Author: Terry, Plain Language Blockchain

Memecoin and VC Token, which one would you choose?

Before 2022, I'm afraid everyone would choose the star projects with high visibility and high valuations supported by well-known VC institutions without hesitation. Now, in just two years, the wind direction has changed, especially the small trend set off by Ordinals in 2023, which quickly grew into a powerful anti-VC wave in the crypto world.

Even since the first half of this year, Memecoin has been leading the market performance comparison with VC Token, attracting a lot of attention and capital inflow in a short period of time.The general public’s call for fairness has gradually become a trend. So behind this, is it that the funds are voting with their feet, or is it a short-term illusion within the market?

01 VC Token’s “Ice and Fire”

The first half of 2024 is almost a series of intensive cashing periods for a series of former “king-level” star projects, from Wormhole to Polyhedra Network, from Starknet to LayerZero, and from Zksync to Blast, all of which are Airdrop projects that community users and wool parties have been looking forward to for a long time.

However, the price performance after the actual cashing out is not satisfactory, especially after the industrialization of Airdrop. While the massive community users/LuMao Studios help these star projects to obtain extremely beautiful paper data and thus push up the project valuation, the increasingly exaggerated FDV caused by their own VC financing also lays the groundwork for the risk of selling early liquidity.

For example, the recent issuance of new VC-type Tokens such as W (Wormhole), ZK, ZRO, and STRK are basically a mess - the FDV is extremely high and the trend is falling. Since its listing, it has ended with a negative line almost every day, and all users who entered the market have been deeply trapped.

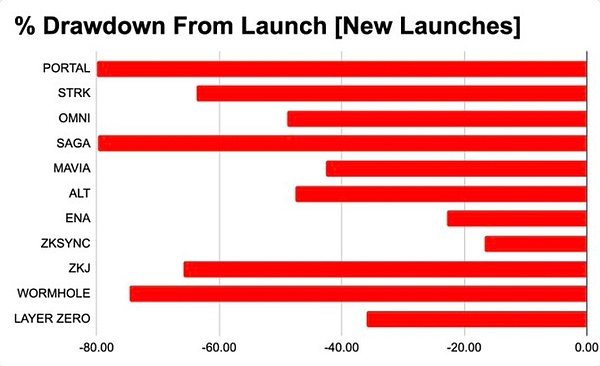

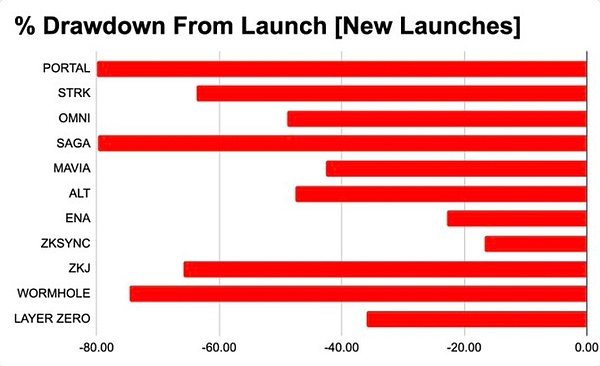

Based on the data statistics in late June (not counting the recent sharp drop), PORTAL and SAGA have fallen by about 80% compared to their opening prices, and W, ZKJ, STRK, OMNI, and ALT have also fallen by more than 50% compared to their opening prices.

Source: @terryroom2014 / X

Source: @terryroom2014 / X

From the data dimension, for ordinary users, the era of "buying and easily earning high returns" of this glamorous VC Token has come to an end.

At least the recent new tokens, if purchased in the secondary market, are almost more cost-effective than the later financing valuations, and there are even signs of an inverted valuation between the primary and secondary markets:

The latest data as of July 10:

ZRO has raised a total of US$3 billion in history, and its current market value is only US$3.8 billion;

W has raised a total of US$2.5 billion in history, and its current market value is US$2.9 billion;

ZK has raised a total of US$1.25 billion in history, and its current market value is US$3.1 billion;

ZKJ has raised a total of US$1 billion in history, and its current market value is US$1.2 billion.

