Today is January 3, 2024, the day when Bitcoin turns 15 years old. Let us first wish Bitcoin a happy 15th birthday!

The conventional story told in the media is that 15 years ago, on January 3, 2009, Satoshi Nakamoto launched Bitcoin on a server in Helsinki, Finland. .

However, according to the research of the teaching chain, the truth is more likely that Satoshi Nakamoto obtained it between the 3rd and 9th of that year. The Times reported on January 3 that after a few days of trial operation, Bitcoin was officially launched on the 9th.

The picture above is from Chapter 3 of "The History of Bitcoin" by Liu Jiaolian, "The Times" https://leanpub.com/history-of-bitcoin

However, in any case, Satoshi Nakamoto chose the publication date of the Times article on January 3 as the time of the Genesis Block. Therefore, people also regard January 3, 2009 as the birth date of Bitcoin.

15 years really flies by in a blink of an eye.

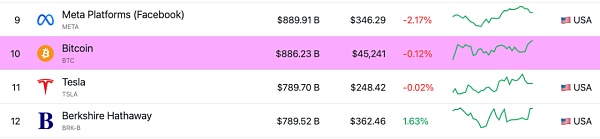

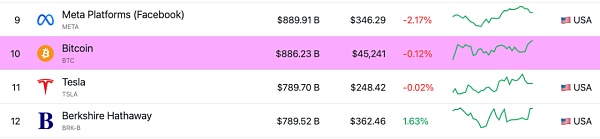

Today, Bitcoin has grown from being worthless to a company with a market capitalization of US$886.2 billion, surpassing Musk's Tesla and Buffett's Burke. Hill Hathaway's market capitalization ranks among the top ten assets in the world, a unique global asset.

Today, the approval of Bitcoin ETF is imminent, and global asset management giants such as BlackRock and Fidelity have already entered the game and submitted applications for Bitcoin ETF to the SEC.

Some people are still watching, questioning, and ridiculing. From not seeing it, to not being able to understand it, to looking down upon it, and finally just not being able to keep up.

Bitcoin is a touchstone. Liu Jiaolian wrote in the 2021.1.10 article "Knowing People by Breaking Coins", "The way you treat Bitcoin is enough to portray the essence of a person." "The Bitcoin holding history of a currency holder can be It is the strongest reflection of personality. Nothing can cover up this light, and nothing can disguise this light. This is the best portrayal of a person's true personality." "For every coin holder, there is nothing in this world There are only two kinds of people, one is a person who holds Bitcoin, and the other is a person who does not have Bitcoin. For the latter, we instantly identify that these people are not qualified partners."

If a financial influencer is still telling you to stay away from Bitcoin with red lips and white teeth at this time, whether he is citing conspiracy theories or ideologies, Da Bang, I advise you to stay away from such a big V as soon as possible. After all, if you pour retarded, retarded, and anti-intellectual mush into your brain every day, your brain will turn into mush sooner or later.

Bitcoin teaches without words and actions without words. It has taught us so many things, deeply impacting our ideas and shaking our hearts all the time.

After studying with it for a long time, our thinking level and cognitive level have been improved subtly.

Let’s give an example. For example, as we all know, Bitcoin must be obtained through PoW workload proof, which consumes computing power, that is, computer hardware and electricity energy. Even in the early days when Bitcoin was useless (of course, many people may still think it is useless to this day), everyone had to pay this price to obtain it.

Bitcoin teaches us about "precious" and "useful".

What is precious will be useful sooner or later, but what is useful is not necessarily precious.

Periodic table of chemical elements, hundreds of elements. Many of them had no idea what they were used for when they were discovered. For example, rare earth elements had little value before the industrial revolution, but once science and technology developed, these rare elements became of great use.

Steamed buns and air are very useful and indispensable to us humans, but no one considers them very precious.

In traditional industries, including the traditional Internet (so-called web2), the starting point of doing things is "usefulness", so the Internet talks most about "user needs", "Application Scenario". As long as I make useful things and sell them to users, I can make money.

Bitcoin, including blockchain (so-called web3), starts from "preciousness". Maybe no one knows the use of this thing now, but the key is that people have to pay a price (and cannot cheat) to obtain it, so that people cherish and value it.

Objects will be useful because they are precious, but they may not be valuable because they are useful. The difference between blockchain and traditional industries and the traditional Internet lies precisely in this difference in logic.

The logic is different, so the thinking and methodology are completely different. The starting point is different, so the order of doing things is completely different.

Fundamentally speaking, because people have subjective initiative. They automatically and spontaneously find uses for their precious possessions.

So, what is the source of value?

The subjective theory of value says it is demand, while the labor theory of value says it is labor. This economic philosophy can also be attributed to the analysis of "useful" and "precious":

The usage scenario determines the feeling of "useful", and the cost of acquisition determines The feeling of "preciousness".

When Jiao Lian was engaged in the Internet in his early years, he was obsessed with the subjective theory of value and read the book "Human Behavior" over and over five or six times. However, when Jiaolian discussed with Bitcoin and went deep into blockchain practice, he became more and more aware of the power of the labor theory of value and began to read "Das Kapital" over and over again.

"Das Kapital" makes it clear that an increase in productivity will cause a decrease in value. The more efficient it is, the less valuable it is. Bitcoin PoW is very inefficient, so it has great value. Other chains are pursuing higher efficiency, so they are actually pursuing lower value. (Digression: The same goes for AI.)

If you talk about it abstractly like this, you will find it counter-intuitive. Then the teaching chain can be explained with the example of making inscriptions.

There are several ways to play these 10,000 inscription collections:

The first one, The most efficient. Write a crawler to download 10,000 avatars. Then write a script, and it can be completed in a few hours. Exactly, fast and efficient.

Second, efficiency is centered. Download the avatar and generate the code. Then develop a "one-click start" web page, so that people can quickly complete the chaining with just a click of a button. Since humans do very few actions and do not require manual input, there is almost no chance of mistyping data.

The third type is the least efficient. There is only one on-chain contract, and users need to complete the rest by themselves. You need to manually download the avatar image, you need to manually encode it with the encode tool, you need to manually copy and paste it into the contract interaction tool, you need to manually check that the input is correct, you need to manually complete the wallet installation and add the network, you need to manually send the address to request gas, you need to manually interact with the contract Winding is completed. It takes a long time to complete this set of movements. Not to mention the hard work, there is a certain probability that you will make mistakes or break them.

After completing 10,000 cases in the above three situations, which method yields the most valuable results? I guess it goes without saying.

Starting from the "useful" thinking, what is the use of this picture on a chain? I can't figure it out even if I try hard enough. But from another perspective, starting from the "precious" thinking, the crystallization of my own labor and sweat is inscribed on the blockchain. It belongs to my own inscription collection and cannot be recreated. Every time I take it out and look at it, I feel happy. "What's important is not the picture, what's important is that I made it with my own hands." Rationality is limited, but feelings cannot lie. This is what Wang Yangming calls "inner light."

Just imagine, if Satoshi Nakamoto issued 21 million Bitcoins directly in the code in January 2009, how much would Bitcoin be worth today?

Satoshi Nakamoto is not. He just wants to mobilize so many people around the world, spend so much manpower, material resources, energy and land, and it will take more than a hundred years (about 2140) to produce all 21 million Bitcoins. come out.

The efficiency is not low.

The value is not low.

You said that instead of using PoW, you can use other methods, such as setting rules, to artificially create limits and scarcity? But rules made by people can be broken by people. Satoshi Nakamoto does not believe that people can hold the bottom line in the face of the temptation of huge interests. It's not that he doesn't want to trust people, it's that he can't trust people. After all, Satoshi Nakamoto wrote in the Bitcoin white paper: "What we need is an electronic payment system based on cryptographic proof rather than (human) trust".

Only a sufficiently high price can convince people of the preciousness of Bitcoin.

Only if Bitcoin is precious enough, people will continue to explore and discover its usefulness.

Bitcoin is useful because it is precious.

JinseFinance

JinseFinance