Recently, the news that the United States is going to approve an Ethereum spot ETF has caused a lot of buzz, and Ethereum has also surged by 20%.

In fact, as early as last month, Hong Kong took the lead in approving Ethereum's spot ETF, and at that time there was no ripples on the price of Ethereum at all

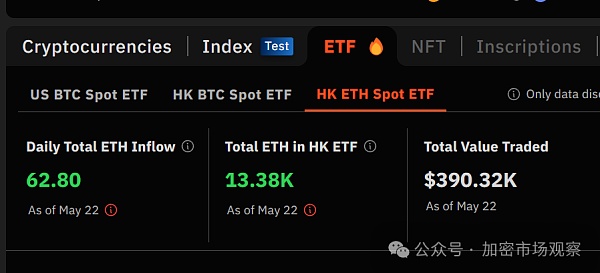

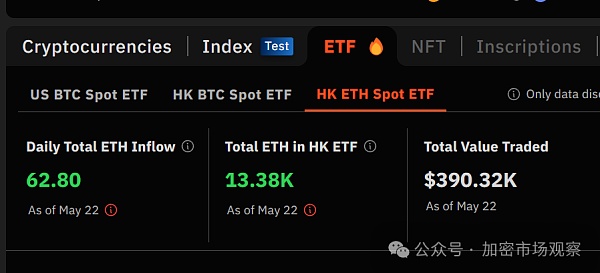

Against the backdrop of Ethereum's skyrocketing, the net inflow of Ethereum spot ETFs of three institutions in Hong Kong yesterday was only 62.8.

This performance is not even as good as one of my retail fans on Binance Square:

Hong Kong's Ethereum ETF did not perform well just yesterday, but has not performed well since its issuance:

Except for some inflows after the first issuance, it feels like the rest of the time was just about tossing the trading volume with the left and right hands.

Not only Ethereum ETF is like this, but also Bitcoin ETF:

Except for the net inflow of more than 3,000 bitcoins on the first day, the trading volume was almost doubled in the following days.

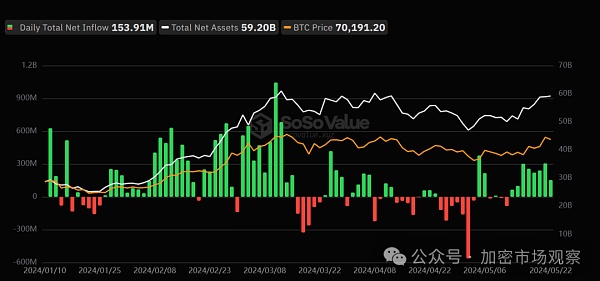

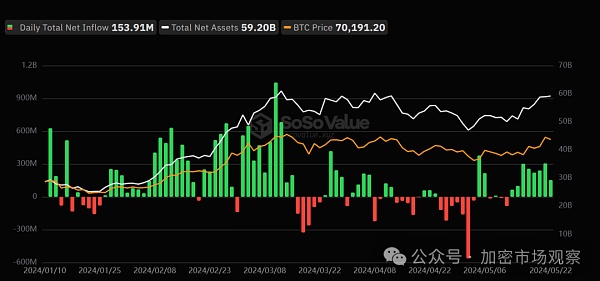

Let's compare the data of the US Bitcoin spot ETF:

The difference in trading volume of Bitcoin spot ETF between Hong Kong and the United States can be a thousand times!

You should know that the trading volume of Hong Kong stocks and US stocks is only 40 times different. . .

However, all mainland users, whether they have opened a Hong Kong stock account or not, or whether they have opened a North-South Link, cannot purchase crypto-related Hong Kong financial products.

It seems that, in addition to investors from mainland China, Hong Kong's compliance institutions may find it difficult to attract others at present.

The public fund companies supporting BTC/ETH spot ETFs in Hong Kong are:

Boshi Bitcoin ETF (03008.HK), Boshi Ethereum ETF (03009.HK), Harvest Bitcoin (03439.HK), Huaxia Bitcoin (03042.HK), Harvest Ethereum (03179.HK), Huaxia Ethereum (03046.HK).

These are all well-known large funds, and it cannot be said that they are not strong.

Not only the trading volume of these spot ETFs is not good, but the exchanges that have previously obtained Hong Kong compliance licenses have rarely played any supporting role in the liquidity of cryptocurrencies in this round of market.

Hong Kong's crypto-friendly policies currently look awkward and a bit like playing house for self-entertainment.

JinseFinance

JinseFinance