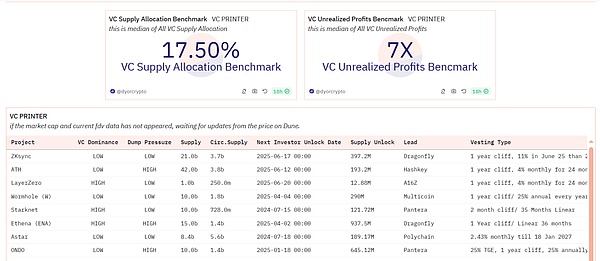

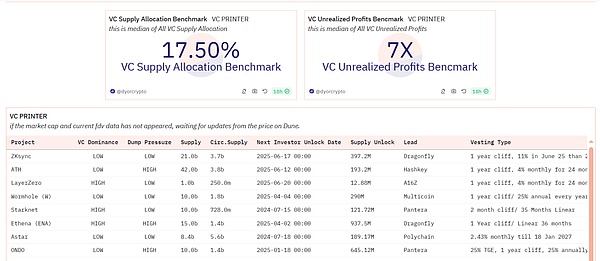

But what’s interesting is that Dune statistics show that even when the market continues to fall, the major VCs still have a floating profit of dozens or even hundreds of times the book value of their investments in these tokens, and the overall unrealized profit of VCs is still as high as 7 times.

Source: dune.com

Source: dune.com

DYOR co-founder hitesh.eth also counted the top 10 “VC Tokens” in terms of overall VC returns on the market, which are basically the main forces in the current market that have been falling, and the market’s confidence has been greatly hit.

But at the same time, although ENA, DYM, SAGA and other tokens have caused heavy losses to secondary market investors, VCs can still lock in more than 10 times of profits - the highest ENA return rate is about 100 times, and the lowest ALT is more than 10 times. The feelings of VCs and secondary market investors can be described as "ice and fire".

02 Memecoin "swallows" the market

Compared to the falling trend of the star VC Token on the online trading platform, the secondary market price performance of on-chain asset attributes such as Memecoin is far ahead, almost "swallowing" the entire market, becoming the current Web3 cultural symbol at this stage.

Whether it is the emerging Memecoin leaders such as PEPE and FLOKI, or GME and other new Memecoins on the public chain, there are constantly emerging wealth codes that are several times or even dozens of times more, which once made people dream back to the market environment during the DeFi Sunmmer in 2020.

Especially since April this year, the volatility of the new star VC Token that has been launched intensively has decreased, making it difficult for secondary market traders to profit from it. The market's FUD sentiment towards VC Token has become more serious, and Memecoin has shown its unique charm, relying on community consensus to attract a lot of attention and capital inflows in a short period of time.

In contrast, although VC Token has strong background support, its performance has not fully met investors' expectations in the rapid changes in the market.

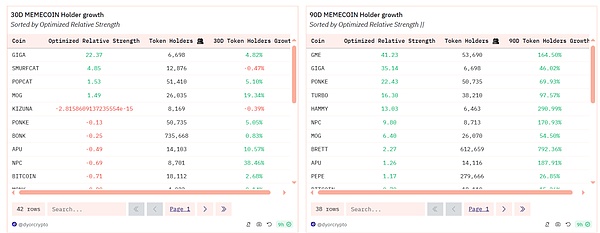

Source: dune.com

Source: dune.com

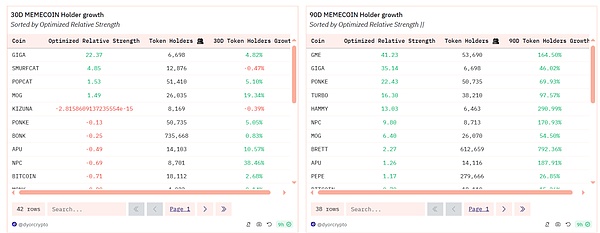

What’s more interesting is that Dune statistics also show that in this round of Meme super cycle, the number of actual on-chain holder addresses of the top 46 Memecoins has indeed been in a clear growth trend in the past 90 days:

Among the 46 Memecoins, except for 4 that are in a growth slump (of which FLOKI only has a slight decline), the number of on-chain holders of the remaining 42 Memecoins has generally achieved double-digit or even more than 100% growth. This data undoubtedly reflects that the market’s attention to and enthusiasm for participating in these Memecoins is indeed rising sharply.

