Author: Alex Tapscott, CoinDesk; Compiler: Songxue, Golden Finance

Bitcoin ETF is finally here. Did this launch achieve the desired results? By most measures, the answer is "yes." In the first six days, the 11 new ETFs raised nearly $4 billion in assets. Equally important, these products collectively achieved $10 billion in trading volume in the first three days.

This performance was slightly tempered by an outflow of approximately $2.8 billion from Grayscale’s Bitcoin ETF (GBTC). Prior to ETF approval, GBTC was a closed-end fund with no redemption options and traded at a significant discount to its fair value, or net asset value (NAV). As a result, holders trapped in this product are utilizing ETFs as an option to exit liquidity. While this isn't the largest ETF trading event in history, most industry analysts agree it's a big deal.

However, the launch turned out to be a “sell-positive” event, with Bitcoin and its associated companies continuing to trade lower in the subsequent week following the launch. I think thisperiod of weakness will be short-lived. WInvestors are closely watching GBTC outflows for signs of whether selling pressure is waning. Once that happens, I expect many mainstream investors who have been waiting on the sidelines to watch the recent volatility will jump into the market in a big way.

It is not clear whether these investors will also start buying back shares of publicly traded companies related to crypto assets.

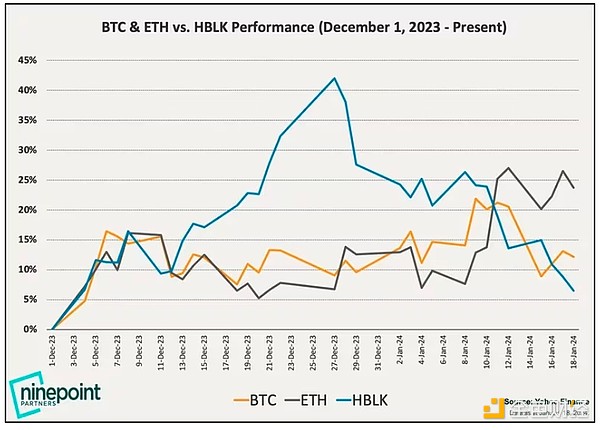

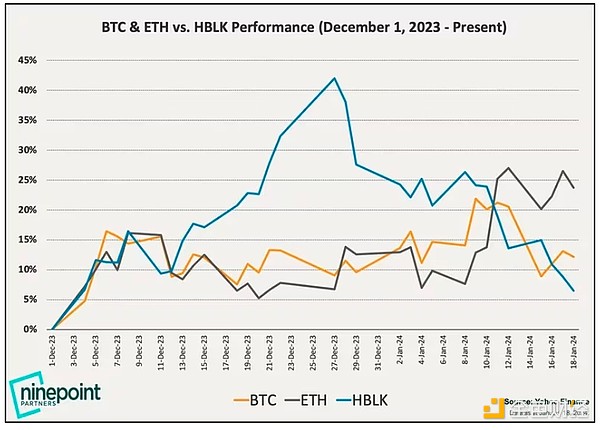

Remember, last December, investors were piling into shares of Bitcoin miners like Riot Blockchain, as well as leading players in the crypto space like Coinbase. The Harvest Blockchain Index, which includes many of these stocks, rose 40% in December, outpacing Bitcoin and Ethereum. However, these stocks have given back almost all of their gains since the ETF's launch (see chart #1) and have performed rather weakly.

Over the years, these The company has been the only opportunity in the public markets for investors to gain exposure to the growth of the underlying asset class. Their fortunes rise and fall in tandem with the price of Bitcoin. However, now that ETFs are easily accessible to anyone, investors will begin to carefully evaluate the pros and cons of these businesses. They don’t go up just because Bitcoin goes up, they also need to be well-run businesses!

Now, all of these companies are taking a widespread hit. There are wide differences between the strengths and weaknesses of these companies, which will become clear after the post-ETF sell-off.

For Coinbase, analysts worry that as the ETF launches, the company will reduce its high-margin fee revenue from retail trading, while the low-margin revenue from custody and institutional trading of most ETFs will not be enough. make up for this loss. However, if the asset class continues to rally, retail trading could return in a big way. Coinbase has more than 110 million users, mostly in the United States (compared to Fidelity’s 42 million users), most of whom have been sitting on the sidelines. There likely won't be an ETF for most crypto assets, so Coinbase still has a chance to dominate the retail trading segment of the market.

ForBitcoin miners, they face huge challenges. First, Bitcoin hashrate, a measure of network security, is near all-time highs, meaning miners need to mobilize more and more computing power to reap new rewards. The Bitcoin halving is expected to occur in April, which will cut block rewards in half, meaningthere will be less rewards available for distribution. BBitcoin Ordinals (dubbed Bitcoin’s “NFTs”) are dividing the communityso miners cannot rely on the additional fee revenue that comes with the implementation of these network updates.

Some miners will thrive in this environment, but the days of crypto miners collectively benefiting from an overall rise in the market are over. This can be a tough truth for some who buy these stocks in the hope that an ETF will ensure they make big gains. But from a macro perspective, this is positive for the entire industry. Investors have more choices, and companies have more incentives to operate profitably and efficiently. Both are signs of cryptocurrency maturation.

JinseFinance

JinseFinance