-term and short-term investors in the time dimension, during which they exchange between BTC and USD.

Statistics of long and short positions (weekly)

BTC started the market in mid-October. The large-scale reduction of long hands began in December, and the climax in February and March pushed the market to a new high during this period and then started to adjust, gradually carving out a "new high consolidation zone".

Since May, the reduction of long hands has been greatly reduced, and this group has restarted to increase holdings. In the past seven or eight months, the increase in holdings has accelerated significantly. From the lowest point to August 31, this group has increased its holdings by 630,000 BTC. The reduction of holdings mainly comes from short-term and miners' selling.

In our June report, we pointed out that there will be two big sell-offs in each bull market, and the second big sell-off will completely drain the market funds and then destroy the bull market. In the past few months, only the first wave of sell-offs has occurred. This wave of sell-offs has lasted for more than 5 months and is nearing its end. The distribution results on the chain can clearly see this.

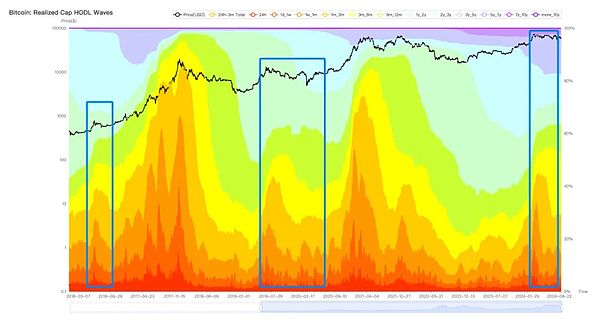

BTC HODL Waves

HODL Waves shows that the number of new coins in March has decreased rapidly, which means that speculative activities have dropped significantly, and the new coins from March to June are also accelerating downward (also an important component of the chips in the new high consolidation area). Most of these BTC holders entered the market after the ETF was approved, and should be "single-cycle long hands". This means that most of the BTC they hold will be converted into long positions, as evidenced by the surge of 470,000 long positions in August. In the foreseeable future, long positions will continue to grow rapidly.

The cooling of the BTC position structure is the result of BTC returning from short to long positions during the "new high adjustment period". This shift will greatly reduce the liquidity of the market. The decline in liquidity will often push the BTC price further down when funds are scarce, and push the price up when funds are abundant.

Therefore, we can judge that after more than five months of fluctuations, the market has been fully prepared, and the price trend is mainly determined by the direction of capital flow (rather than internal chip conversion).

Fund flow: ETF channel funds that have been shut down

In the November 2023 report, we proposed that the stablecoin channel fund flow turned positive in mid-October, which was the first time since February 2022, representing the arrival of a new stage. Since then, BTC has started a round of sharp rise.

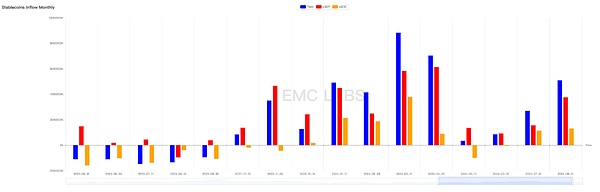

Statistics of inflow and outflow of major Stablecoins (monthly)

Statistics of inflow and outflow of major Stablecoins (monthly)

In the past five months of adjustment, May and June were the most scarce time for market funds, with only $1.201 billion inflow recorded in these two months. This pessimistic situation is being reversed, with inflows in July and August reaching 2.696 billion and 5.09 billion respectively. The entry of these funds shows their recognition of the price in the new high consolidation range and their medium- and long-term optimism about the second half of the bull market.

After the approval of 11 BTC ETFs in the United States in January this year, the funds in this channel began to become an important independent force. In previous reports, we have repeatedly pointed out that the funds in this channel have independent will, and because of their scale and action power, they will become an important force in pricing BTC. In the panic selling of the German government in July, BTC ETF channel funds acted decisively and picked up rich and cheap chips.

However, as the US dollar rate hike in August became more and more confirmed, the Japanese yen unexpectedly raised interest rates, and arbitrage traders fiercely closed their positions, causing violent fluctuations in global stock markets, which affected the BTC ETF, which is regarded as a high-risk asset. The continuous selling from ETF holders at the beginning of the month caused BTC to fall to $49,000, a new low in several months, and also broke through the lower edge of the "new high consolidation zone". Subsequently, the ETF channel funds gradually returned (stable currency bottom-fishing funds also poured in later), and the BTC price was pulled back to $64,000. By the end of the month, the ETF channel funds returned to outflow, and the BTC price also fell below $60,000 again.

Statistics of overall capital inflows and outflows of 11 BTC ETF Funds in August (daily)

Statistics of overall capital inflows and outflows of 11 BTC ETF Funds in August (daily)

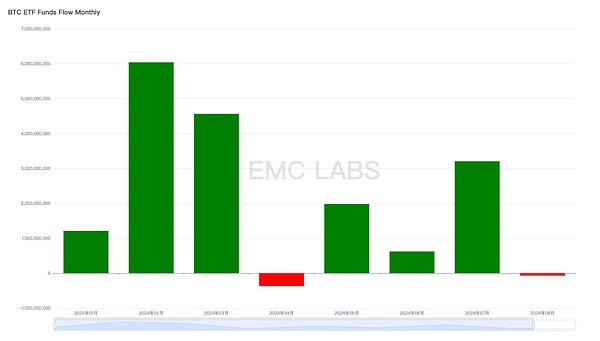

From a monthly perspective, the inflow of BTC ETF channel funds this month was -72.83 million US dollars, the second worst month in history, only better than April.