And the relative number ratio of buyers/sellers in the past 30 days is basically above 1, which also indicates that investors are relatively optimistic about the future trend of Memecoin and are willing to invest more funds to obtain potential returns.

In short, unlike many previous crypto projects with large financing and VC-led narratives, which have high thresholds and are more oriented to crypto OGs and on-chain whales (rich elites), Meme gives more ordinary people outside of OGs and whales an opportunity, especially allowing the general public to participate fairly and share dividends.

Therefore, in contrast, the discussion and questioning about Memecoin and VC will inevitably become the mainstream of the community again. Meme will at least bring continuous incremental funds and attention with the help of user flow, while the new projects with valuations of billions of dollars in recent times are all old concept products with grand narratives or old gameplay, so it is natural that they are disliked by the community.

03 The community resistance behind the Meme wave

In fact, if we carefully examine the current market environment, we will find that in addition to short-term speculation, the general public's call for fairness represented by Meme has gradually become a trend, and funds are voting with their feet.

To put it bluntly, the rise of the Meme wave actually represents, to a certain extent, the correction of the traditional "financing-cash-out" model of the past two years by community users and the market:The previous star project relied on top VCs to gather, combined with high-end technical narratives to raise large amounts of financing at high valuations, and finally attracted the community to pile up a series of beautiful on-chain data through the so-called "Airdrop". This is basically the end of the game.

Especially since this year, long-awaited projects such as ZKsync and LayerZero have set off major Airdrop-related controversies such as "Witch Attack" and "Rat Warehouse" in the community, which basically means that the Web3 world is gradually entering the "post-Airdrop era" - when star project owners begin to regard Airdrop as an arrogant power of resource allocation, Airdrop is no longer a mutual fulfillment between community users and project owners.

For this reason, the rise of Memecoin is precisely because they are often not bound by the traditional primary and secondary market takeover rules. Although this also means that its risks are higher and price fluctuations are more drastic, it is at least one more choice for ordinary users.

If we analyze in depth the reasons behind the rise and fall of Memecoin and VC Token, in fact, the objective market conditions are almost obvious:

First, there is the selling pressure caused by high valuation and low circulation.After all, today's star projects almost all use high FDV and low actual circulation as the issuance rule, which forms a potential unstable factor. The selling cycle is extremely long, which brings huge pressure to the market;

Secondly, users are gradually becoming immune to technical narratives, especially from L2 to Restaking. After experiencing the rendering of technological innovation by many projects, especially stars, users have become more rational and prudent, and are no longer easily impressed by those technical narratives that seem unfathomable but lack substantive breakthroughs;

In addition, the high-frequency capital pumping effect cannot be ignored, similar to the large-scale IPO in the stock market Blood-drawing phenomenon. Recently, the community has also debated whether the intensive launch of star projects has led to a large amount of funds being withdrawn from the market, which has seriously affected the liquidity of the market. After all, the actual voting of funds will not deceive people. To a certain extent, the alliances and interests between VCs in the crypto world and Web3 industry have reached a stage where they obviously need to break through, and users' spontaneous pursuit of real money-making effects and hot spots is understandable. After all, in this market full of temptations and opportunities, users instinctively tend to those opportunities and hot trends that can bring tangible benefits. Once existing projects cannot meet this demand, they will express dissatisfaction and resistance in various ways to seek better investment returns and market environment. This also sounded the alarm for VCs and project parties who are accustomed to path dependence.

JinseFinance

JinseFinance