Source: MIIX Capital

Introduction:

The implied volatility of BTC short-term out-of-the-money put options is still higher than that of call options, indicating that the market's concerns about the recent price correction have not been eliminated, but the implied volatility of long-term options remains stable, showing that institutions are optimistic about the long-term prospects of BTC.

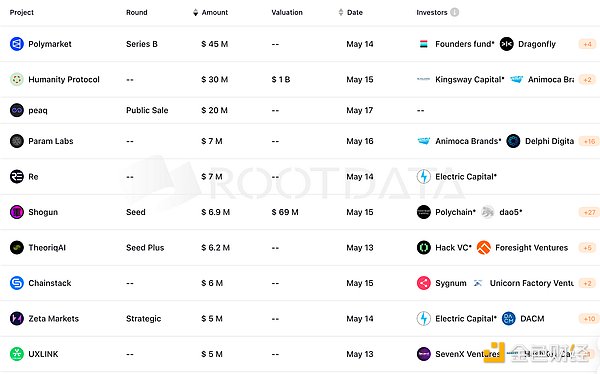

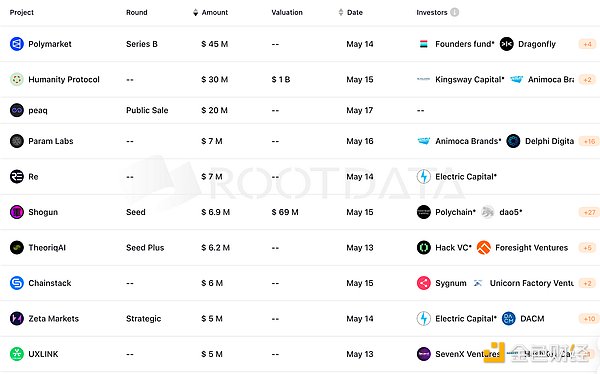

1. Investment and Financing Observation

Last week, there were 26 investment and financing events in the crypto market, a decrease of 36.58% from the previous month, with a total capital scale of over 170 million US dollars, with no change in the previous month's growth rate and basically the same scale:

DeFi announced 9 investment and financing events, among which the cryptocurrency trading platform Arbelos Markets completed a $28 million financing led by Dragonfly Capital;

GameFi track announced 7 investment and financing events, among which Web3 game developer Seeds Labs completed a $12 million seed round of financing, with Blizzard Fund and others participating;

The AI track announced 1 investment and financing, and ChainML, an AI platform supporting Web3, completed a $6.2 million seed round of extension financing, led by Hack VC;

The infrastructure and tool track announced 4 investment and financing, among which Humanity Protocol announced a new round of financing of $30 million with a valuation of $1 billion, led by Kingsway Capital;

The centralized finance field announced 1 financing, and Raven, a crypto trading company founded by former Wintermute employees, completed a $2.7 million seed round of financing, led by Hack VC;

Other Web3/crypto applications announced 4 financings, among which the crypto prediction market Polymarket has raised $70 million through two rounds of financing, the most recent round led by Founders Fund;

About Polymarket

Polymarket is a contract trading platform for a decentralized information market that allows users to trade on the world's most controversial topics (such as coronavirus, politics, current affairs, etc.). Currently, betting on the 2024 US presidential election has become the most popular contract.

About Humanity

Humanity Protocol is a DID-resistant blockchain network that uses palmprint recognition technology and zero-knowledge proof to ensure user privacy and security, and aims to provide an easily accessible and non-intrusive method for establishing human proof in Web3 applications.

About peaq

peaq is the DePIN network that powers the Internet of Things (EoT) on Polkadot. Peaq enables entrepreneurs and developers to build decentralized applications for vehicles, robots, and devices, while empowering users to manage and earn income when connected machines provide goods and services.

2. Industry data

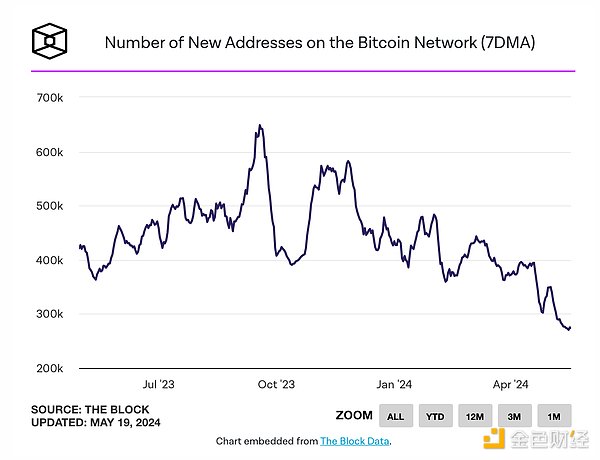

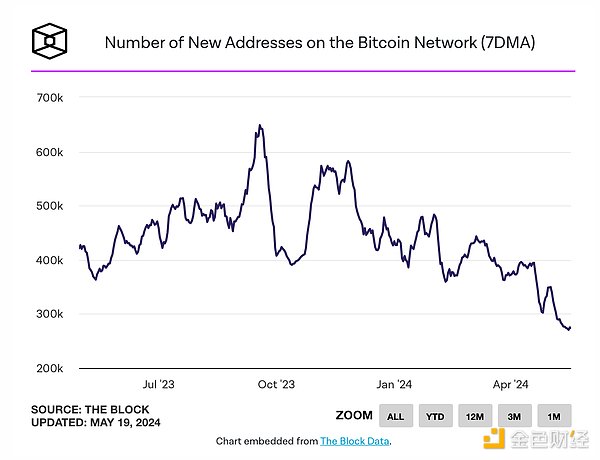

The number of new BTC wallets has dropped to the lowest level in 6 years

The block data: In the past week, the average daily number of new BTC wallets was 275,000, the lowest since 2018. Other related indicators have also declined, among which the miners' income measured by hash rate has fallen to a historical low, and the transaction fees on the network and the on-chain transaction volume indicators are also on a downward trend.

From the trend, the overall data shows a bottoming trend, and it is expected that the data recovery and rebound will begin to change and adjust with the market turn. In addition, despite the decline in on-chain indicators, new protocols on the BTC network are attracting record interest from venture capital firms, which has laid the foundation for the market recovery.

Six months ago, the average daily number of new wallets for BTC was 625,000, more than twice as much as it is now. At that time, the number of new addresses was close to the historical high due to the listing of BTC spot ETFs, the development of the BTC ecosystem and the superposition of halving events.

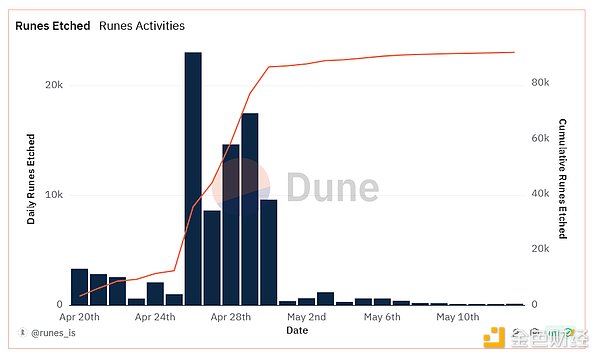

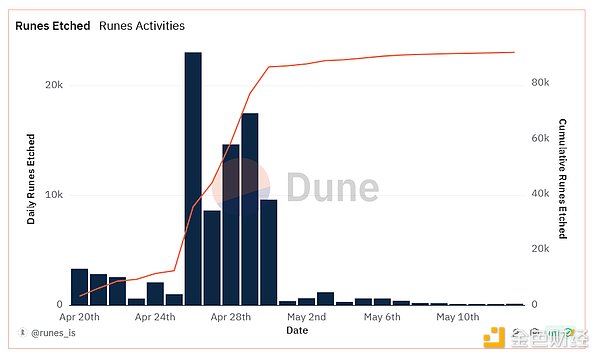

BTC runes are down 99% from the peak at the end of April

In the past week, the number of new runes etched on the BTC chain has dropped to less than 250 per day, down 99% from the peak data at the end of April, but rune transactions are still the most active part in May. These transactions mainly occur on markets such as Magic Eden, OKX, Ordinals Wallet and UniSat.

The decline in the number of rune etchings is consistent with the heat and activity of the entire market. The main reason is the impact of market conditions, but it also reflects that runes have not been able to run out of independent market heat like previous inscriptions. The subsequent trend still depends on the macro market and the activity of the BTC ecosystem.

According to the data dashboard created by RUNES in Dune: From April 26 to 30, an average of 14,700 new runes were etched every day, of which 23,061 runes were etched on April 26, setting a record high;

Since Runes was launched on April 20, BTC miners have received a total of US$4.5 million in transaction fees, about US$189 per day. To date, more than 91,200 runes have been engraved on the BTC chain;

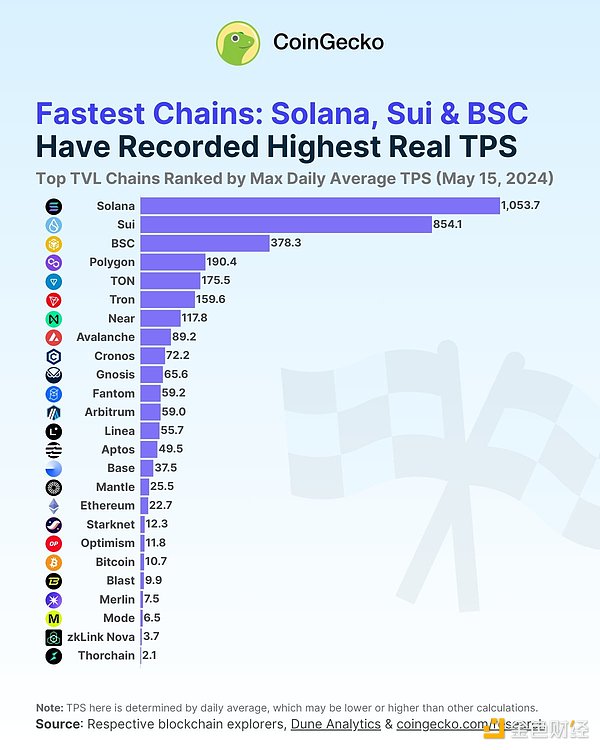

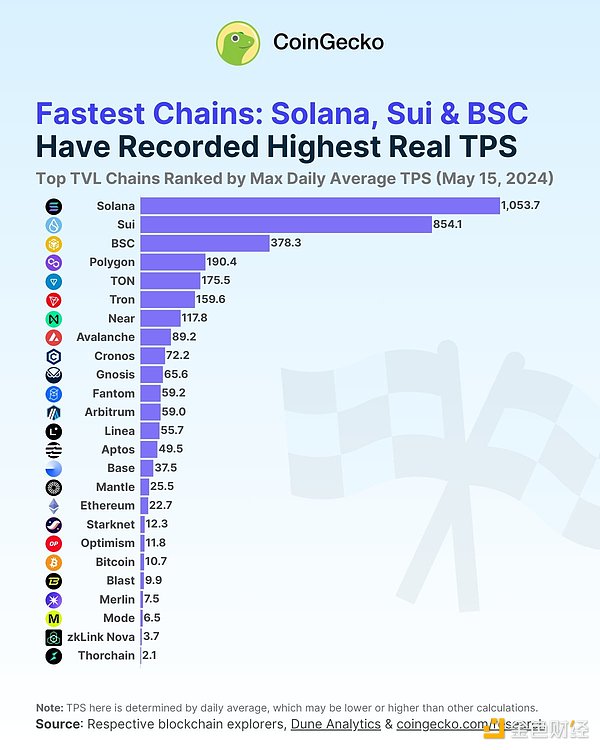

Solana has become the public chain with the highest TPS

CoinGecko data: Solana's on-chain TPS (transactions per second) reached a maximum of 1504 times, becoming the fastest large-scale blockchain, more than 5 times faster than Polygon and 46 times faster than ETH. Despite this, Solana has only achieved 1.6% of its claimed theoretical TPS (65,000 times/second). In addition, the second fastest blockchain is Sui, which reached a maximum TPS of 854 in July 2023.

Combined with the data comparison, the average TPS of non-EVM public chains is 284, while the average TPS of EVM and EVM-compatible public chains is 74, that is, non-EVM public chains are nearly 4 times faster than EVM public chains. However, in terms of stability and security, ETH-based public chains still have an advantage, and the TPS of ETH-based public chains has not become an important factor affecting or hindering its rapid development.

BSC and Polygon are the fastest EVM blockchains. BNB Smart Chain (BSC) has a maximum of 378 TPS, and Polygon has a maximum of 190 TPS, which is currently the fastest Ethereum expansion solution.

Sponsored Business Content

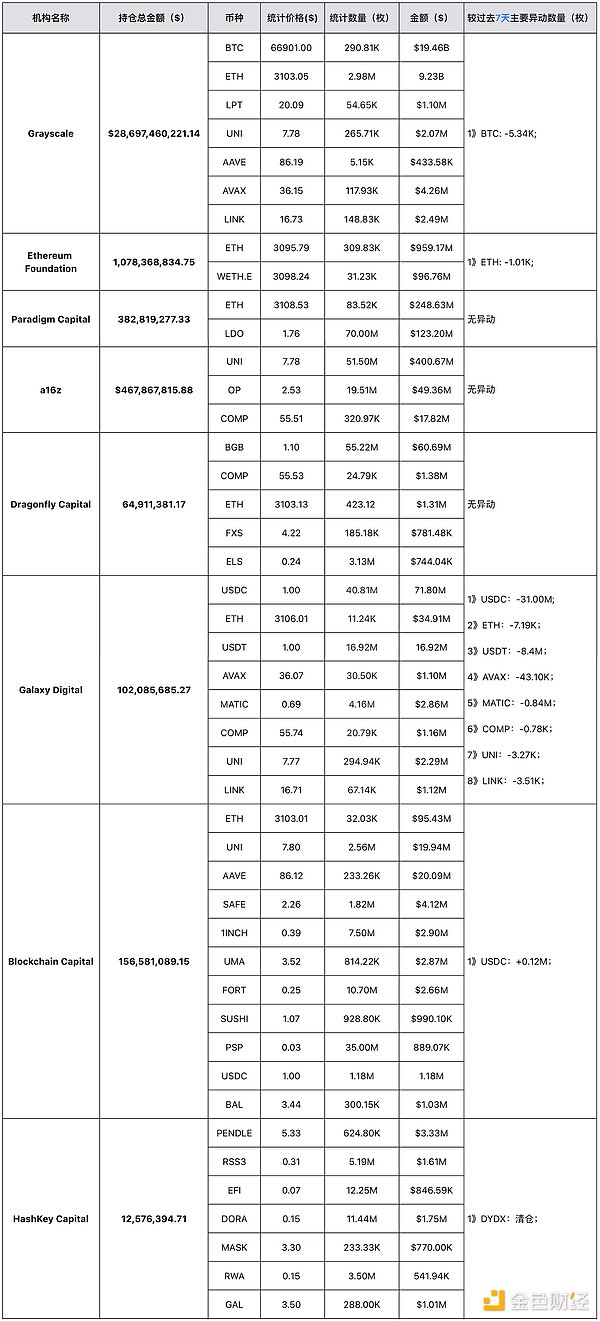

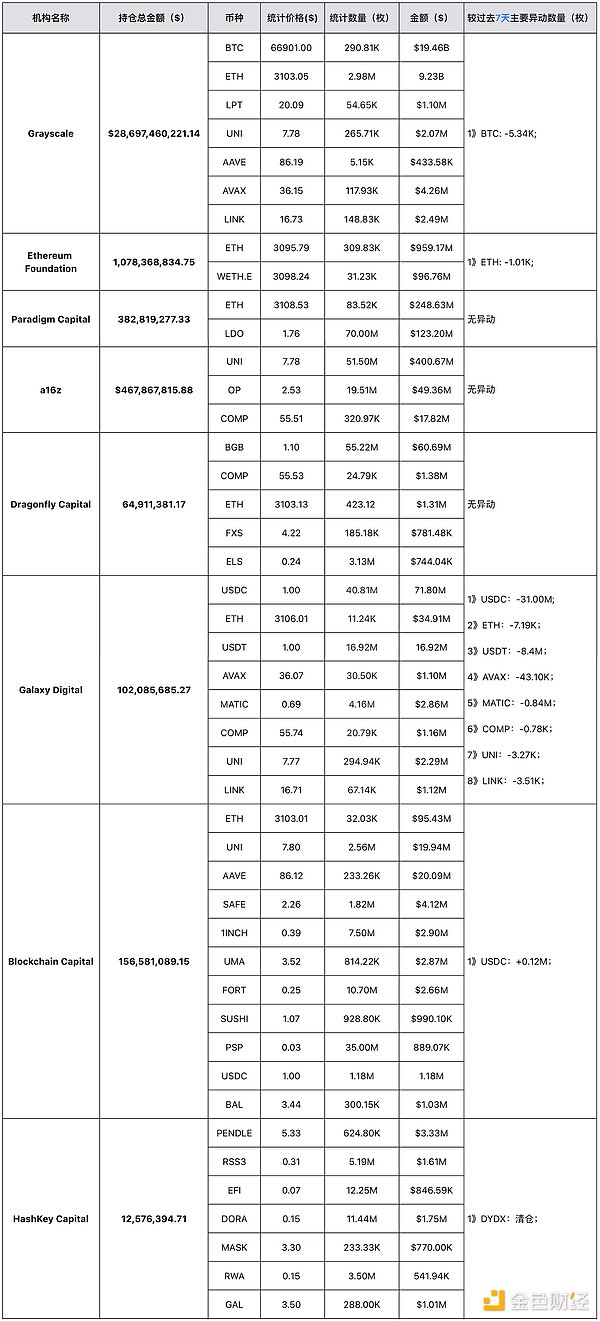

3. VC Holdings

Note: The above data comes from https://platform.arkhamintelligence.com/, statistical time: May 20, 2024 19:00 (UTC+8).

4. Focus this week

May 20

FOMC voting member and Atlanta Fed President Bostic was interviewed by Bloomberg TV;

Federal Reserve Board Member Barr spoke on bank supervision;

Federal Reserve Vice Chairman Jefferson spoke on the economic outlook and the real estate market;

PayPal's new policy, which took effect on May 20, will cancel the protection of buyers and sellers of NFTs;

BounceBit announced the asset withdrawal schedule, and BTCB, WBTC, FDUSD, and USDT that were not pledged in Premium are open for collection;

IoTeX and DMC jointly held a conference on the theme of "What are the development directions and trends of DePIN in China and the West under the expectation of interest rate cuts? ” online event;

May 22

FOMC voting members Bostic, Mester and Collins will participate in the panel discussion on "Central Banks in the Post-Pandemic Financial System";

Jupiter's LFG third round of voting will begin on May 22;

SEC and Terraform Labs and Do Kwon lawyers will conduct court debate on the fraud case compensation plan on May 22;

Bitcoin Pizza Day;

AVAX tokens will unlock 9.54 million at 8:00 on May 22, worth approximately US$340 million, accounting for 2.49% of the circulation;

Microsoft Build Developer Conference;

May 23

The number of initial jobless claims in the United States that week;

The Federal Reserve releases the minutes of the monetary policy meeting;

The SEC will decide whether to approve the spot Ethereum ETF application submitted by VanEck on May 23;

The decentralized GPU cloud infrastructure Aethir will officially launch the edge computing device Aethir Edge on May 23;

The Super Artificial Intelligence Alliance (ASI) is scheduled to be launched on May 24, and the merger of the three has been voted through proposals in various communities;

Euler (EUL) will unlock approximately 4.66 million tokens at 00:17, worth approximately US$370,000, accounting for 0.34% of the current circulation;

ETH Berlin will be held at the CIC Innovation Park in Berlin, Germany from May 24 to 26, 2024;

May 25

Animoca Brands Japan launches "Fairy Tail" digital collectible cards, which will be launched on Quidd at 05:00 on May 25;

This week, there are several important events and conferences, such as Crypto Expo Dubai 2024, Microsoft Build Developer Conference and ETH Berlin, which will bring new technological innovations and cooperation opportunities to the industry. In addition, tokens worth about $1.3 billion will be unlocked one after another, including $340 million worth of AVAX and $812 million worth of PYTH, which will inevitably bring great selling pressure to the market. After two months of falling prices, the FDV of AVAX and PYTH after the tokens are unlocked will not fluctuate significantly. If the macro performance is positive, market confidence will be further enhanced, and the long-term trend will be more optimistic.

In addition, the vote on the US FIT21 Act is being promoted, which may become a key event in the history of US crypto regulation and have a huge impact on the entire industry, providing a strong positive trend at the macro level and becoming a key factor affecting subsequent industry trends and market changes. Investors are advised to pay close attention.

JinseFinance

JinseFinance