11 BTC ETF Fund overall capital inflow and outflow statistics (monthly)

11 BTC ETF Fund overall capital inflow and outflow statistics (monthly)

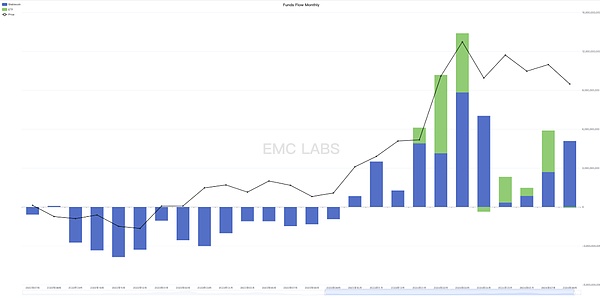

We will combine the two funds -

Total inflow and outflow of stablecoins and 11 BTC ETF channels (monthly)

Total inflow and outflow of stablecoins and 11 BTC ETF channels (monthly)

Although stablecoins have recorded increasing inflows for three consecutive months, the ETF channel recorded outflows this month, resulting in the overall inflow of funds in August to only US$5 billion, lower than the US$5.9 billion in July. EMC Labs believes that, with the distribution of chips becoming more stable, capital inflow is the fundamental reason why BTC was able to pull back to $65,000 in August after the big crash. However, the reduction in capital inflow has made this month's high of $65,050 far lower than $70,000 in July. The reduction in funds means that the inflow of funds from the ETF channel has dropped from 3.2 billion in July to 72.83 million US dollars this month.

The attitude of BTC ETF channel funds, which are closely connected with US stocks, has become the most critical factor in determining market trends.

September rate cut: soft landing vs hard landing

Unlike BTC's weak performance in August, although it also experienced violent fluctuations, the US stock market still showed amazing resilience during the same period. The Nasdaq recorded a monthly increase of 0.65%, while the Dow Jones Industrial Average hit a record high. During this period, there was a lot of discussion about whether to raise interest rates by 25 or 50 basis points in September, but the real focus of traders was actually on the core issue of "whether the US economy will have a soft landing or a hard landing".

According to the current trend of US stocks, EMC Labs believes that the market as a whole tends to believe that the US economy will achieve a soft landing, so it has not priced the US stock market downward under the expectation of a hard landing. Based on the assumption of a soft landing, some funds chose to withdraw from the "Big Seven" that had already risen sharply (most of them underperformed the Nasdaq this month), and entered other blue-chip stocks with smaller gains, pushing the Dow Jones Index to a record high.

Based on past experience, we tend to judge that investors in the US stock market regard BTC as a "Big Seven" asset - although it has a great future, it is currently overvalued, so there has been a large-scale sell-off, which is roughly synchronized with the sell-off of the "Big Seven". However, compared with mainstream funds, the "Big Seven" is much more attractive than BTC, so after the plunge, the rebound of the "Big Seven" is stronger than BTC.

Currently, CME FedWatch shows that the probability of a 25 basis point rate cut in September is 69%, and the probability of a 50 basis point rate cut is 31%.

EMC Labs believes that if the 25 basis point rate cut in September is finalized and there is no major economic and employment data indicating that the economy does not meet the characteristics of a "soft landing", the US stock market will run steadily. If the seven giants repair upward, then the BTC ETF will most likely resume positive inflows, pushing BTC upward and hitting the psychological barrier of $70,000 again or even challenging new highs. If there are major economic and employment data indicating that the economy does not meet the characteristics of a "soft landing", the US stock market will most likely be corrected downward, especially the seven giants, and the corresponding BTC ETF channel funds will most likely not be optimistic. If so, BTC may go down and challenge the lower edge of the "new high repair period" of $54,000 again.

This speculation is based on the assumption that there will be no trend changes in stablecoin channel funds in September. In addition, we are cautious about stablecoins. Although funds in this channel continue to accumulate, we tend to think that it is difficult for it to push BTC out of an independent market. The most optimistic prediction is that under the background of the upward revision of the seven giants, the funds of stablecoins and ETF channels are flowing in simultaneously to push BTC upward. If so, breaking through the previous high has a greater probability of success.

Conclusion

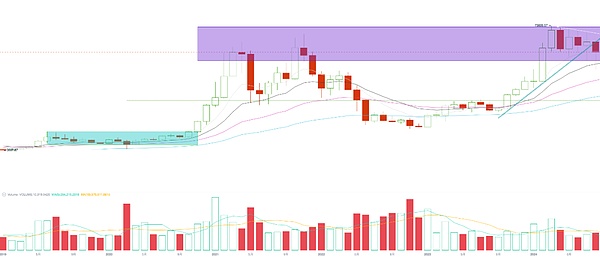

BTC broke through $54,000 in January this year, set a record high in March, and started to fluctuate and consolidate in the "new high consolidation zone" in April. It has been more than five months so far, catching up with the six consecutive months of increase since September last year. In terms of time, it is close to the turning point of the trend.

BTC monthly chart

This should also be the reason why the funds of the stablecoin channel are gradually gathering to reshape the buying power.

However, the real breakthrough still depends on the positive macro-financial and core economic data of the United States, and the subsequent re-influx of mainstream funds from the US stock market into the BTC ETF channel.

As the US dollar re-enters the interest rate cut cycle, September has become the most important month of the year, and the US stock and crypto markets will give preliminary answers this month.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coinlive

Coinlive  Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist